Highlights:

WLFI Token announces World Swap forex platform built around USD1 stablecoin.

The platform aims to reduce cross-border remittance fees using digital dollar transfers.

Lending Trump's platform attracts hundreds of millions of deposits after launch.

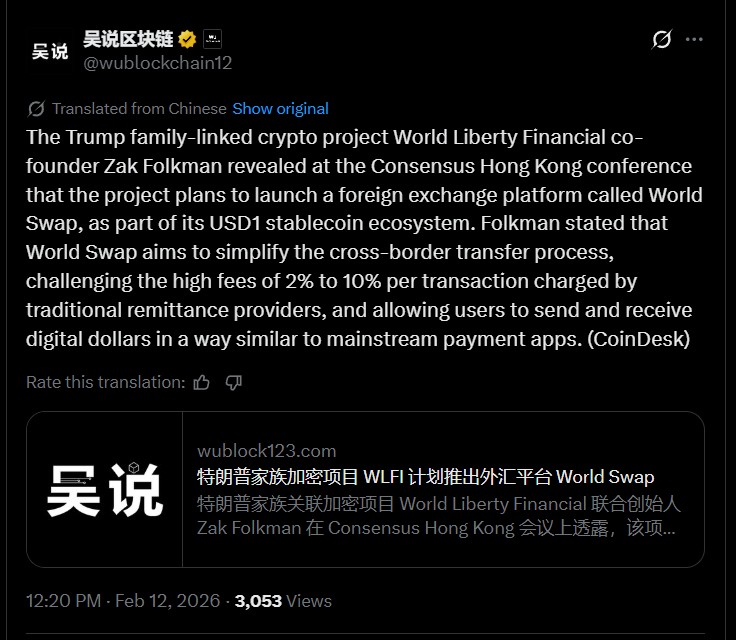

The cryptocurrency project World Liberty Financial (WLFI), which is connected to the Trump family, is broadening its digital finance plans. During the Consensus Hong Kong conference, the co-founder Zak Folkman announced a foreign exchange platform known as World Swap that would be deployed as part of the USD1 stablecoin system of the project.

The announcement indicates that WLFI is planning to leave the stablecoins and lending to cross-border payments and foreign exchange services and become a competitor to traditional remittance providers.

The intended launch is another dimension to the strategy to establish an integrated blockchain-based financial infrastructure around its cash-backed USD1 stablecoin.

Source: Official X

Folkman describes World Swap as a company that tries to make money transfer internationally as easy as possible by eliminating the technical aspects that are typically linked to crypto wallets and blockchain transactions.

Conventional remittance services usually impose a transaction fee of 2-10%, depending on the line and service provider. This will consider that these costs might be significantly decreased with the help of blockchain-based settlement based on stablecoins.

Folkman explained during the conference that the goal is to make sending digital dollars “as simple as using mainstream payment apps.”

If successful, the platform could appeal to:

Migrant workers sending remittances

Businesses conducting cross-border payments

Crypto-native users seeking cheaper settlement options

Lower fees and faster settlement remain key selling points for stablecoin-powered financial services globally.

At the center of WLFI’s financial ecosystem is USD1, a dollar-pegged stablecoin backed by cash and cash equivalents, according to the company.

WLFI is developing multiple products designed to increase the stablecoin’s adoption and utility, including:

World Swap (forex platform)

World Liberty Markets (lending platform)

DeFi protocol integrations

This “financial stack” approach mirrors strategies used by major crypto platforms attempting to build stablecoin-centric payment ecosystems.

Folkman noted that Markets has already attracted hundreds of millions of dollars in deposits within weeks of its launch, suggesting early institutional and retail interest.

Speculation around World Liberty forex ambitions began in late January, when crypto community members discovered that AMG Software Solutions LLC, a Puerto Rico-based firm that owns intellectual property, had registered “World Swap” trademarks.

The trademark activity appears to confirm that development of the platform is underway.

Folkman also hinted that additional details about WorldSwap and trump crypto project's broader roadmap will be revealed at an upcoming event at Mar-a-Lago later this month.

Stablecoins have also been placed as a low-cost alternative to the traditional payment rail, especially in emerging markets where remittance fees are still high.

In case the project manages to launch WorldSwap, it would become a part of an increasing number of blockchain-based projects trying to modernize:

International payments

Currency conversion

Cross-border liquidity settlement.

Nonetheless, compliance with regulations, liquidity, and adoption by users are likely to define the ability of such platforms to compete with already existing financial institutions.

The USD1 stablecoin, lending services, DeFi, and most recently, an intended forex platform all seem to put WLFI token on the path to becoming a complete-service crypto financial ecosystem.

The forthcoming announcement of Mar-a-Lago might shed more light on:

WorldSwap's launch timeline

Supported currencies

Regulatory framework

Collaborations and mergers.

To date, the extension of the project to the foreign exchange indicates an increase in the competition in the sphere of payments carried out with the help of stablecoins.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.