The Trump Administration Intel Purchase is in discussion today, with the government planning to own a 10% stake in Intel, as per The Kobeissi Letter Twitter post.

This means the White House may become a significant shareholder, joining other investors in the tech company.

This $INTC news is making headlines because it is unusual for a government to take part in a private tech company. The Trump US tech investment is important for several reasons:

Boost Growth: If the government owns a part of the firm, it can help the company make new chips faster and build more factories.

Investor confidence: When people know the White House has a stake, they may feel safer and willing to buy more of the company’s shares.

National technology strategy: Having a part of the corporation helps the US stay strong in making important chips and keeps the country ahead in the global technology market.

This Trump investment is not just about money. It’s about shaping how technology develops in the country and keeping critical technology in US hands.

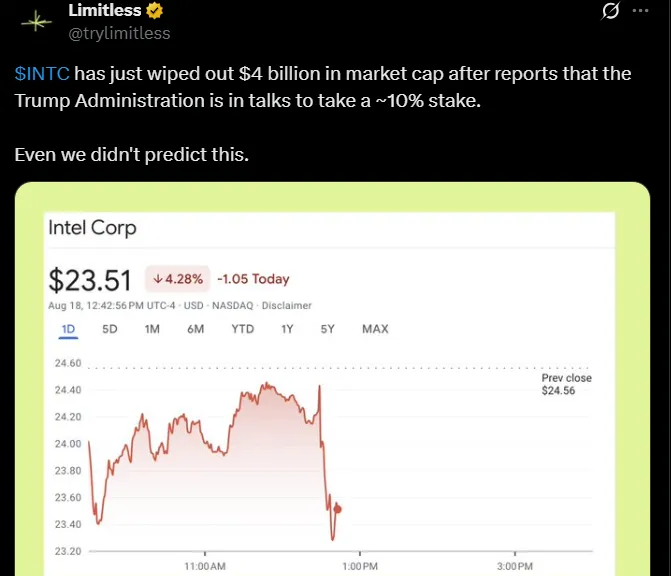

After the news, investors are closely watching Intel price reaction. Some believe the stock may go up because of the strong support from the government. Others say the short-term market might see small ups and downs as traders adjust.

According to a crypto analysts prediction account named Limitless, $INTC shares has just wiped out $4 billion in market cap after reports that the administration is in talks to take a 10% stake.

With a Trump Administration $INTC Purchase, these projects could get more attention and funding, making tech firm a stronger player in tech.

As per the chart analysis; the ideal strategy I’m seeing being a crypto analyst is: Breakout - Retest - Go

This step could affect other chip makers like AMD and NVIDIA. Investors might rethink which companies to hold, as government backing can shift market dynamics.

This news indicates a possible long-term benefit. By joining as a shareholder, the administration could help the firm maintain leadership in chip production and innovation. This move might also influence tech-related funds, ETFs, and institutional portfolios, showing a broader effect on the market.

If the Trump Administration Intel Purchase becomes official, it could change the corporation's upcoming projects, influence $INTC stock prices, and impact the whole semiconductor industry. This development also helps investors understand what this move means for the firm and the wider US technology sector.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.