Highlights

The Federal Reserve injected $31 billion into U.S. banks via overnight repo operations on January 1, 2026.

December liquidity support crossed $40 billion, one of the largest since the COVID-19 crisis.

Rising liquidity is drawing attention from stock and crypto investors amid economic uncertainty.

The U.S. Federal Reserve liquidity operation conducted at the beginning of 2026 added $31 billion to the banking system by the use of overnight repurchase agreements (repos).

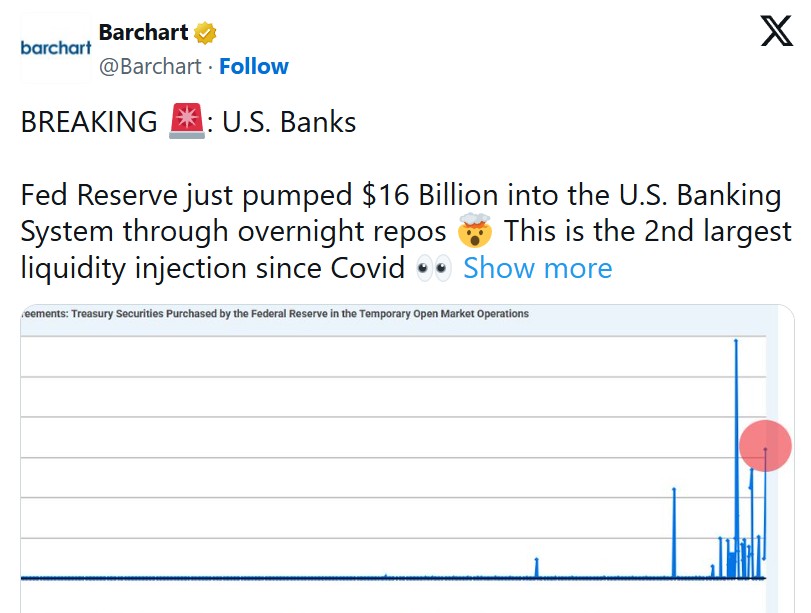

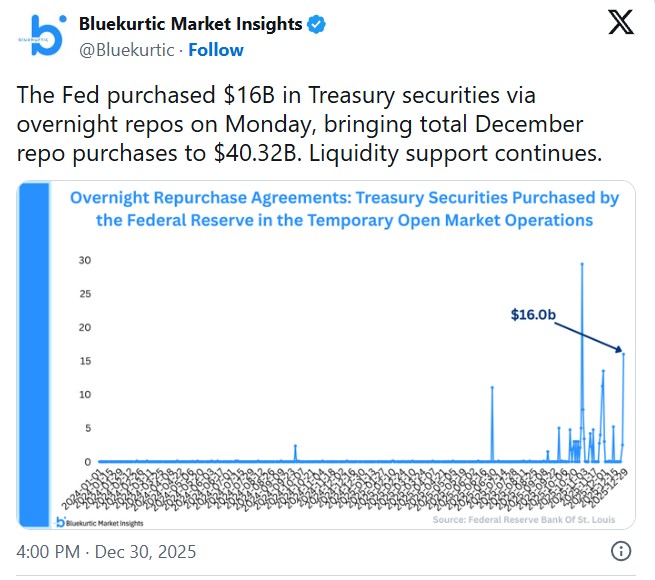

This was after another significant operation was made on December 30 with an addition of $16 billion, which brought the total December repo injections to $40.32 billion.

This is the highest amount of overnight liquidity increase since March 2020, according to the Federal Reserve Economic Data (FRED), and it exceeds the level during the Dot-com bubble era.

Source: CryptoAman X

Why is this important?

The large repo operations are not common outside the times of financial stress. Although the Fed typically performs repos at the end of the quarter and year, the volume of this intervention is noticeable, and the market participants are trying to understand whether there is an underlying pressure in the short-term funding markets.

Graphs of the temporary open market operations indicate a sharp spike in the activity of repo. In the past, such spikes have been associated with economic uncertainty or stress in the market. Shaded recession zones on the charts further highlight how unusual the current move is.

Source: Official X

Most analysts do not view this as an outright crisis. The dominant reason has been cited as the restrictions of the end balance sheet and the regulatory reporting requirements that tend to make banks hesitant to lend to each other. The institutions resort to the Fed as a backstop when the private lending becomes tight.

Other commentators feel that there is more stress under the surface due to the size of the injections. Financial analyst Andrew Lokenauth opined that banks might require additional funds to meet the commitments related to collateral mismatches and commodity-related exposures. Persistent reliance on Fed facilities can signal rising risk aversion.

The Fed maintains that these operations are not quantitative easing (QE). Officials describe them as routine liquidity management aimed at keeping short-term interest rates under control. Nonetheless, the latest FOMC meeting minutes might show a possible not QE reserve program, with a maximum of $220 billion of Treasury purchases during the coming year to have sufficient reserves.

Source: X

The Fed is also wary of reducing rates even though liquidity is increasing. Policymakers pointed out that the rates will remain high longer unless inflation declines with persuasion. The next rate cut is not anticipated until March 2026 in the markets.

Source: X

The world is now enjoying the highest liquidity ever, up about $490 billion, due to the better collateral situation, to fiscal flows that look like stealth QE, and more lenient policies in the major economies, including the seasonal liquid assistance of China.

In the past, risk assets like equities and cryptocurrencies have been supported by expanding liquidity. Most crypto-oriented analysts are optimistic that Bitcoin will finally react positively if the capital momentum persists.

Bitcoin is in a range of between $85000 and $90000, probably because of the high Fed interest rates regulatory unpredictability, low trading volumes, and investor paranoia.

The Federal Reserve is quietly reinforcing the financial system with substantial support while maintaining a restrictive rate stance. Although officials insist this is not easing, the direction of capital is clearly upward. Whether this marks a turning point for markets remains uncertain, but investors are watching closely as capital conditions continue to evolve.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.