Can a delayed launch make a crypto project stronger instead of weaker? The latest update around the OneFootball Club airdrop suggests that patience may bring a more stable and well-planned entry into the market.

According to Airdrop Hunt with Lakhan’s X post, the team has chosen to slow down the process to secure long-term growth, product readiness, and strategic partnerships.

Source: Airdrop Hunt with Lakhan

The update confirms that the OneFootball Club airdrop listing date will happen in Q2 2026 and clearly before June. Based on current progress, April or May looks like the most realistic window. This aligns well with the global football calendar and the long-term roadmap tied to the FIFA World Cup 2026 narrative. However, this is just an assumption, as there is no official comment from the project yet.

The project explained that the delay was intentional. It was done to focus on a “major opportunity” that strengthens its roadmap. Product finalization and partnership discussions are now the priority. The registration for the Pre-TGE portal has already closed, showing that early participation is complete.

Season 1 of the community journey has ended and Season 2 has begun. The official website describes this phase as the moment when user loyalty and leaderboard efforts finally connect with real token rewards. The collection of balls, leaderboard rankings, and community engagement will soon meet the token economy.

The message is simple: slow preparation now can create a stronger launch later. In crypto history, projects that take time to align utility, liquidity, and community trust often perform better after token listing.

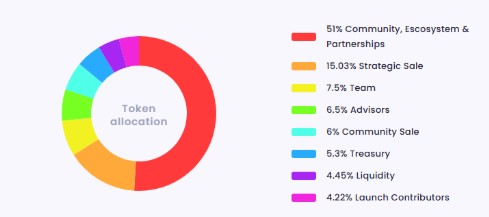

The total supply is assumed to be 1 billion tokens, though the final structure may differ. The current estimated distribution shows a balanced design:

Source: Official Website

51% Community, Ecosystem & Partnerships – rewards users, grows adoption, and funds expansion.

15.03% Strategic Sale – supports early funding and institutional trust.

7.5% Team – ensures long-term commitment and development continuity.

6.5% Advisors – rewards strategic guidance and industry expertise.

6% Community Sale – promotes fair public access.

5.3% Treasury – secures financial stability and future operations.

4.45% Liquidity – supports smooth trading and market depth.

4.22% Launch Contributors – recognizes early supporters.

This structure reflects a strong community-first approach while maintaining operational stability.

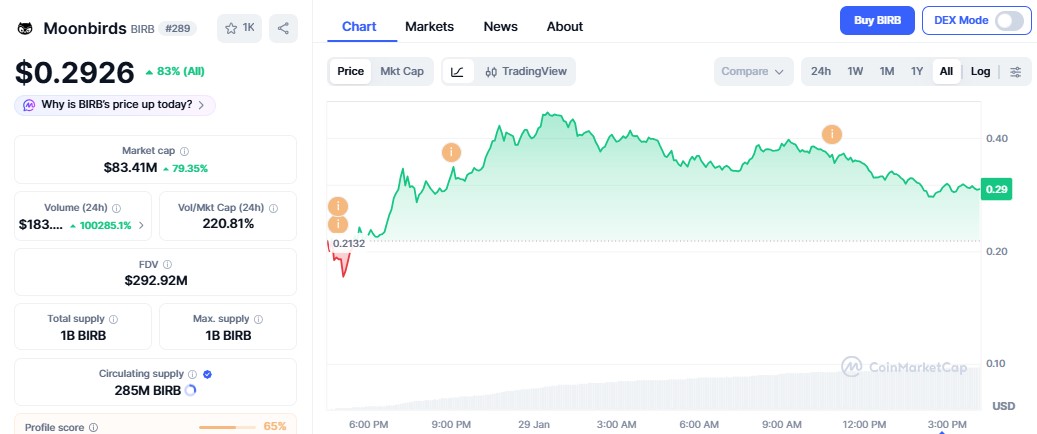

For OneFootball Club airdrop valuation, analysts compare it with Moonbirds (BIRB), a token that also has a 1 billion supply. BIRB listed on January 28, 2026 at $0.21, reached an all-time high of $0.4725, and is now trading around $0.2933 after an 83% intraday surge, as per CoinMarketCap.

Source: CoinMarketCap Data

Based on this data and CoinGabbar analysts’ evaluation, the expected launch range is between $0.30 and $0.50. If market sentiment remains strong, the token may test $0.80 to $1.00 in the near future. These levels depend on liquidity strength, exchange support, and user activity after TGE.

The OneFootball Club airdrop shows how patience, structure, and community design can shape a stronger crypto launch. With Q2 2026 as the confirmed window, balanced tokenomics, and realistic pricing expectations, the project presents a carefully planned entry into the market rather than a rushed experiment.

YMYL Disclaimer: This article is for educational and informational purposes only. It does not constitute financial advice. Cryptocurrency investments are highly volatile and risky. Always conduct your own research and consult a qualified financial advisor before making any investment decisions.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.