Highlights:

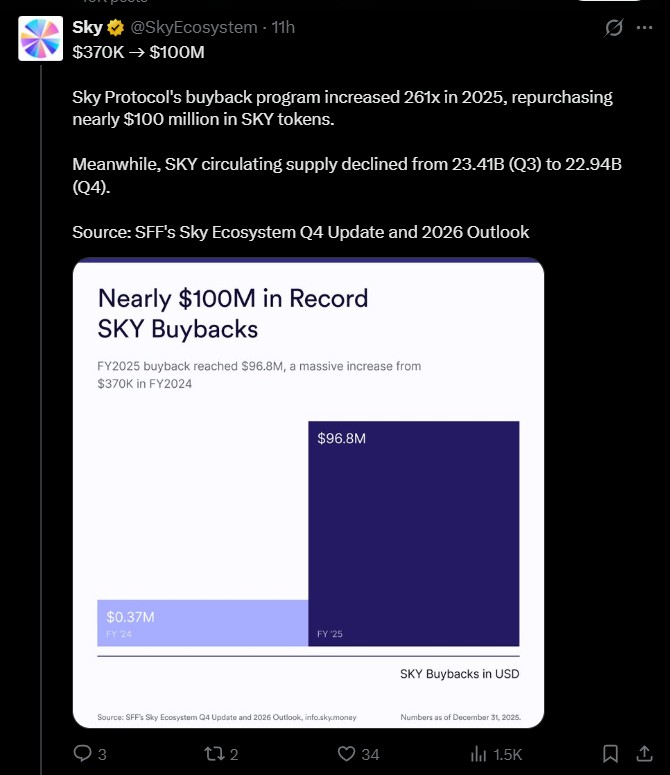

Sky Protocol Crypto buyback shot up 261x to an almost hundred million value.

SKY's circulating supply decreased by two percent following quarterly token burns.

The growth of revenue supports buybacks, staking rewards, and ecosystem growth.

One of the most successful token-economic projects in the field of decentralized finance (DeFi) this year is the Sky Protocol Token buyback program. According to the latest disclosure of the ecosystem, significantly expanded its buyback program during the year 2025, with the total amount of the repurchase growing to an estimated amount of almost 100 million, nearly twenty-six times higher than the previous year.

Such an aggressive capital allocation policy indicates the increasing revenue power of the protocol and its further transition to sustainable tokenomics in the DeFi ecosystem.

The repurchase scheme, which is paid out of protocol-generated fees, is an indication of a shift to value-accrual schemes akin to traditional equity buybacks, on blockchain-based governance tokens.

Source: Official X

The effect on the supply of tokens is one of the most valuable consequences of the extended buyback program. According to the quarterly update of data released by the ecosystem, the circulating supply dropped to around:

23.41 billion tokens in Q3 2025

22.94 billion tokens in Q4 2025

This is equal to about a 2% decrease in circulating supply, which was brought about by repurchases of approximately $96.8 million of SKY tokens, including about 1.55 billion tokens bought and taken out of circulation.

The deflationary effect was also partially due to quarterly burns of non-upgraded MKR tokens, which tied the new SKY tokenomics to the old MakerDAO system of governance.

As a measure to create scarcity, Protocol is strengthening supply by lowering it and demand by incentivizing staking, which is commonly linked to token price floors in economies over the long term.

The protocol's financial performance was high and thus enabled the buyback expansion. It is estimated to have earned nearly $338 million in annual revenue in 2025, which gives it enough liquidity to engage in massive token buys.

In the future, it is estimated that the growth will keep increasing:

2026 revenue projection: $611.5 million (81% annual growth)

Earnings forecast: $157.8 million (198% annual growth)

When achieved, such numbers may enable the protocol to sustain or speed up buybacks on top of the existing cumulative total of $106 million already completed, reinforcing the deflationary model.

In addition to the reduction of supply, the strategy is closely associated with staking rewards and ecosystem incentives. During Q4 2025 alone:

Stakers were given 324 million tokens.

The staking returns were about 16.14% APY.

This incentive scheme makes the ecosystem one of the biggest yield-generating stablecoin-based DeFi platforms, backed by:

USDS supply: $9.2 billion

Total value locked (TVL): $11.9 billion.

The growth plan of the protocol is more and more based on the extension of the use of the USDS stablecoin, non-custodial savings products, and the development of new credit infrastructure.

The buyback disclosure indicates that the token is shifting towards a shareholder-value-style framework of holders - a framework that may affect other DeFi protocols.

In comparison with the emission models of the past DeFi cycles that are heavy on inflation, aims to:

Revenue-funded buybacks

Token supply contraction

Green rewards on staking.

The growth of stablecoin ecosystems.

Assuming that the adoption of USDS and credit products is increasing, the buyback mechanism may be an example of the sustainability of tokenomics in DeFi.

The project already surpasses $106 million, and the revenue is expected to increase substantially. The program seems to continue being one of the most prominent elements of the strategy of the ecosystem in 2026.

Using deflationary token dynamics, high revenue generation, and growth of stablecoins, it is trying to build a more robust DeFi economic design - one that balances user, staker, and long-term token holder incentives.

The success of this strategy in the long-term positioning will be determined by the further use of USDS, the expansion of the DeFi market environment, and the possibility of maintaining revenue-based buybacks.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.