In the latest Trump Tariffs announcement, the U.S. government has declared that EU wine tariffs will increase from 10% to 15% US tariff starting August 1. This move will impact all European wine and spirits entering the American market, as confirmed by multiple news sources and EU diplomats, according to The Kobeissi Letter.

Source: X

The reason behind this new Tariffs on EU? According to officials, it's a pressure tactic. Unless the U.S. and the European Union reach a new trade deal, the 15% rate will stay in place. EU diplomats said negotiations will continue into autumn, but there’s no clear sign of a breakthrough yet.

Earlier, The US President had already imposed Trump Tariff on India at 25%, 15% on South Korea, and 40% on Brazil. With this new action against Europe, it seems Trump’s trade strategy is expanding fast — and he's not slowing down.

Despite the pressure from tariffs, U.S. Federal Reserve Chair Jerome Powell is not planning to cut interest rates right now. The current U.S. interest rate remains between 4.25% and 4.50%.

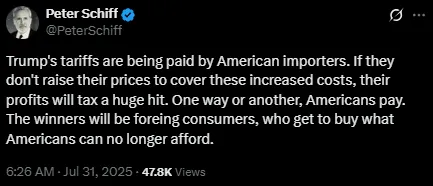

Many financial experts are not happy with the Trump Tariff news. Economist Peter Schiff said that these tariffs hurt American consumers directly. Importers pay the extra cost, but in the end, those costs get passed on to the buyers. On top of that, state and local sales taxes apply to the higher prices — making it even worse for shoppers.

Source: X

Meanwhile, President Donald Trump is also urging Powell to reduce interest rates, even though he’s increasing global trade tensions. Some see this as a dictator-style approach, where he's pushing his plans without compromise.

Despite this tariff news, the market remains positive and is stable. In fact, it's slightly up.

According to CoinMarketCap, the global crypto market cap stands at $3.89 trillion, up by 0.34% in the last 24 hours. Here’s a quick look:

Bitcoin price today is $118,504, up by 0.36%.

Ethereum price is $3,855, showing bullish signals.

XRP price is $3.17, after a strong 2.64% intraday rise.

So, why crypto market is up today? One reason is that investors are looking for safe assets outside the traditional economy. Tariff tensions create fear in the stock market, and crypto becomes an alternative for many.

Trump’s unstoppable tariff wave — from India to Europe — is shaking up global trade. While it may help in forcing deals, it’s also making life harder for American buyers. However, crypto investors are staying calm and even gaining trust in decentralized markets. It looks like digital assets could become the shelter in Trump’s storm.

Disclaimer: This article is for informational purposes only and not financial advice. Always do your own research before investing.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.