The Espresso Token Launch has officially taken place, marking a major milestone for the modular blockchain ecosystem. With the transition to a permissionless Proof-of-Stake (PoS), the Espresso system and foundation are moving toward full decentralization while strengthening cross-chain interoperability for Layer-2 Rollups.

Below is a structured breakdown of the announcement, technology, ecosystem growth, and future roadmap.

Key Highlights

The ESP token became functional when the network switched to a permissionless PoS security model.

More than 65 million blocks attested in 9 integrated chains since the November 2024 mainnet launch.

10% of 3.59 billion tokens will be distributed to the community as airdrops to early contributors.

The Foundation declared the Espresso crypto network to have reached a new stage after TGE. The network has since shifted to a decentralized sequencing stage to a permissionless Proof-of-Stake system, where anyone can be a stakeholder in securing the protocol by staking.

Since the Espresso launch date of the mainnet in November 2024, the network has:

More than 65 million blocks confirmed.

Sponsored 9 affiliated chains.

Rollup block finality of approximately 6 seconds was achieved.

The protocol, according to the roadmap, is expected to reach sub-second finality by 2026, and this might greatly enhance the speed and composability of cross-chain transactions.

It was also announced that Espresso tokenomics would have a community airdrop distribution of 10% of the total 3.59 billion ESP supply. Community members are already watching for tools like an Espresso airdrop checker as participation incentives grow.

Source: Official X

As modular blockchain architecture expands, Rollups face two major challenges:

Ecosystem fragmentation

Centralized transaction sequencing

The system addresses these problems through a decentralized shared sequencer network that acts as a confirmation layer for Rollups.

This design enables:

Quick certification in several L2 networks.

Cross-chain composability

Inter-Rollup liquidity.

Ordering of the transactions in a censorship-resistant way.

Blocks has verified are eventually settled on Ethereum L1 with extra security assurances.

Shared Sequencer Decentralized: The majority of Rollups are based on centralized sequencers, which form a single point of failure. The project replaces this model with a distributed validator network that confirms transactions in about six seconds.

HotShot Consensus Protocol: HotShot BFT consensus protocol facilitates quick validation amongst Rollups. The devnet has already proved:

2-second finality

5 MB/s throughput

Cross-Chain Composability Layer (Presto)

The Presto protocol supports one-click cross-chain transactions, where smart contracts on one Rollup can directly interact with smart contracts on another Rollup without bridging.

Jill Gunter, Ben Fisch, Charles Lu, and Benedikt Bunz are the founders of Jill Gunter, Ben Fisch, Benedikt Bunz, and Charles Lu, which was established in 2020. The Systems has collected over $60 million in two funding rounds and sis upported by large investors such as

Andreessen Horowitz and

Coinbase Ventures.

The network has already partnered with over 20 chains, such as ApeChain, RARI Chain, Celo, Cartesi, and Polygon AggLayer, and enhanced its modular ecosystem presence.

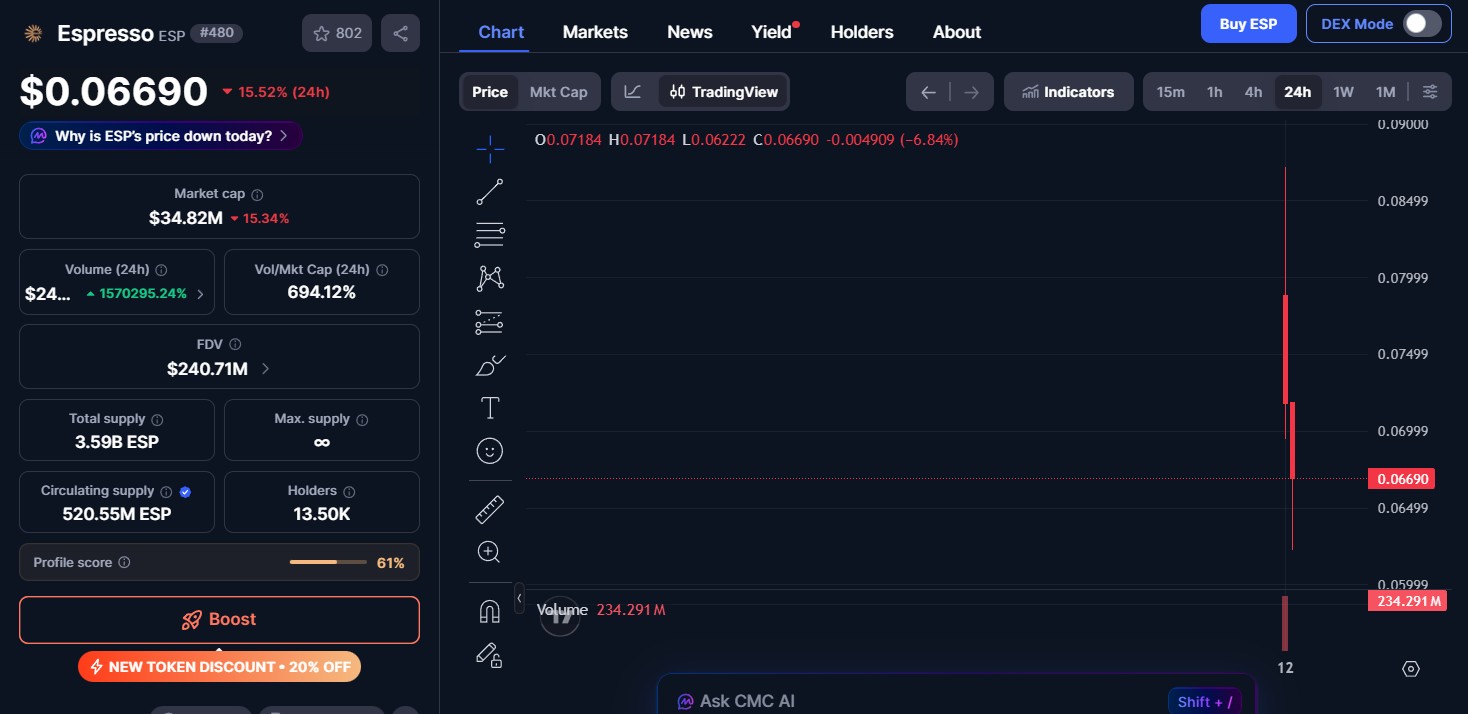

Although Espresso coin price are speculative and volatile and may change with the dynamic market conditions, shared sequencing infrastructure adoption may have a major impact on the Espresso esp token price in the long run.

Source: CoinMarketCap

The ecosystem is being extended by the project by:

Hackathons and ETHGlobal bounties by developers.

Node operator onboarding

Incentive schemes in communities.

Testnet integrations

Nevertheless, rivalry in the common sequencing area and adoption choices by the giant Rollups are significant ambiguities. Provided manages to provide sub-second finality and cross-chain composability, it may become a lower layer of the modular blockchain stack.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.