It is a project that enhance Ethereum, the Layer 1 blockchain. It also has a native coin named as: $OBOL token. This altcoin provides a much-needed safety feature into Ethereum staking using distributed validators, as opposed to running a validator on one single computer. The cryptocurrency has three uses: voting, rewards, and community participation.

This article outlines listing details, exchanges, tokenomics, and Obol token price prediction.

The highly anticipated altcoin listing date is set for May 7, 2025. According to the official BNB X account, Binance Alpha trading begins at 10:00 AM UTC, followed by Binance Futures at 10:30 AM UTC. This top cryptocurrency exchange advises traders to place Limit Orders to avoid Ethereum congestion.

Source: Binance Official X Account

Curious where will this altcoin be listed? Let’s break it down

Here’s the confirmed Obol token listing exchange lineup:

Binance Alpha — 10:00 AM UTC

Binance Futures — 10:30 AM UTC

Bitget, Gate.io, Bybit — 11:00 AM UTC

This multi-exchange launch brings the sight of sales across the world to instant reality, thus enabling a highly liquid launch.

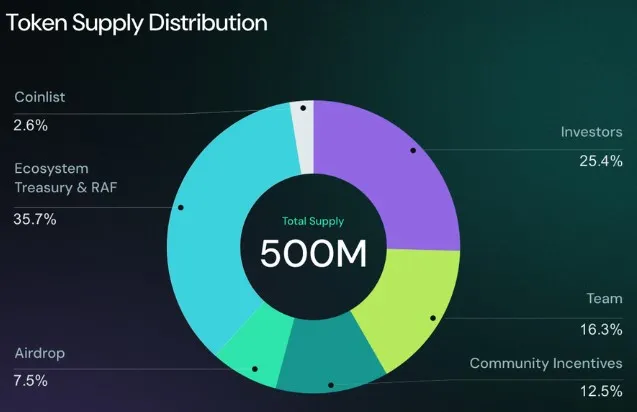

The tokenomics strategy is geared towards long-term sustainability and community integration. The total supply of this crypto is 500 million, which are distributed as follows:

Source: Obol Collective

35.7% — Ecosystem Treasury & RAF (development, partnerships)

25.4% — Investors (early and strategic backers)

16.3% — Team (aligned with project success)

12.5% — Community Incentives (airdrops, rewards, participation)

7.5% — Airdrop Allocation (rewarding early users)

2.6% — Coinlist (public sale/platform distribution)

Having analysed many crypto launches and tokenomics, my analysis says, this is one the best distribution setup to support growth, align key players, and ensure a vibrant ecosystem.

The bullish analysts have given forecasts, especially considering the giant exchange launch.

| Phase | Price Range | Notes |

|---|---|---|

| Listing Price | $0.30 – $0.50 | Multi-exchange launch grounds and Ethereum hype. |

| Short Term (1–4 weeks) | $0.50 – $0.90 | Initial surge due to airdrop excitement and some staking lockups may increase prices. |

| Long Term (6–12 months, Bullish case) | $1.00 – $1.50 | Based on market demand and if more partnerships take place. |

| Long Term (6–12 months, Bearish case) | $0.40 – $0.60 | If adoption lags or competition increases. |

Being a crypto analyst, looking toward 2025, the price prediction for 2025 suggests strong upside if the project captures even 3–5% of Ethereum’s staking market.

Post-launch, its ecosystem has big plans:

Rewards in the Airdrop: Holding Alpha Points will grant holders the right to receive rewards 20 minutes after the launch.

Ecosystem Expansion: Brace for new partnerships and staking integrations.

Community Campaigns: A hefty 12.5% of the supply is fixed for the incentivization of user engagement.

With the listing date and price finally locked in, the situation marks a watershed event in the Ethereum infrastructure. Conjuring cutting-edge technology, solid tokenomics with some top exchanges, it ranks among the most exciting crypto coins of 2025.

May 7 could very well mark the beginning of a new chapter for Ethereum — do not miss out.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.