Crypto commentator and Cofounder of TIP.GP, Preston Pys has recently shared his views on why self-custody Bitcoin makes more sense for everyday investors.

He compared Strategy Bitcoin holdings from 2024 to today and highlighted how Strategy Bitcoin stocks may look attractive but also carry higher risk, recently shared on his X handle (formerly twitter).

Source: X

According to Preston, back in November 2024, the firm held about 279,420 BTC with 193 million shares outstanding. This worked out to roughly 0.00145BTC per share.

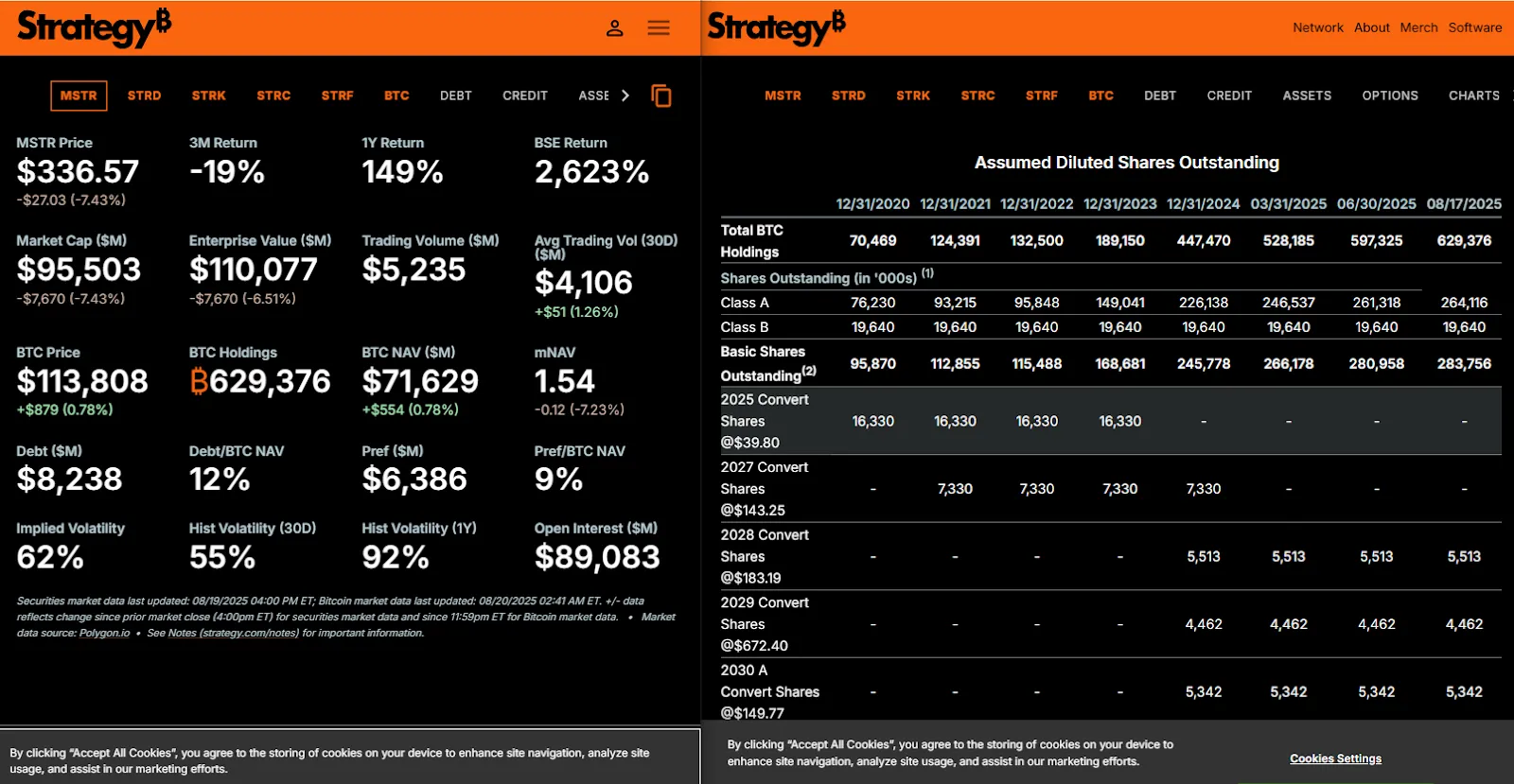

At that time the stock was trading around $338. And now in August, 2025 Strategy Bitcoin holds a total 629,376 coins with 283.6million shares which equals 0.00222 BTC per share and a 53% increase in asset exposure per share even though the stock price is still the same in USD.

Source: MSTR

Preston pointed out that Strategy Bitcoin is now even more leveraged compared to last year and trying more to buy the asset and strengthen its treasury. That means its stock can swing much harder than BTC itself whenever the market moves.

For small investors that kind of added volatility can be difficult to manage especially without a solid understanding of risk.

According to him, the better option for retail investors is to hold coins directly in their own wallets. This way there is no dependence on a company , an exchange or a third party.

If you do not understand the risks or can’t calculate them properly then there are chances you will end up buying and selling at the wrong time, do not take decisions by flowing in emotions and think logically.

Owning the coin directly is like holding your money in your own hands. You remove the extra layers of risk that come with corporate strategies, stock dilution and market leverage.

For most people who just want long-term security, self custody is unmatched as keeping your asset in your custody keeps things simpler and safer.

From my point of view, Preston’s message is on spot. While companies like MicroStrategy make headlines with their massive bets everyday investors do not need that complexity. Holding assets directly gives you control, peace of mind and protection from unnecessary risks.

But, if you hold a large amount of assets, MicroStrategy can be a good option since it is trusted, transparent, and provides clear details about its holdings.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.