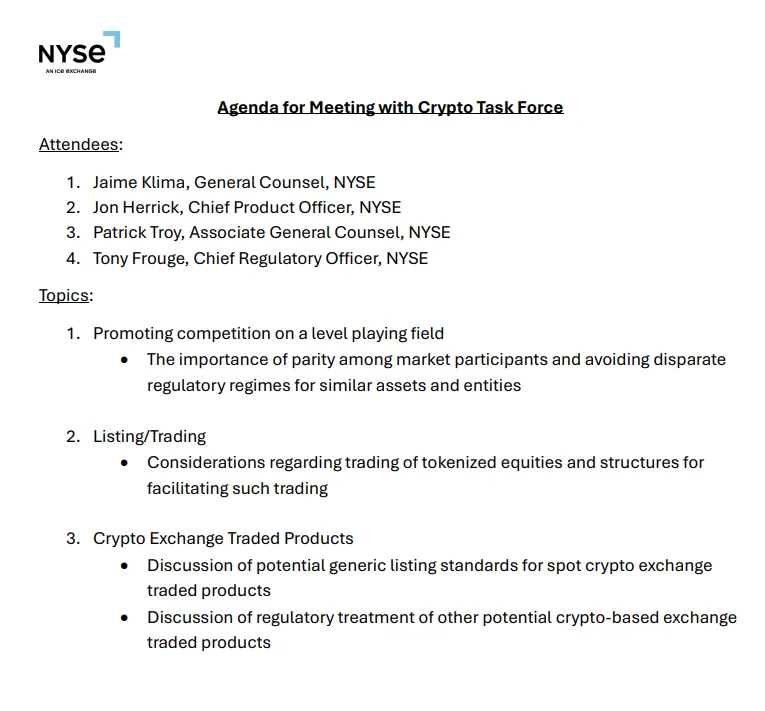

The U.S. Securities and Exchange Commission SEC is making astute moves towards crafting the future of crypto regulation, specifically concerning tokenized stocks and exchange-traded products (ETPs) linked to digital tokens. On June 24, 2025, the SEC's task force held a clandestine meeting with influential stakeholders of the New York Stock Exchange (NYSE) to review the regulation of digital assets under U.S. securities laws.

This session is a growing sense of a need to set fair and consistent standards for both traditional and tokenized financial products.

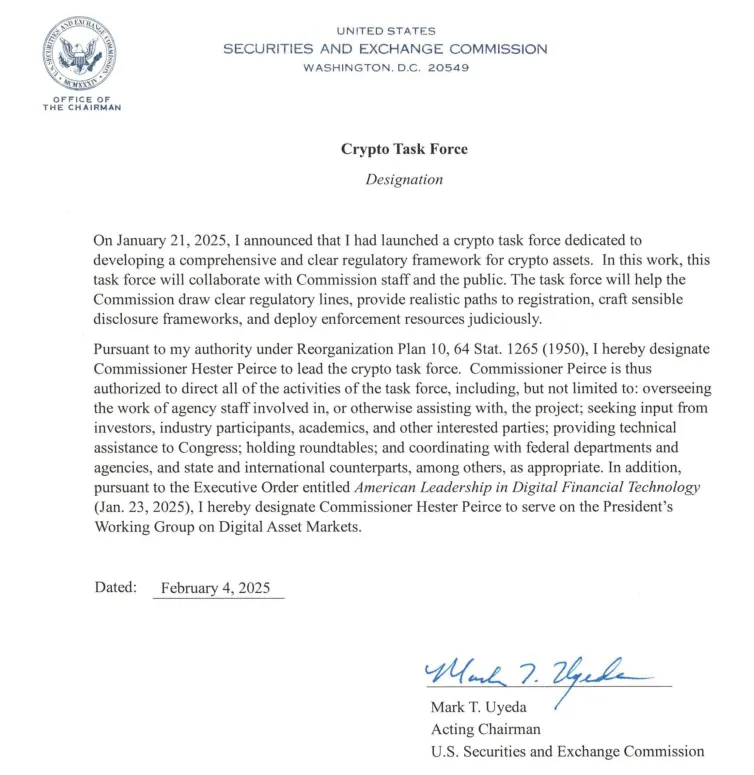

The SEC crypto task force was established through a January 21, 2025, designated letter to engage with stakeholders and ensure that individuals comprehend how federal securities laws address digital assets. Commissioner Hester Peirce leads the task force in its efforts to focus on regulatory harmonization, addressing crypto-specific issues, and recommending policy improvements. The task force also serves as a central point of contact for market participants.

Source: Official SEC designation letter

Led by Acting Chairman Mark Uyeda and Commissioner Hester Peirce, the Task Force was formed to further oversee how digital tokens are handled under U.S. law and more effectively inform businesses and investors of the regulations.

In a recent sit-down, the task force met with NYSE executives to discuss the future of tokenized assets and making sure fair and equitable rules apply to both traditional and digital markets.

Task force priorities:

Shift from enforcement to clarity: creating rules that guide innovation, not stifle it.

Transparency and disclosure channels: helping crypto businesses legally register assets through tailored frameworks.

Identifying crypto's unique nature: imposing outmoded rules on decentralized and self-custody models.

Examining exemptive relief: leaders in this area, Uyeda, support provisional relief in regulation for emerging ventures.

Involving the public: Addressing general issues like asset classification, trading models, and custody concerns.

Preferring legislative precision, Pierce has supported reexamining investment contracts employed in securities law.

The message clearly states that the SEC is seeking to treat comparable financial instruments equally, whether crypto-based or otherwise, as it works to create a safer, more predictable market for all parties.

Source: Sec.gov

SEC crypto task force members met with top NYSE officials to examine how On-chain assets can be brought into the existing regulatory framework.

The goal is to regulate digitally issued financial products on an equal basis, neither over- nor under-regulated compared to traditional assets.

Issues addressed:

Level Playing Field has equal rules for the same asset types, whether tokenized or traditional.

Tokenized Equity Trading: regulations and concerns about listing and trading digital stocks.

Crypto ETPs were discussed on standardized guidelines for spot crypto exchange-traded digital stocks.

The conversation resonates with the SEC's growing interest in ensuring digital currency becomes a safer and better-organized space.

Discussion has been held on trading tokenized company shares like common stocks and being fair to digital as well as physical assets. What is the configuration to list and trade tokenized stocks securely? The objective remains to treat all assets similarly while maintaining markets secure and transparent.

But tokenized stocks could interfere with traditional platforms by providing them advantages like 24/7 trading and reduced charges. Investors may find the ease of tokenized options preferable, which could erode the market share of traditional exchanges.

These regulations are set to have a massive influence in the digital space by having the capacity to impact market structure, investor protection, and tradable assets.

The impact on the market can be:

Market Structure: These regulations may introduce changes in digital tokens and trading and custody, impacting exchange and trading platform structure.

Investor protection can be strengthened through the enforcement of registration requirements and disclosures, as well as potentially caps on specific activities.

Asset classification: Once a token has been determined to be a security, it will have stricter regulations, such as registration requirements and disclosure obligations.

Market volatility: Because investors would react to new regulations and potential changes in market dynamics.

Institutional Adoption: Appropriate regulation can bring about institutional investment in the crypto arena with lesser uncertainty and a better-defined set of rules to participate.

Innovation: Some would target some innovations; others would create a more stable and reliable atmosphere to foster long-term development and responsibility formation.

While precise figures are yet to be developed, the possible impact on the market is significant, ranging from how assets are marketed to the types of projects that can exist.

Source: Sec.gov

Sanket Sharma is an experienced crypto writer with five years of expertise in blockchain technology and digital assets. He specializes in translating complex concepts into clear, accessible insights, catering to both novice and seasoned investors.With a keen focus on Bitcoin, altcoins, NFTs, and DeFi, Sanket provides in-depth analysis of market trends, price movements, and emerging developments. His work is rooted in thorough research and a deep understanding of the evolving crypto landscape.Passionate about blockchain’s transformative potential, he is committed to delivering well-researched, informative content that empowers readers to navigate the fast-paced world of cryptocurrency with confidence. Through his writing, Sanket continues to educate and engage audiences, helping them stay ahead in the digital asset space.