Ripple is back in focus after announcing a major upgrade to its custody platform on February 9, 2026. The update strengthens Ripple’s push toward banks and large financial institutions by making crypto custody more secure, compliant, and easier to deploy.

Source: Coin Bureau

The recent rapid developments and this latest move signal that the network is moving deeper into real-world finance, not just crypto speculation.

The latest Ripple Custody upgrade integrates Securosys Hardware Security Modules (HSMs), a security standard widely used and trusted by traditional banks and institutions. These tools securely generate, store, and manage private keys–the most critical part of holding digital assets.

Institutions can now choose between

Securosys’ on-site CyberVault system: a physical device installed inside their own data centers, or

A cloud-based option: for faster and more flexible deployment

This gives banks a faster, cheaper, and easier way to set up strong digital security, without long delays or complicated purchasing processes.

Along with that, the network also added:

Figment staking without running validators

The platform now supports staking for Ethereum and Solana through Figment. Institutions can earn staking rewards while Figment handles validator operations, uptime, and technical maintenance. This removes the need for in-house blockchain teams or complex node infrastructure.

Integrated compliance with Chainalysis

Chainalysis tools are built into the custody platform, enabling real-time transaction monitoring, risk scoring, and regulatory reporting. This helps institutions meet AML and KYC obligations while operating in public blockchain environments.

Scalable wallet infrastructure from Palisade

Ripple’s earlier acquisition of Palisade strengthens the custody stack with scalable wallet technology designed for institutions managing large volumes of assets, users, and transactions across multiple networks.

Taken together, the security, staking, compliance, and wallet layers turn Ripple custody into a full institutional package. Banks and financial firms can enter crypto management quickly, securely, and in a regulator-friendly way, without building everything internally.

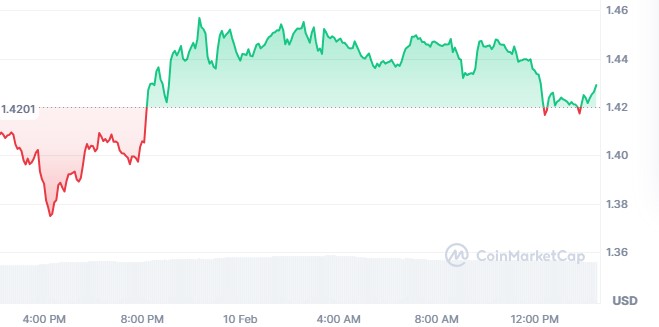

Following the announcement, XRP showed steady price behavior rather than sharp volatility. The coin surged 2.75% to $1.41 in the last 24-hours, reflecting growing confidence rather than hype-driven trading.

Source: CoinMarketCap Data

Although the prices are low from its $2–3 level, analysts see the upgrade as a long-term positive rather than short-term price catalyst.

Ripple has continued to stack major milestones, reinforcing its focus on building a strong, compliant, and scalable blockchain network for institutions. Some of the recent milestones includes:

Activated the Token Escrow Amendment on XRPL in February 2026, expanding escrow beyond XRP to RLUSD, trustline tokens, and Multi-Purpose Tokens.

Secured a full EU Electronic Money Institution (EMI) license in Luxembourg, enabling regulated crypto payments across Europe.

Partnership with UAE-based Zand Bank to support AEDZ and RLUSD liquidity for regional and cross-border payments.

Together, these developments highlight Ripple’s steady shift toward institutional-grade blockchain infrastructure. By combining regulation, security, and real transaction use, Ripple continues to prepare XRPL for long-term growth and deeper integration with the global financial system.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.