As the Spur Protocol is getting closer to its awaited Token Generation Event TGE happening on January 26, the investors are questioning one thing very loudly: Will $SON bring in huge profits, or will the early price swings drag the whole thing down?

With a smaller reduced airdrop eligibility, definite exchange listings, and a locked token allocation, Spur Protocol is generating a lot of buzz prior to its launch. Let’s scrutinize the $SON price forecast, the prevailing market emotion, and the possible outcomes post-listing.

Spur Protocol is an ecosystem built on Web3 that is decentralized and community-driven, which emphasizes transparency, security, and long-term growth.

The project, before TGE, has made a significant airdrop update by reducing the eligibility requirement to 100,000 SPUR points, thus making it easier for the users to participate.

As per the tweet, the airdrop snapshot will be conducted on January 12, and the wallets that are eligible will automatically be included - no additional steps are required! The Second Season will begin right after this, and user engagement will be kept strong as the project moves into its next phase.

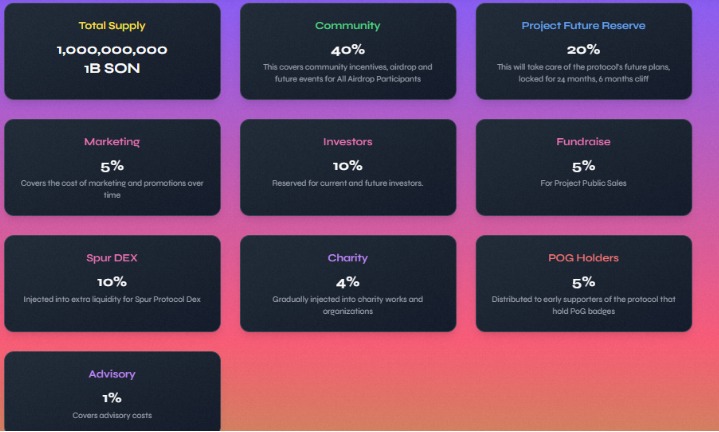

The total supply of the tokens will be 1 billion tokens, and a verified on-chain contract will be operating behind the scenes to ensure transparency and trust during the trade.

Coinstore

MEXC

BingX

SpurSwap

PancakeSwap

The strategy of listing on multiple exchanges will help in making the token available to a wider audience, ensure healthy liquidity, and get early adoption right from the start.

Tokenomics Breakdown: Built for Long-Term Stability

Community – 40%: Incentives, airdrops, ecosystem rewards

Project Future Reserve – 20%: Locked 24 months, 6-month cliff

Investors – 10%: Strategic growth and expansion

DEX Liquidity – 10%: Strong on-chain liquidity

Marketing – 5%: Partnerships and brand growth

Public Sale – 5%: Wider token distribution

POG Holders – 5%: Rewards early supporters

Charity – 4%: Social impact initiatives

Advisory – 1%: Strategic guidance

This arrangement not only minimizes the immediate selling pressure but also facilitates healthier price movement after the listing.

Community Speculation and Market Narrative

Some members of the community have begun speculating on the possible price of $0.026 and are basing this speculation on both the 26/01/26 TGE date as well as the BlockDAG presale end. The fact that this price is not yet public shows that interest is increasing and, therefore, so too is speculation.

Estimated Price Range: $0.042 – $0.054

Potential Gain: +40% to +80%

If $SON meets the following criteria, it would be a powerful mover:

Post-listing community engagement keeps on growing

No early selling due to the locks on the tokens

Strong liquidity across all exchanges remains intact

The entire altcoin market is in a bullish phase

In this case, the speculation and listing hype could contribute to short-term momentum, pushing the prices up in 24-72 hours.

Estimated Price Range: $0.018 – $0.024

Potential Decline: −20% to −40%

A slight decline could be the case if:

The trading volume is low

The market overall is negative

Early investors sell too quickly to take their profits

However, the situation of heavy token locks and the vast majority of the supply still being unavailable makes a deep or protracted sell-off less likely.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.