The cryptocurrency space witnessed a brutal selloff in the last 24 hours, leaving investors searching for answers to why is crypto market down today. The global market cap slipped to $2.97 trillion, reflecting a sharp 3% decline in a single day.

Bitcoin, Ethereum, altcoins, and even traditional safe assets like gold and silver collapsed together, signaling a broader liquidity shock rather than a cryptocurrency-only issue. This was not a slow correction. It was a fast, system-wide breakdown driven by fear, leverage, and global liquidity stress.

In this article, we will uncover the crypto market down reasons, will it recover, and what might happen next.

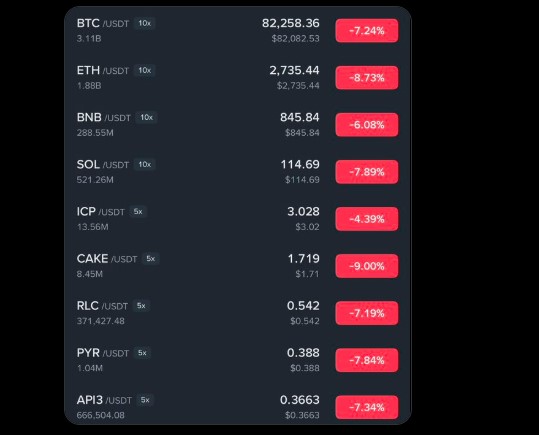

Investors first noticed the damage on the price chart. Bitcoin dropped 7.24% to around $82,258, while Ethereum fell 8.73% to near $2,735. The selling did not stop there as major altcoins followed instantly. BNB declined 6.08%, Solana slipped 7.89%, and mid-cap tokens like CAKE dropped 9% in the same direction.

This uniform red across Bitcoin, Ethereum, and mid-cap tokens confirms that the core reason behind why cryptocurrency market is falling today is a industry-wide selloff, not a single-project failure.

The biggest trigger behind why did crypto crash today came from outside the industry. Gold and silver experienced historic selloffs, creating a high-volatility liquidity shock.

Silver collapsed from the 118–120 zone to near 104 on the 15-minute TradingView chart, erasing weeks of gains in minutes. RSI dropped to the low-30s, showing aggressive panic selling.

Gold followed with an even larger move, falling from above 5,500 to near 5,100, wiping out nearly $3 trillion in value. MACD printed one of its sharpest negative expansions, confirming institutional-scale selling.

Combined, safe-haven assets erased over $3.75 trillion, while US equities added pressure as the S&P 500 and Nasdaq lost more than $1.5 trillion intraday. This massive capital drain explains why did gold and silver price drop today—and why digital assets became the next casualty.

Once traditional space cracked, cryptocurrency leverage collapsed fast. In the last 24 hours, $1.72 billion positions were liquidated, impacting 274,442 traders. Long positions took the biggest hit, with over $1.60 billion in longs wiped out, showing traders were heavily bullish before the crypto crash news.

As seen in the Coinglass liquidation chart, $BTC alone saw $786.5 million in liquidations, followed by Ethereum at $422.7 million. XRP, Solana, and other altcoins also faced forced exits. This liquidation spiral explains the speed and depth of today’s fall.

In summary, why is crypto market down today is not about the digital assets alone. A historic gold and silver crash triggered a global liquidity reset. In the short term, volatility may continue for 3–4 days as the industry digests the liquidity shock.

However, as per Coingabbar analysis, one potential stabilizing factor is the market structure bill expected to be signed today at 11:00 AM ET. The bill aims to reduce manipulation and improve regulatory clarity, which could help calm investor fear and stabilize prices.

YMYL Disclaimer: This article is strictly for informational purposes only, not financial advice. Cryptocurrency prices are highly volatile. Traders and investors should always do their own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.