The Spur Protocol listing date has turned into one of the most closely watched and uncertain token launches of January. As January 30 arrives, Kingdomstarter Spur Protocol airdrop claims are opened, and yet the project has not confirmed the exchange launch.

What should have been a routine Coinstore debut has now become a credibility test, following an abruptly ended presale, repeated date changes, and the absence of matching confirmations from official channels.

The Spur Protocol presale ended strictly due to its scheduled timeline, not because the hardcap was reached. The on-chain SpurSwap presale dashboard data clearly shows that only about 1.88 million SON tokens were sold out of the 8.33 million allocation. This means only 22–23% of the presale supply was filled, leaving nearly 77% unsold.

There was no late buying activity, and the sale chart remained flat toward the end. This behavior signals cautious investor sentiment rather than strong demand. This dynamic directly threatens the $SON listing price prediction by increasing dilution pressure.

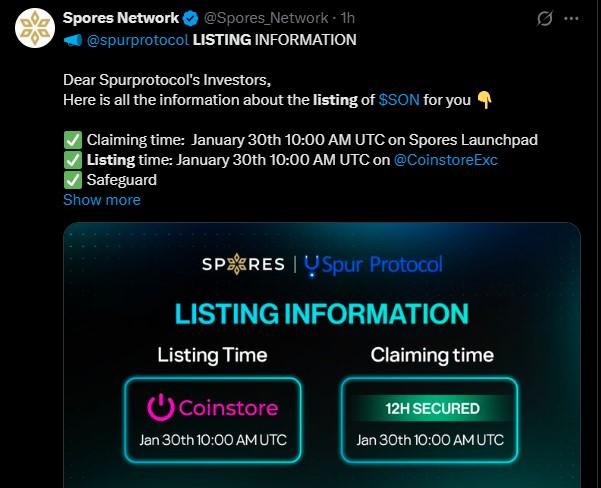

An update shared by Spores Network outlines the Spur Protocol listing date Jan 30 timeline, stating that claiming and launch are scheduled at 10:00 AM UTC, with trading expected on Coinstore. The update also confirms 10% TGE unlock, followed by 10% monthly vesting, based on an IDO price of $0.03.

However, this information has not been confirmed by the official team, nor has Coinstore published any independent announcement. This gap is critical. The launch has already shifted five times: Q4 2025 → Dec 19 → Jan 8 → Jan 26 → now Jan 30. Each delay has weakened market confidence rather than strengthening it.

Without synchronized confirmation from both the project and the exchange, today’s SON listing timeline remains uncertain and should be treated cautiously.

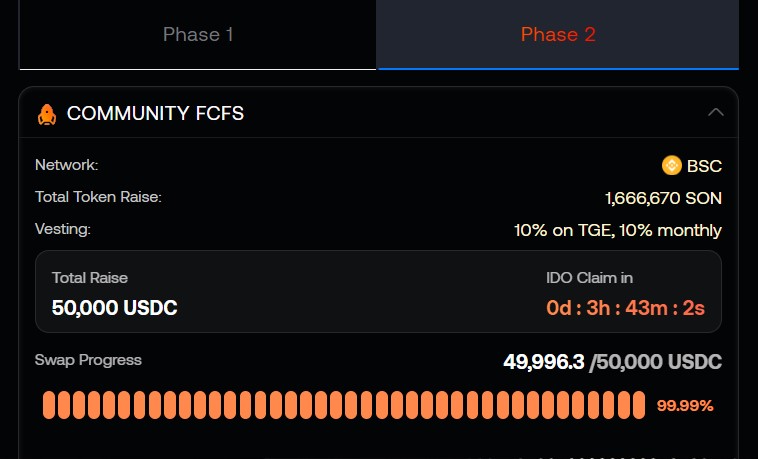

A Community FCFS Phase 2 round on KingdomStarter has successfully completed. The round raised $50,000 USDC, reaching 99.99% completion, with 1,666,670 tokens allocated. $SON Claims from this round are live today. Migration of the tokens has also started to improve functionality across the ecosystem.

While this is a short-term positive signal, the FCFS round represents a very small raise relative to the total presale allocation. It does not reflect full market demand and should not be confused with broad investor confidence in the Spur Protocol Coinstore listing.

If the launch on Coinstore happens today, early trading is still likely to face selling pressure. CyreneAI premarket data shows weak data. A realistic Spur token listing-day range sits between $0.00110–$0.00125. As per Coingabbar’s top crypto analysts, a short bounce toward $0.00140–$0.00155 would require stable liquidity and follow-up confirmations.

If the debut does not happen today and the airdrop claim closes on Kindonstarter, sentiment could weaken further. Prices may slide toward $0.00090–$0.00105 as traders exit on uncertainty. Even a delayed entry would struggle unless supported by strong exchange confirmations and restored trust.

The Spur Protocol listing date Jan 30 is no longer about timing—it is about credibility. With airdrop claims live on KingdomStarter but no official confirmation from $SON or Coinstore, risk remains elevated. Clear, verifiable updates are now essential to stabilize sentiment and define its market outlook.

YMYL Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly risky. Readers should verify all official announcements and conduct independent research before making any financial decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.