Highlights

Ethereum staking exit queue is cleared, while over 1.18 million ETH wait to enter staking after Bitmine’s massive deposits.

Tom Lee price prediction estimates that Ethereum will rise 8,000% to $250000, worth $30 trillion to the network. Bitcoin would also be worth $250,000 in 2026.

Bitmine increases its ETH holdings to over 12 billion and intends to expand its shares in large volumes before the possible stock splits.

Source: Wu Blockchain

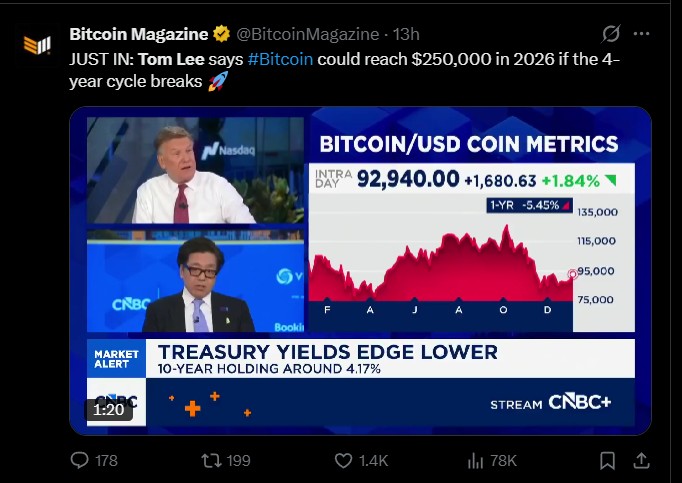

Tom is confident that Bitcoin will reach 250,000 by late 2026, provided that the conventional four-year halving cycle is disrupted. He says that a reset of leverage in October 2025 cleared up the surplus risk and paved the way to a new rally.

He singles out increasing Wall Street acceptance, the U.S. government endorsement of crypto, and the recent boom in gold as the leading indicators of the next move by Bitcoin.

While Bitcoin is currently trading near $95,000, he warns of short-term pullbacks of 10–15% before the next major upside unfolds.

Source: BTCmagazine X

Tom Lee ETH Price Prediction

He has made his boldest Ethereum call yet, predicting ETH could rise nearly 8,000% to $250,000. This would push Ethereum’s market value to around $30 trillion.

He cites staking yields above 5%, institutional demand, and Ethereum’s growing role as core financial infrastructure. Ethereum currently trades just above $3,100, making Lee’s forecast one of the most aggressive in crypto market history.

Source: X

Bitmine purchase has aggressively increased its Ethereum exposure, recently adding $1.4 billion worth of ETH. The company is now in possession of more than 12 billion in ETH, which is approximately 3.4% of the circulating supply. Bitmine also staked approximately 768,000 ETH in ten days, which added to a big queue of staking entries. Bitmine, supported by such large investors as Founders Fund and ARK Invest, is targeting an ETH share of 5% growth.

Source: X

Tom Lee has confidence in his combination of macroeconomic trends, historical market cycles, and on-chain data. He tends to equate crypto expansion to early internet uptake and considers Bitcoin and Ethereum as the financial infrastructure of the future.

He is also optimistic that institutional capital, government backing, and yield-generating assets such as ETH staking will enable a long-term demand. He believes that market resets will clean up excess leverage, and this is what gives him optimism that the market will experience future rallies.

Yes, he has consistently backed his predictions with action. Through Bitmine, he has accumulated billions of dollars worth of Ethereum and actively expanded staking operations.

The proposal to increase Bitmine’s authorized shares from 500 million to 50 billion is designed to prepare for future stock splits, showing confidence in long-term price appreciation. Rather than just forecasting, Lee has positioned Bitmine’s balance sheet directly around his crypto convictions.

The predictions of Tom are controversial. The advocates believe that his calls are supported by his institutional support, long-term vision, and direct financial exposure. Opponents highlight unmet historical goals and caution that price ranges of $250,000 are based on highly implausible adoption rates.

His predictions might be rosy, but it is not hype and empty talk, as the way he acts portrays that he believes in what he is saying. Nevertheless, investors must view such predictions as a high-risk, long-term situation instead of a guarantee.

Bitcoin (BTC) price today reached $93700, rose by 1.14% in the last 24 hours, with a trading volume of $45.7 billion and a market cap of $1.8 trillion.

Ethereum priced at $3219.98, up 2.12% in 24 hours, with a trading volume of $24.31 billion and a market cap of $388.5 billion.

Source: Coinmarketcap

Bitmine stock has risen by almost 15% after the announcement of its share expansion plan, and it is still fluctuating in tandem with the price of Ethereum.

Community Reaction.

The crypto community is divided over the radical calls of Tom. Bulls laud his belief, institutional reinforcement, and violent ETH accretion as indicators of confidence. Skeptics point out the lack of achievement of targets in the past and doubt that Ethereum would ever become a $30 trillion company. Social media responses are on one extreme optimistic, and on the other extreme, there is skeptical doubt, which is more generalized in the crypto markets in early 2026.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.