Spur Protocol is entering a make-or-break moment. The presale is ending today, January 29, with only “5 hours” left on the timer, but traders are still unsure if the token will actually debut tomorrow.

Spur Protocol listing date January 30 is no longer about a calendar deadline. It has become a direct test of real market demand. The repeated shifts in timeline, weak early sale progress, and missing exchange confirmations are now driving questions like: Is market quietly rejecting the project?

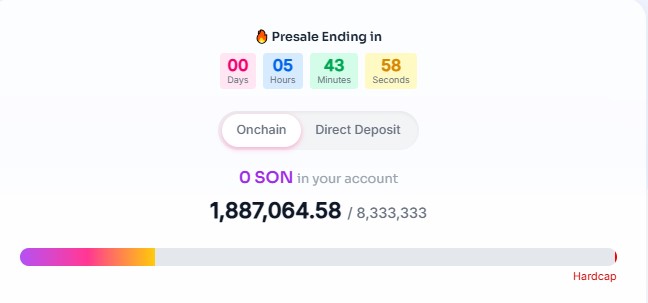

According to reports, Spur’s early sale concluded on January 25 and was marked as ended. But it reopened again till January 29, which aligns with Spur Protocol presale end today narrative.

Source: SpurSwap Website

In parallel, the listing timeline has moved five times: Q4 2025 → Dec 19 → Jan 8, 2026 → Jan 26 → now Jan 30. The team says the latest extension is meant to boost marketing, host a pre-TGE AMA, and finalize technical preparations. Yet the back-and-forth has made the market more cautious, not more confident.

The funding gap may be the biggest reason for another delay. Out of a total goal of 8,333,333 coins, only 1,887,064.58 has been raised—about 22.6% completed. That leaves roughly 77.4% still remaining, or around 6.44 million yet to be filled.

A time-based sale ending cannot hide weak buying interest. This makes the “presale end today” message less convincing for traders who track liquidity and supply pressure.

Will $SON listing delay to February 2026? Because the countdown is time-based, not cap-based, the sale can “end” without meeting its goal, which increases the probability of another extension. Some market watchers also expect a possible shift January 30 to February (around Feb 10–16), aligning with BlockDAG’s timing, especially since BlockDAG also extended its early sale to cover an unsold gap.

Source: Official X Account

As per Coingabbar’s expert analysis, the launch date can even extend to Q3-Q4 of 2026 because the project doesn't look ready yet. Dates are continuously shifting with market conditions, but demand is still too weak for multi-exchange debut.

Even though the website lists Coinstore, MEXC, BingX, and SpurSwap, there has been no clear exchange-side confirmation for tomorrow’s event.

Traders have not seen basic details like timing, a USDT pair, or an official exchange post about the January 30 debut. The absence of these Spur Protocol new updates is becoming a key red flag in the current launch and presale cycle.

If the $SON Spur Protocol listing date makes an official entry tomorrow, the early trade may open under bearish pressure. A reasonable debut zone could be $0.00110–$0.00125 based on current sentiment.

On CyreneAI, $SON’s premarket price is around $0.001410 on a 15-minute chart, down about 8% over 24 hours, with a reported market cap near $7.06k. If the listing date slips into February or Q3, sentiment may weaken further as traders lose patience. Still, a broader altcoin bounce could lift the price toward $0.00160–$0.00180 later.

The largest risk is not price volatility—it is timeline credibility. A clear exchange announcement, pair details, and a final $SON presale end date status would be the fastest way to reduce uncertainty.

Right now, the Spur Protocol listing date is more about execution than promises. With the SON presale only 22.6% filled, no strong exchange confirmation, and a history of shifting timelines, traders should prepare for both outcomes: a soft, bearish debut or a further extension into February or even Q3.

YMYL Disclaimer: This article is strictly for informational purposes only and not financial advice. Crypto assets are high-risk. Always verify updates from official sources and do your own research before investing or trading.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.