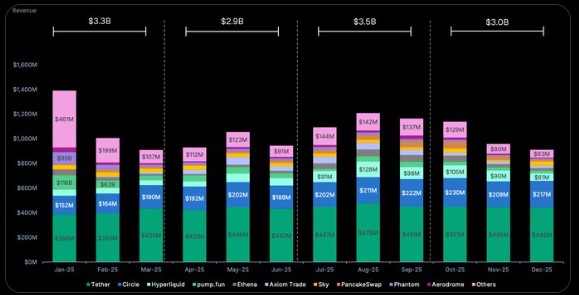

Tether crypto revenue topped the global cryptocurrency industry in 2025, making the stablecoin issuer the most profitable player in the sector. According to CoinGecko’s annual report, Tether generated $5.2 billion in gains, accounting for 41.9% of total cryptocurrency industry earnings, even as the overall market capitalization slipped 10.4% to $3 trillion.

Source: CoinGecko Official

This highlights how stablecoins, especially USDT, continue to generate strong income during both bull and uncertain market phases.

In 2025, stablecoin issuers Tether-Circle together earned over $7 billion, while DeFi innovators such as Hyperliquid ($1.4B) and Ethena ($1.2B) ranked lower in the cryptocurrency revenue ranking. Trading platforms like Pumpfun ($1.2B) and PancakeSwap ($910M) also performed well but were far behind USDT-issuer in total earnings share.

This represents how liquidity tools are now more profitable than many DeFi and trading narratives.

Unlike many crypto projects that depend on token speculation, Tether's digital asset revenue comes from scale and real-world financial mechanics. When users hold and transfer USDT, Tether invest the backing reserves into safe, yield-generating assets like U.S. Treasuries and cash equivalents.

The profits from these yields are excess income, not customer funds. In 2025, this structure allowed the USDT operator to build a strong buffer while providing liquidity across digital asset markets.

A major factor behind the strength of the stablecoin leader crypto revenue in 2025 was its growing exposure to gold. In Q4 2025, the network added 27 metric tons of the precious metal, lifting total holdings to roughly $4.4 billion. This followed another 26-ton purchase in Q3, placing the USDT-operator among the world’s largest non-government gold buyers.

Gold represents roughly 7% of Tether’s consolidated reserves, while the rest is largely held in the U.S. Treasuries (70–80%), plus smaller amounts in Bitcoin and cash equivalents. About 12 tons are allocated to XAUT, its tokenized gold-product, while the remainder strengthens the company’s overall reserve base.

Source: TetherGold Official

Gold’s role in the portfolio is twofold. First, it acts as a hedge against inflation, currency devaluation, and geopolitical uncertainty, providing a safe store of value.

Second, with gold prices reaching record highs above $5,000 per ounce in 2025, the value of Tether’s holdings increased significantly, boosting both reserve strength and market confidence in USDT.

This combination of digital scale through USDT and physical asset backing through the precious metal makes it unique. It stabilizes the peg of USDT, enhances investor trust, and helps the stablecoin giant maintain its market-leading position even in turbulent market conditions.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. Readers should conduct their own research and consult qualified professionals before making investment decisions.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.