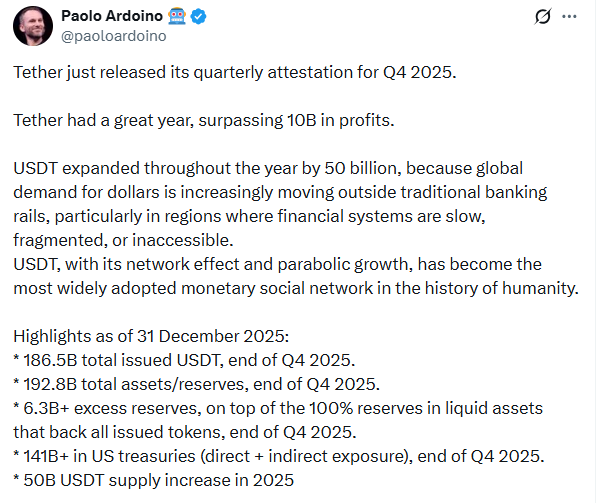

The Tether Q4 2025 attestation has officially confirmed a net profit exceeding $10 billion for the year 2025. The report, which was published on January 30, 2026, and verified by the top-five global independent accounting firm BDO, provides a transparent look at the balance sheet of the world’s largest stablecoin issuer. The findings reveal that Tether has not only maintained its supremacy but has effectively become a foundational pillar of global liquidity.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

By the close of 2025, total issued USD₮ reached a staggering $186.5 billion, representing a supply increase of approximately $50 billion over the calendar year. This growth was particularly aggressive in the second half of 2025, during which $30 billion was minted to meet soaring demand in emerging markets. This growth, as described by CEO Paolo Ardoino, reflects a global trend where users are bypassing fragmented traditional banking systems in favor of digital dollars that operate on a "monetary social network" scale.

One of the most impressive parts of the Tether Q4 2025 attestation is the sheer amount of U.S. government debt the company now holds. To ensure that every digital dollar is backed by a real one, the firm has invested heavily in U.S. Treasuries, essentially loans to the American government that are considered the safest assets in the world. As of the end of 2025, the company’s total exposure to these Treasuries reached a staggering $141 billion.

Beyond digital dollars and debt, the firm has quietly become one of the most powerful players in the physical gold market. The Tether Q4 2025 attestation reveals a massive stockpile of over 140 tons of physical gold, valued at approximately $24B. To put this in perspective, if Tether were a country, its gold reserves would rank just behind the Central Bank of Brazil and ahead of nations like Qatar and Greece. The company has been hauling up to two tons of gold per week into a high-security, Cold War-era nuclear bunker in Switzerland, effectively creating a "digital dollar" fortified by the world's oldest hedge against inflation.

The report makes it clear that the company is holding significantly more money than it actually owes to its users. This "extra" money helps keep the system stable even when the market gets bumpy.

Total Assets: The firm holds nearly $193 billion in total assets.

Excess Reserves: On top of the 100% backing for every token, there is an additional $6.3 billion in "rainy day" funds.

Liquid Holdings: Most of the reserves are held in cash or short-term government bonds that can be sold instantly if users want to cash out.

Industry analysts note that this level of profit and treasury holding puts the company in the same league as major global banks. By holding $141 billion in U.S. debt, the firm has actually become one of the top 20 largest owners of U.S. Treasuries in the world surpassing countries like South Korea and Germany.

Moving into 2026, the focus seems to be shifting from just "surviving" to "building." Tether is using its extra profits (over $20 billion) to invest in future-focused industries or in tech industries like Artificial Intelligence (AI), green energy, and peer-to-peer communication. These investments are kept completely separate from the money backing the USDT tokens, ensuring that the core "digital dollar" remains safe and reliable for the millions of people who depend on it every day.

Your Money Your Life Disclaimer

This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets involve significant risk. Readers should conduct independent research and consult qualified professionals before making financial decisions.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.