Jerome Powell’s job might be in serious danger—and the U.S. Presidnet is not hiding it anymore. The Trump Fed Chair replacement drama is heating up—and fast. He has openly confirmed that he’s interviewing new candidates to take over, even though Powell’s term runs until May 2026. The twist? If this happens then it could flip the script on rate cuts, inflation policy, and even crypto market momentum.

In a move sending shockwaves through Wall Street and Washington, Donald has confirmed he’s interviewing candidates to replace Federal Reserve Chair Jerome Powell, way before his term ends in May 2026.

Source: X

Popular Crypto pages like Coin Bureau validated this update on X, signaling strong market implications and fueling speculation among traders and analysts.

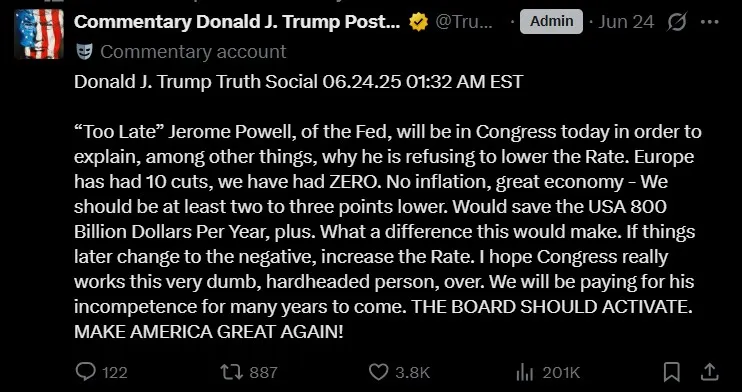

The Trump Powell feud escalated further after the president's blunt remarks on June 20–21, 2025, when he called the chairman a “moron,” adding that the country is “paying the price for his incompetence,” as per Truth Social reports. This wasn’t the first time he expressed frustration over Powell’s interest tariff decisions—but it may be the most serious.

Source: Donald Trump Truth Social

According to Litquidity Capital’s founder earlier post, one of the candidates might include Bill Hwang, the controversial hedge fund figure behind the Archegos collapse, who is allegedly being considered as a top candidate.

Other names being floated as potential Jerome replacements include:

Kevin Warsh – Former Federal Governor

Kevin Hassett – Former National Economic Council head

Christopher Waller – Current Federal reserve Governor

Scott Bessent – Ex-Treasury Secretary under Donald

As of now, no official confirmation has been made, but the Trump Fed Chair pick could bring a major shift in monetary policy—especially around the rate cut July 2025 debate.

Technically, Trump replacing Powell before 2026 faces legal barriers due to a Supreme Court precedent protecting Fed independence. However, he may not need to fire Powell outright. By openly evaluating successors, he is likely aiming to pressure the chairman into rate cuts.

Earlier Fed officials have stated that no rate cut is expected in July, but with U.S. Leader's aggressive stance, this forecast could soon change.

This renewed attention on the feud comes just weeks after Fed Chair indicated no near-term cuts, citing “economic resilience” and “inflation control.”

But if the president continues to push forward publicly with Jerome Powell replacement news, analysts suggest that:

July rate cut odds may increase

Crypto Market may see Bitcoin and altcoin crash along with trading volume

This development is now directly linked to the Federal Reserve news cycle, influencing everything from bond yields to BTC prices.

Though Trump FED chair replacement may be legally difficult, the strategy seems effective. By big names floating and framing Jerome as unfit, president is dominating the interest rate cut policy narrative.

What should every trader watch next?

Watch for the FOMC July meeting outcome

Stay alert for sudden changes in rate cut guidance

Follow the U.S. leader's next public announcements or social media posts

Monitor crypto market price spikes and volatility till the next major update come.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.