Will a long-awaited relief finally arrive for markets, or will politics overshadow the Fed’s cautious path?

On Friday, Jerome dropped the biggest hint yet — a Powell rate cut could be coming in September. Investors cheered, cryptocurrency jumped, and optimism spread across Wall Street. But the celebration didn’t last long.

Source: Not Jerome Powell X Account

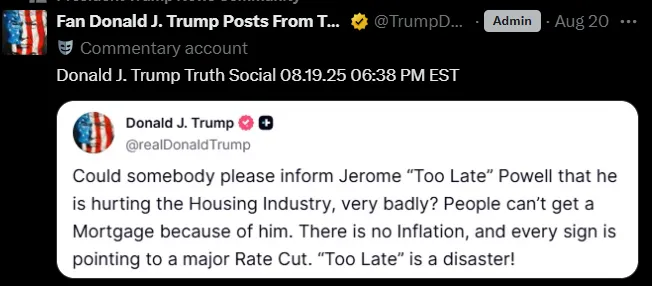

Within minutes, Donald Trump dismissed Powell move as “too late,” demanding deeper and faster reductions. What looked like good news for the economy suddenly turned into a political showdown, raising the question: Is the federal reserve steering the economy, or is the US president pulling the wheel?

At the Jackson Hole conference Jerome Powell gave his clearest sign yet that a rate cut could arrive in September. Markets immediately reacted with relief, pushing stocks higher. His words hinted at a softer policy path, but with one clear caveat — decisions will be made on economic data only.

He admitted the labor market is weakening and warned that the inflation threat — particularly from tariffs — remains alive. His message: relief is coming, but slowly.

The U.S. president however, wasn’t celebrating. In sharp criticism, he blasted the Fed chief for moving too slowly. From the White House, he said, “He should have acted a year ago.”

Source: Truth Social Trump Posts X Account

Administration voices have gone further. Treasury Secretary Scott Bessent suggested the Fed September rate cut should be just the beginning, with reductions of up to 150 basis points possible. For Donald, a 25-point adjustment is merely “scratching the surface.”

Despite political noise, he stood firm that the Federal Reserve will act cautiously. His two priorities are:

Employment risks – Weakness in hiring is his top concern.

Price pressure – Tariff-linked inflation still lingers.

That balance explains why the Powell rate cut September isn’t designed as a rapid series. Instead, the Fed prefers gradual moves to protect credibility and avoid runaway prices.

While Jerome was speaking in Wyoming, the United States president turned up the heat again. In the latest Trump powell news, he threatened to remove Lisa Cook, a Fed Governor, citing mortgage fraud allegations. Cook has denied wrongdoing and said she won’t step aside.

This clash highlights both the parties' stance: one side pushing for aggressive action, the other stressing data and independence.

September now becomes critical. Possible outcomes include:

Single 25bps reduction → Markets gain, but White House keeps pressing.

No move → Donald escalates pressure, creating more political risk.

Larger slash → Could spark a new inflation warning if prices flare again.

Investors must watch carefully as policy, politics, and credibility collide.

The Powell rate cut is almost certain, but it won’t match the Republican leader’s aggressive demands. The central bank insists on steady decision-making, while the former president wants sweeping reductions.

For now, his careful path may reassure traders, but this showdown ensures the debate over America’s interest rate cut news will dominate the weeks ahead.

Bottom Line: A September adjustment is likely, but the fight over how deep to go is just beginning.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.