Key Highlights:

Crypto market cap increases to 2.73T amid high fear levels.

BTC and ETH are up by a slight margin, and volatility is elevated.

Mixed signals, as good gainers conflict with acute losers and reserved prospects.

Overall Crypto Market Update, 3 Feb 2026: The cryptocurrency experienced a slight recovery due to increasing cap and volumes, but the extreme fear remains as macro uncertainty, ETF losses, and disproportionate performance of altcoins continue to dominate the mood.

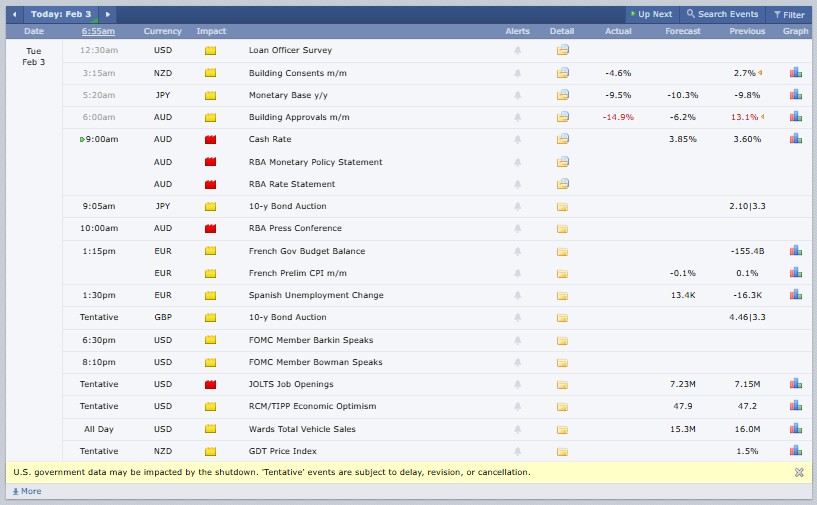

Source: Forex Factory

The global cryptocurrency market today reached a capitalization of $2.73 trillion, noted an impressive 1.5% upward trend in the last 24 hours, whereas Total trading volume recorded at $198.8 billion.

Bitcoin’s (BTC) dominance over the industry remains intense, with 57.7%, while Ethereum (ETH) carries 10.4%. The largest gainers of the industry are Polkadot and XRP Ledger Ecosystem in the past day.

Bitcoin (BTC) and Ethereum (ETH) Price Analysis:

(Note: BTC and ETH are often viewed as less volatile historically, but still risky. The data recorded from CoinMarketCap)

Bitcoin (BTC) price today reached $78832.99, surged 1.34% in the last 24 hours, with a trading volume of $72.94 billion and a market cap of $1.57 trillion.

Ethereum (ETH) price today is at $2347.3, soars 1.68% in 24 hours with a trading volume of $46.36 billion and a market cap of $283 billion.

Top Trending Crypto Coins Price in 24 Hours:

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

Dogelon Mars price (ELON): $0.0000003672, soars 9.38%, trading volume (TV): $29.23B.

Zama price (ZAMA): $0.03576, slides 20.81%, TV: $204.59M.

Zilliqa price (ZIL): $0.005119, up 24.41%, TV: $221.59M.

Hyperliquid price (HYPE): $34.23, rose 9.77%, TV: $884.4M.

XRP price (XRP): $1.61, up 0.23%, TV: $4.76B.

Top 3 Crypto Gainers in 24 hours:

(Ranked by 24-hour percentage gain)

Stacks price today (STX): $0.2958, surged 14.04%, trading activity around $40.33 million.

MemeCore price today (M): $1.48, jumped 13.65%, trading activity near $13.28 million.

Kaia price today (KAIA): $0.06166, gained 11.58%, trading activity roughly $36.68 million.

Top 3 Crypto Losers in 24 hours

(Ranked by 24-hour percentage loss)

Story price (IP): $1.43, down 9.74%, trading activity around $148.66 million.

Pump.fun price (PUMP): $0.002377, lower by 7.93%, with trading volume near $256.56 million.

Monero price (XMR): $382.94, slipped 7.74%, trading activity close to $121.82 million.

Stablecoins and Defi Update:

Stablecoins reflects 0.3% positive change over the past 24 hours, with a market capitalization of $310.4 billion and trading volume of $168.6 billion.

The Overall (Defi) Decentralized Finance market escalated 3.3% over the last 24 hours, recording a market cap of $95 billion and trading volume (TV) at $6.4 billion. Defi dominance globally marked 3.5%.

Source: Alternative Me

Today’s Fear and Greed Index is 17 (Extreme Fear), up from 14 yesterday, but far below 29 last week. Persistent price drops, weak volume, and negative sentiment keep fear high, despite minor short-term stabilization signals.

(Note: All of these updates have an effect on traders, as they affect liquidity, sentiment, and potential returns, and thus have to be monitored closely.)

1. Coinbase Adds DEEP and WAL to Listing Roadmap: Coinbase has added DeepBook (DEEP) and Walrus (WAL) to its asset listing roadmap. Trading will begin later, subject to support technical readiness.

2. Bitcoin May Drift Toward Long-Term Support: Galaxy Digital’s Alex Thorn warns Bitcoin may drift toward $58,000, as 46% supply stays underwater, gold correlation fades, and $56,000–$58,000 remainsa historic support zone ahead.

3. Bitcoin ETF Buyers Face Losses: U.S. spot Bitcoin ETF investors face paper losses as average entry near $84,100 clashes with $79,000 prices amid weaker inflows and liquidity conditions.

4. US–India Strike Major Trade Deal: Trump agreed with PM Modi to cut US Trump tariffs on Indian goods to 18%, as India stops Russian oil buys and boosts U.S. imports trade.

5. Trump Denies Knowledge of Crypto Deal: Trump denied knowledge of a reported UAE investment in his family’s crypto firm, said relatives handle it, and reiterated support for crypto to counter China.

6. Crypto Hack News: Venezuelan police arrested Rosa María González, accused of being the Zoe Ponzi mastermind, after fleeing Argentina with 611 BTC, leaving investors $120 million poorer; extradition now complicated diplomatically.

Compared to the Feb 2 cryptocurrency update, today, Feb 3, shows a mild recovery: capitalization rose from $2.69T to $2.73T, volumes increased, BTC turned positive, and ETH stabilized. However, the fear increased by a small margin, which means that sentiment is still weak despite the improved price performance and increased involvement of altcoins.

For crypto users, the market is an indicator of short-term trading prospects, though the risk is higher. Price rebounds lack strong conviction, making cautious positioning, risk management, and close monitoring of macro and regulatory news essential.

Risk Context: This commentary is not about long-term conditions and is merely informational. It does not point in the direction of the price or show an action to be taken on an investment.

Based on the last 24 hours, crypto investing remains risky but selectively beneficial. Long-term investors may accumulate cautiously, while short-term traders should expect sharp swings. Blind optimism is risky; disciplined strategies and patience are crucial right now.

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile and risky. Always conduct your own research and consult a qualified financial advisor before making investment decisions. Not all regions can offer some of the services or assets discussed.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.