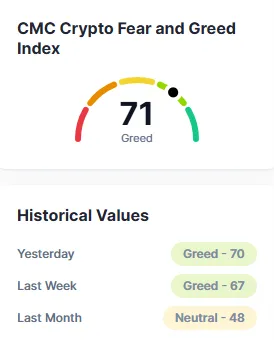

What happened in Crypto Today: Fear and Greed Index Reaches 71, Trading Volume at $298 Billion

Crypto Today experienced some of the big movements. The combined worldwide cryptocurrency trading volume over the past 24 hours stood at $298 billion. Bitcoin remains at the top with 59.7%, while Ethereum takes the 11% share. The widely followed Crypto Today Fear and Greed Index stepped up a point to 71, marking intense greed levels among investors.

Source: CoinMarketCap

CryptoToday Highlights: These are the most important cryptocurrency news stories of the day that shook things up and had a big effect on the Crypto today market.

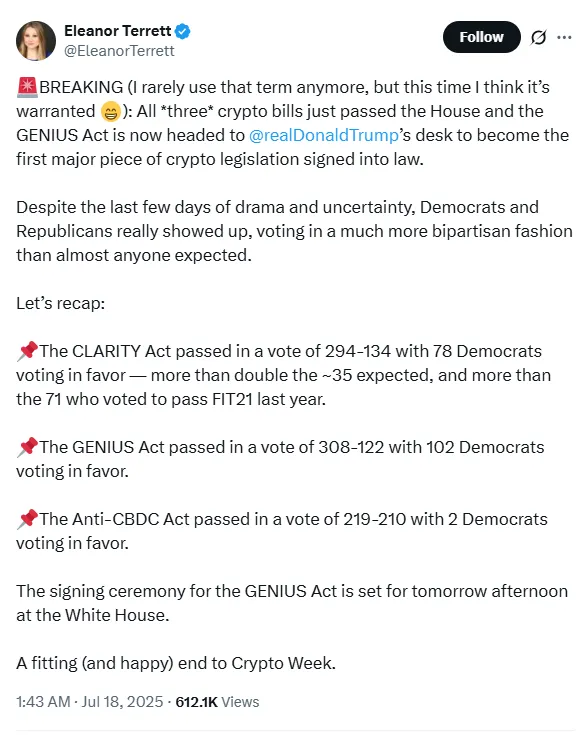

The U.S. House of Representatives made history by passing the GENIUS Act, a significant move in introducing regulations into the world of DeFi. The act was strongly passed-308 voted yes, including 102 Democrats.

CrptoToday saw a major policy breakthrough as The GENIUS Act targets stablecoins-digital currencies that are pegged to actual assets such as the U.S. dollar. It seeks to deliver transparency, consumer protection, and clear legislation. This is a significant step to sanitize the $250 billion stablecoin market.

Two other pieces of legislation also passed along with it: the CLARITY Act and the Anti-CBDC Surveillance Act. They collectively are a huge effort by legislators to put definitive regulations in place in America. President Trump will soon sign the GENIUS Act into law.

Source: X

Nasdaq-listed Thumzup Media Corporation has sanctioned a gigantic $250 million investment in crypto. Their new strategy will be centered around Bitcoin, Ethereum, XRP, Solana, Dogecoin, USDC, and Litecoin.

CEO Robert Steele stated, Crypto Today reflects a turning point- This demonstrates our confidence in the future of digital assets. We wish to grow with the market and add more value to our shareholders.

This comes after Donald Trump Jr.'s shocking investment in the firm, whereby he purchased 350,000 shares.

SharpLink Gaming has increased its plan of investing in Ethereum from $1 billion to a whopping $6 billion. The firm is modifying the rules of selling its stock to raise funds for this purpose. Currently, SharpLink owns 18,737 ETH valued at $67.33 million and plans to purchase much more.

Crypto Today witnessed the immediate impact of this move. Ethereum prices surged 8.58% in 24 hours, now trading more than $3,600. SharpLink plans to utilize the money raised not just for ETH but also business expansion, marketing, and working capital.

Source : X

Crypto Today reported one of the largest history moves , a whale of Bitcoin has sold 80,000 BTC- valued more than $9.5 billion. The initial investment was only $132,000, or a 72,000x return.

This wallet had remained dormant since 2011. Now rumors are abounding that the gains may be going into Ethereum and XRP. ETH has risen 42% this month and XRP is climbing quickly too-up 66% in the past 30 days.

Altcoins in Focus: Is It Their Time to Shine?

Crypto Today shows a notable shift in momentum: As BTC selling pressure is strong, funds appear to be entering altcoins. Two large ETH wallets purchased more than 206,000 ETH valued at $745M, perhaps from the same whale. World Liberty and BitMine are also building their ETH holdings, while XRP gains renewed momentum with prices rising. The market cap recently crossed $4 trillion, reflecting strength of a different kind.

Crypto Today was action-packed- from billion-dollar wagers to new legislation that will redefine the future. As Ethereum and XRP continue to pick up steam, everyone is waiting with bated breath for what is next in this exciting bull run.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.