Bitcoin Price Prediction 2027 is not coming from blind optimism this time.

The market mood today is very different from earlier cycles.

Price is moving slower, reactions are sharper, and traders are thinking twice before committing capital in the current Bitcoin market outlook.

That itself says a lot.

Right now, BTC is not behaving like a coin chasing headlines.

It is behaving more like a maturing asset trying to define its long-term BTC price forecast in a market where liquidity is selective and confidence comes in waves.

Every rally faces questions. Every dip attracts interest, but not panic buying.

So when people ask, "What if BTC moves toward $200,000 by 2027?"—it is less about excitement and more about structure, adoption, and how patient money reacts over time.

The idea is not unrealistic, but it is not guaranteed either. Bitcoin price prediction 2027 sits somewhere between belief and proof, and that gap is where the real story begins.

To understand Bitcoin price cycle analysis and where BTC could head by 2027, it helps to first look at what already played out during the 2024–2025 cycle.

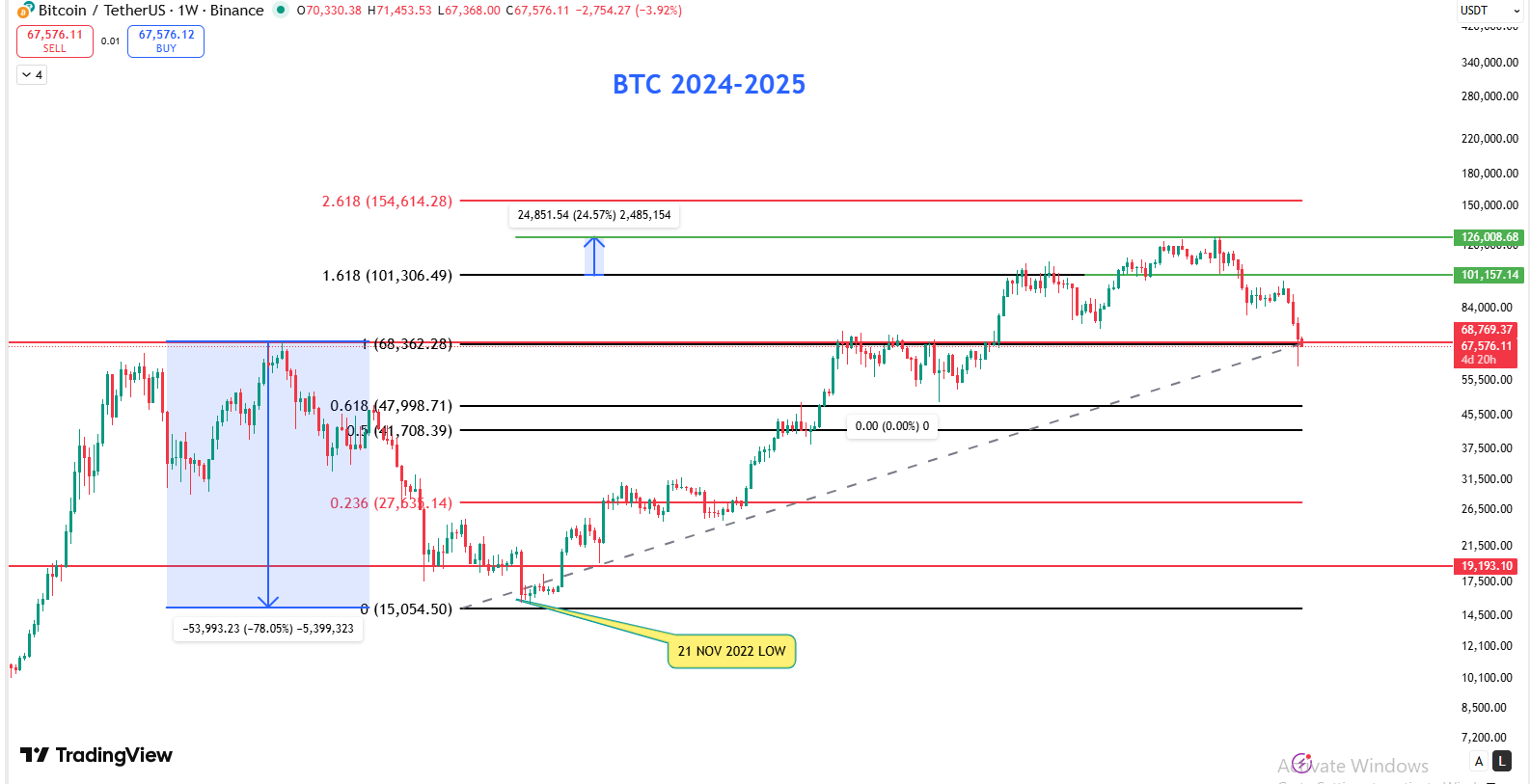

On that TradingView chart, Fibonacci is drawn from the 2021 cycle high down to the November 21, 2022 low.

That low marked the point where selling pressure finally ran out of strength. From there, BTC did not rush upward.

It entered a Bitcoin recovery phase instead—a slow, uneven climb where confidence was rebuilt brick by brick.

By 2024, Bitcoin printed a new high, but that move did not last uninterrupted. A sharp retracement followed.

The cause was not mysterious.

Institutional profit booking combined with macro uncertainty forced the market to cool off.

The effect was a necessary reset that pushed out weak hands and slowed momentum. What matters is what happened after that pause.

Once the Bitcoin Fibonacci retracement settled, BTC pushed through the 1.618 Fibonacci level. Price did not stall there either.

It extended roughly 24.57% above that level, forming a high near $126,008. This move was not random.

It followed the same rhythm BTC has shown across previous cycles—hesitation first, expansion later.

On the weekly TradingView chart, when shifting focus to the 2026–2027 projection, Fibonacci is applied from the 2025 high down to the 2023 low.

Compared to the earlier Bitcoin price rally, current price action looks slower, even tired at times.

The reason is selective liquidity. Investors are no longer buying every headline.

Capital is cautious, reacting to global uncertainty rather than chasing momentum.

In a worst-case scenario, price could revisit the $26,814 zone without breaking the long-term bullish cycle structure.

Even in that case, one thing stands out.

Price continues to hold above the Bitcoin 200-week EMA, a level widely viewed as a long-term support and resistance marker.

As long as this level holds, the broader cycle remains intact.

A phase where price moves sideways around the $50,000 region would not be unusual. In fact, it would be healthy.

This kind of consolidation allows the market to absorb liquid supply before the next meaningful expansion begins.

Based on current projections, that level sits near $188,141.

If the market then mirrors the previous cycle and extends roughly 24.54% above the 1.618 zone, the next logical area appears around $234,338.

These levels are not built on hype. They reflect how BTC has historically behaved when a cycle matures and conviction returns.

Bitcoin Price Prediction 2027 is shaped more by structure than speculation.

The $200,000 zone appears on the chart only if Bitcoin's long-term outlook continues to respect its cycle behavior and market discipline.

This path is unlikely to be smooth, with consolidations and pullbacks playing a role along the way.

As always, these projections reflect possibilities, not guarantees, in a highly volatile market.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.