The BTC price crash shocked everyone today after it suddenly fell from $92,000 to $89,000, showing a clear 3% drop in the last 24 hours. Many traders got liquidated, and the community was left asking why Bitcoin Is Falling today.

As per market research, the answer is a mix of chart breakdown, fear in the market, and major upcoming events. This fall looks serious because both technical indicators and global factors worked together, creating a sharp drop.

Let’s understand the reasons and what’s coming next.

Before the actual fall, the bitcoin crash was already giving “danger signs,” as seen in the TradingView chart. The Bollinger Bands were becoming very tight. This means the market was getting ready for a big move. Once the asset broke the middle line and then the lower line, the BTC price crash started quickly.

Since $92,000, the token shows that it is making lower highs again and again. This pattern clearly shows buyers are losing strength, and the price drop may continue for a short period.

MACD Turned Strongly Bearish: On December 5, the MACD showed a deep red signal as the line crossed sharply below the signal line. This confirmed heavy selling pressure. Even today, MACD is still below zero, which explains why is bitcoin crashing right now.

Support at $90,500 Broke: Once the token lost $90.5K, a smooth path opened toward $89K–$88.5K, which became today’s low.

All these signals combined to create a textbook technical breakdown, fueling fear sentiment across the market.

Beyond the chart, there are several Bitcoin price drop reasons. Here are the major Bitcoin updates:

1. Fear & Greed Index Hits 23 (Extreme Fear): Extreme fear makes people sell in panic. The crypto fear index at 23 is one of the biggest reasons behind today’s 3% fall.

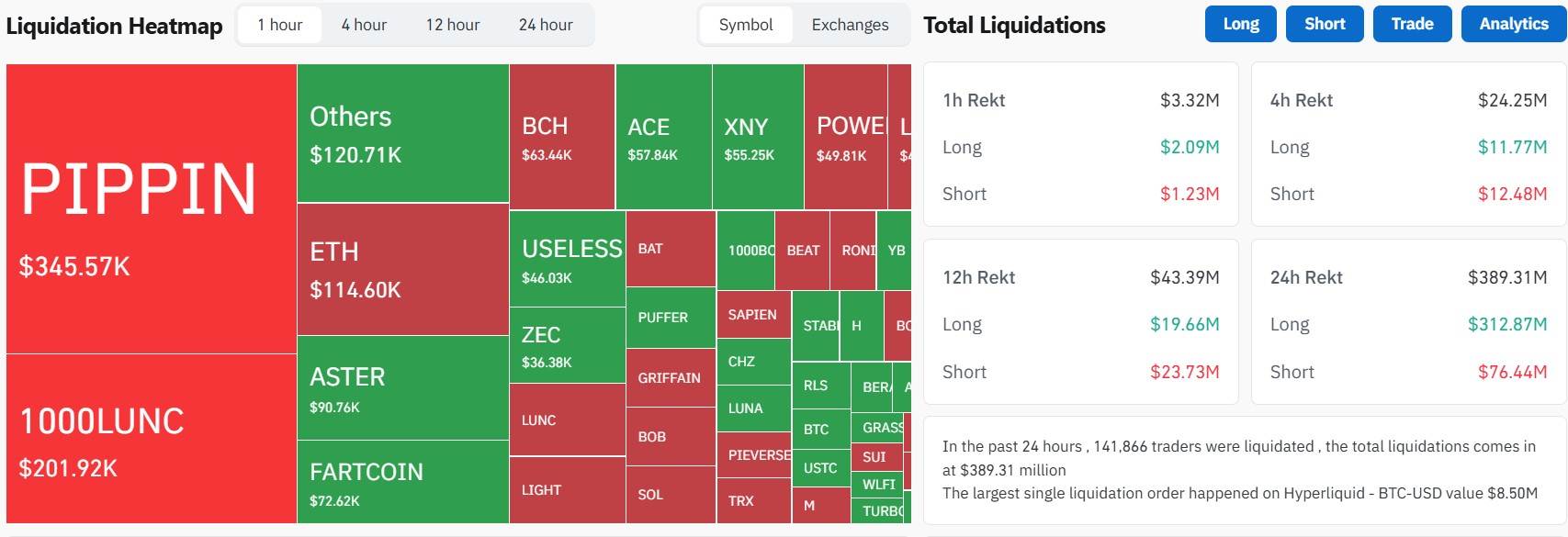

2. $390M Liquidations in 24 Hours: Coinglass data shows that 140,617 traders liquidated, which brings the total liquidations to $390.46 million.

The interesting part? The largest liquidation came at an $8.5M BTC order on Hyperliquid. These liquidations create chain reactions, leading to a bigger BTC price crash.

3. SEC Crypto Roundtable Shock Dec 15: The SEC announced discussions on crypto surveillance and privacy, featuring Zcash founder Zooko Wilcox. This news increased fear and uncertainty, adding more pressure to the world’s largest cryptocurrency.

4. Fed Rate Cut Meeting on Dec 10: Rate cut odds are sitting at 82.3% for a 25 bps cut after U.S. PCE inflation data came at 2.8, and core PCE came at 2.8%.

Crypto analyst Ethan said that if the asset keeps touching the same trendline and falling, it may drop below $80,000 before 2026.

Let’s see what the data says:

Short Term (1–2 Weeks): After analyzing why Bitcoin is falling today, the technical chart, and major reasons, I believe the asset may fall again toward the $88,000–$84,000 zone.

Midterm (Dec End – Early 2026): If it keeps getting rejected from the trendline, then chances of falling to the $80,000 low may increase, aligning with what crypto analyst Ethan said.

Long Term (2026 Bull Phase): Even if the BTC price crash hits a $75,000–$80,000 downtrend, the long-term outlook stays bullish. Rate cuts, ETF inflows, and institutional demand can push it toward $110K–$130K in 2026.

Today’s BTC price crash wasn’t random; it was the result of technical rejection, fear-driven liquidations, regulatory unease, and macro uncertainty hitting all at once.

The asset is still in a strong long-term uptrend, but the short-term path looks volatile. All eyes are now on the Dec. 10 Fed meeting and Dec. 15 SEC roundtable.

Disclaimer: This article is for educational purposes only, and it does not support any financial advice. Always do your own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.