The SON Presale update has raised serious questions on the Spur Protocol listing date and price scenario. Just one day after the project said its launch date was extended to January 30, the team reversed its stance. Now the presale will end on January 29 and is being called the “final opportunity.” This sharp change has confused the market.

Source: Official Spur X Account

First, the launch date was extended, then the early sale was pulled back by one day. Such fast reversals show weak planning. When a project changes deadlines within 24 hours, it damages trust. Investors expect stability, not reactive decisions. This situation signals uncertainty, not confidence.

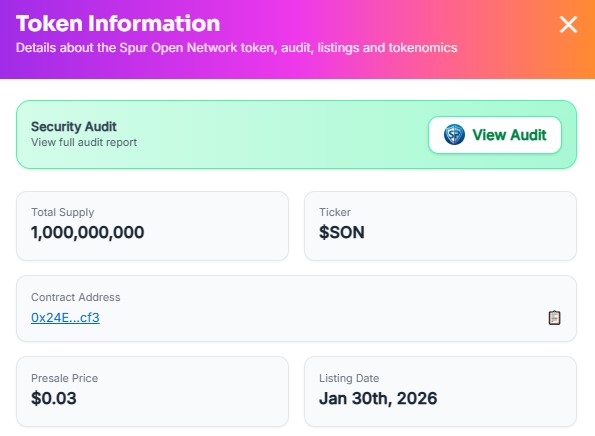

The Spur protocol presale update tells a clear story. Only 1,887,064.58 tokens have been sold out of 8,333,333. That means just 22.6% of the hard cap is filled. More than 77% remains unsold, even with only one day left on the timer. The price is fixed at 1 SON = 0.0000337 BNB, and the current presale price is around $0.03. Despite this, buying pressure is very low. Strong early sale close naturally due to demand. Weak ones use urgent words like “final chance.” The data shows pressure-driven marketing, not organic momentum.

This explains why the $SON listing Jan 30 outlook feels risky. The market response is slow, and investors are cautious.

The Spur Protocol listing date and price 2026 roadmap has changed many times.

From Q4 2025 ➔ December 19 ➔ January 8 2026 ➔ Jan 26 ➔ Now January 30.

Such repeated changes reduce credibility. On top of this, the official website has shown 403 forbidden errors. Users are blocked from accessing it, which raises technical and transparency concerns. However, the SpurSwap website still shows Jan 30, 2026, as the final launch date, with a total supply of 1,000,000,000 coins.

Confirmed listing platforms include Coinstore, MEXC, BingX, SpurSwap, and PancakeSwap. Even with these names, repeated delays weaken confidence in the $SON airdrop price reliability.

The Spur Protocol premarket shows it is trading around $0.001458 with a decrease of 2.60% in the last 24-hour. Volume is almost zero, and the market cap is just $7.29K. This means liquidity is extremely thin.

In such a market, even small trades can move the Spur protocol listing price sharply. The chart shows an early spike, a strong drop, and then sideways movement. This usually signals fading hype.

From a technical view, the price is still bearish. The bounce seen earlier looks like a reaction, not real accumulation. This confirms that the SON Presale is not supported by strong secondary market confidence.

Short-Term and Mid-Term Outlook

Short-term, the asset can fall toward $0.00120–$0.00110 if selling pressure increases. A bounce to $0.00155–$0.00160 is possible only if volume improves. Without volume, any rise will be temporary.

As per the latest presale news today, the mid term outlook might shift around $0.00130 with steady volume growth. If it fails, the market may push it below $0.00100 after debut.

The SON Presale and the unstable Spur Protocol listing date and price show a project struggling with consistency and market confidence. Weak demand, thin premarket liquidity, and repeated deadline changes signal high risk. Until volume, transparency, and execution improve, this project remains in a fragile and uncertain phase.

YMYL Disclaimer: The above article is strictly for education purposes only. It does not provide or support any financial advice. Cryptocurrency markets carry high risk, so always do your own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.