Tokenized gold is gathering wide attention among the XRP community as the claims of XRP Ledger (XRPL) to support gold on-chain are heating up.

Even though tokenized gold has existed on the network since 2024, the recent excitement comes from renewed momentum and greater adoption in 2026.

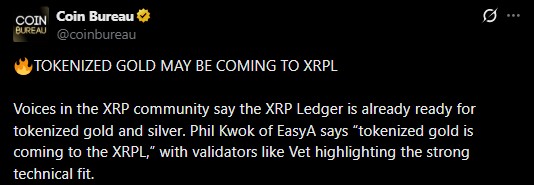

Source: Coin Bureau

Phil Kwok, co-founder of Web3 education platform EasyA, recently stated that “tokenized gold is coming to the XRPL,” a comment that quickly spread across the community.

Phil Kwok Reposted

It’s less about “first launch” and more about growth, scale, and future opportunities in the booming real-world asset (RWA) market.

While the recent buzz suggests something new may be approaching, tokenized gold already exists on the XRP-Ledger. In 2024, Ripple partnered with an Australian tokenization platform named Meld-Gold, to launch digital tokens on XRPL.

Here each digitized token represents one gram of physical metal which is fully backed and claimable through regulated custodians like MKS Pamp and Imperial Vaults.

The current buzz is widely seen as a result of renewed momentum, increasing demand, or the possibility of additional projects opening more doors for growth in 2026.

Influencers like Phil Kwok highlight XRPL’s readiness which makes it a perfect choice for handling precious metals trading.

XRP Ledger validators agree with this view, pointing to the ledger’s ability to handle fast settlement, 24/7 operation, built-in decentralized exchange features, and automated market makers. These features make XRPL attractive for shared ownership, real-time transfers, and auditable trading of physical assets.

On the other hand, from a market perspective, tokenized-gold strengthens XRPL’s role as a serious RWA infrastructure, not just a payment ledger.

The increasing attention in on-chain commodities come as the real-world asset (RWA) tokenization market crossed the $35 billion level in late 2025. Beyond yield-based RWAs, interest is expanding into commodities, metals, and tangible stores of value.

On-chain ownership allows customers to trade fractions of physical metal, instant settlement without the need for third parties, and an ease of global access. These benefits align closely with XRP ledger’s development motives, significantly expanding its role beyond payments into asset management and commodities trading.

For now, one thing is clear: tokenized-gold is once again in the headlines, and XRP Ledger is potentially positioned in the relation as a blockchain ready for real-world assets' mass adoption.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.