The crypto market witnessed another major shock as the Trove token crash wiped out millions of dollars in value within minutes of its launch. Trove Markets launched its $TROVE token on Solana on January 19, promising a $20 million fully diluted valuation. Instead, the token collapsed by more than 90%, falling to a market cap near $600,000. For many investors, this was not just a loss, it felt like a betrayal.

Source: X (formerly Twitter)

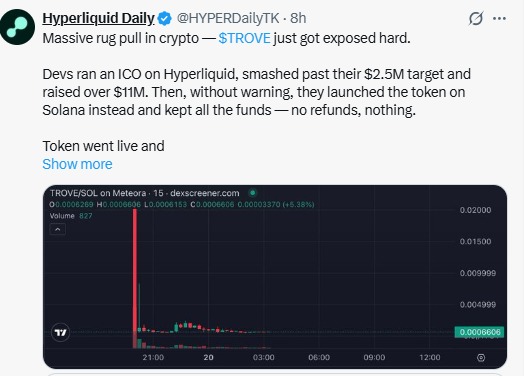

Before launch, Trove Markets had raised around $11.5 million in an ICO that originally targeted the Hyperliquid ecosystem. The project was heavily oversubscribed, far beyond its $2.5 million target. Expectations were high, and early buyers believed they were entering a strong new trading platform. But the outcome was the opposite, making the Trove token crash one of the biggest disasters of 2026 so far.

The token launched with extremely low liquidity, around $50,000. This alone created danger. When early holders began selling, the price collapsed almost instantly. The FDV dropped from nearly $20 million to under $1 million in minutes.

Some investors shared heartbreaking stories. One trader said his $20,000 investment turned into just $600. This kind of damage is what makes the price crash feel more like a soft rug than a normal market dip.

The team later said they refunded about $2.1 million, while keeping around $9.4 million for “development.” This only increased anger in the community.

Originally, It was built around Hyperliquid. But just before the launch, the team suddenly moved the token to Solana. This last-minute chain switch shocked investors.

Source: X (formerly Twitter)

Many people thought that the hype was created through the ecosystem developed by Hyperliquid, but the idea that it launched on Solana for ease of exit broke the trust. The Trove rug pull situation taught a lesson on how quickly trust can vanish once approach changes without warning.

The matter went from bad to worse after blockchain investigator ZachXBT revealed evidence of transactions from the ICO wallets being sent to casino sites and bets on Polymarket. This raised serious red flags.

Nonetheless, there were also reports of several crypto influencers who were compensated to endorse the crypto ICO without disclosing it to the public. One major name, @waleswoosh, was accused of receiving $8,000 USDC. He later admitted payment issues and apologized for not being clear.

Undisclosed promotions are dangerous. During the crash, many traders realized they trusted voices that were secretly being paid.

Many believe the price crash was not accidental.

Red flags included:

Oversubscription without clear refund rules

TGE Delays

Sudden chain migration

Low liquidity at launch

Influential marketing

Funds reportedly used for gambling

They all culminated to create a perfect storm.

The Trove market dump proves one thing clearly: presales are high risk. Flashy testnet numbers and big marketing campaigns cannot replace real products.

If a team controls large funds and offers weak transparency, investors carry the full risk.

A similar structure appeared in the $ASTER price crash case, where aggressive promotion, heavy influencer marketing, backed by personalities like CZ, and post-crash ‘rescue plans’ followed sharp price declines. In both cases, retail investors were left holding losses while narratives shifted to damage control.

The trove token crash is now being called 2026’s first major rug-style collapse. It reminds the crypto community that hype alone is never enough.

Always question:

Where is the money going?

Who is getting paid to promote?

Is liquidity safe?

In crypto, trust is everything. And once it breaks, recovery is almost impossible.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.