The United Arab Emirates has taken a major step with the launch of the UAE USDU stablecoin. This new stablecoin is designed to support secure and compliant digital asset settlement inside the country. The key highlight of this news is that the dollar-pegged virtual asset is officially registered under the Central Bank of the UAE, giving it legal recognition within the national financial system.

This move shows that the country is not just welcoming crypto innovation but shaping it in a regulated and responsible way. The dollar-backed token is built to work as a professional settlement tool for digital finance, not as a retail payment coin for everyday users.

Source: TheBlock Xofficial

USDU is issued by Universal Digital Intl Limited, a company operating within the UAE’s regulated financial environment. The virtual asset is registered under the CBUAE Payment Token Services Regulation as a Foreign Payment Token.

This is very important to understand clearly:

USDU is not issued by the country’s central bank. It is only registered and approved under the central bank’s regulatory framework. That means the central bank allows it to operate legally, but it does not control or issue the coin itself.

USDU is also positioned within Abu Dhabi Global Market (ADGM), which is known for strong digital asset regulation. This gives the dollar-backed token a dual layer of compliance, making it suitable for institutional use.

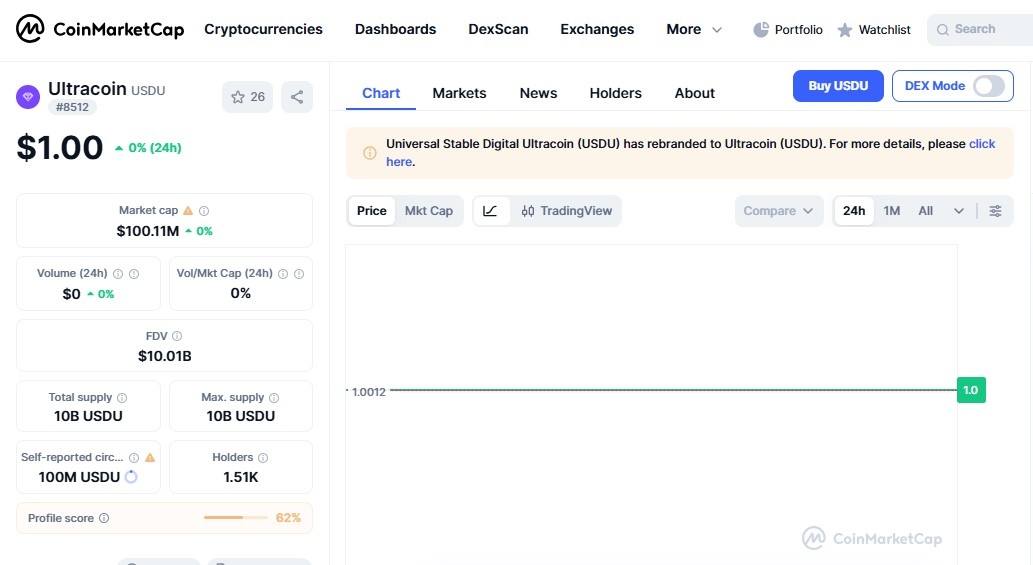

Source: CoinMarketCap official

UAE USDU stablecoin is launched as an institutional-grade settlement rail, not a payment coin for the general public. Retail investors and everyday users are not its target. It is meant for professional trading desks, brokers, digital asset platforms, and financial institutions that need a regulated USD-based settlement token.

The virtual asset is:

Fully backed 1:1 by US dollars

Reserves are held in regulated bank accounts

Designed for transparency and compliance

Used for secure digital asset settlement

This makes USDU different from global retail digital dollar tokens like USDT or USDC. Its focus is not mass adoption but financial infrastructure reliability.

Impact on the Nation’s Crypto Market, Stablecoin Space, and Global Economy

The UAE USDU stablecoin strengthens the country’s position as a serious global crypto hub built on regulation, not speculation. A central bank-registered virtual asset improves confidence for international institutions looking to operate in the region. It also encourages exchanges and brokers to follow stricter compliance standards.

In terms of stablecoin market share:

Inside the country, the dollar-backed token can gain adoption in institutional settlement activity

Globally, it will not immediately challenge USDT or USDC

Its role is specialized, not mass-market

For the global crypto market, this sends a strong message. It shows that stablecoins are evolving from trading tools into real financial infrastructure. Governments and regulators are now shaping how virtual dollar tokens can operate safely within national economies.

In the long run, this step can:

Improve trust in the regulated virtual dollar token

Support tokenized finance and digital settlements

Strengthen the nation’s financial innovation image

Attract institutional capital into the region

YMYL Disclaimer: The above article is strictly for educational purposes only. It does not provide or support any financial advice. Cryptocurrency markets carry high risk, so always do your own research before investing.

Krishna Tirthani is a dedicated crypto news writer with 1 year of hands-on experience in the cryptocurrency market. With a strong focus on market trends, token launches, price movements, and blockchain innovations, Krishna delivers timely, accurate, and easy-to-understand crypto content for both beginners and experienced investors.

Over the past year, Krishna has closely followed major developments across Bitcoin, Ethereum, altcoins, DeFi, NFTs, Web3, and emerging crypto projects. His writing style blends data-driven insights with clear explanations, helping readers stay informed in a fast-moving and often complex market. From breaking crypto news and exchange listings to tokenomics analysis and price predictions, his work aims to simplify information without losing depth.

Krishna believes that credible research, transparency, and consistency are essential in crypto journalism. Each article is crafted with SEO best practices in mind, ensuring high visibility while maintaining originality and factual accuracy. His growing experience in the crypto space allows him to spot early trends and explain their potential impact on the wider market.

With a passion for blockchain technology and digital assets, Krishna Tirthani continues to evolve as a crypto writer, committed to delivering reliable, engaging, and value-driven crypto news content.