The global cryptocurrency market is facing a sharp correction today, January 23, 2026, as a "perfect storm" of geopolitical tension, institutional retreat, and regulatory setbacks rattles investor confidence. The total crypto market cap has slipped toward $3.03 trillion, with over 90 of the top 100 coins posting losses in the last 24 hours. The crypto down today

According to live data from CoinMarketCap, the market is struggling to find a solid floor:

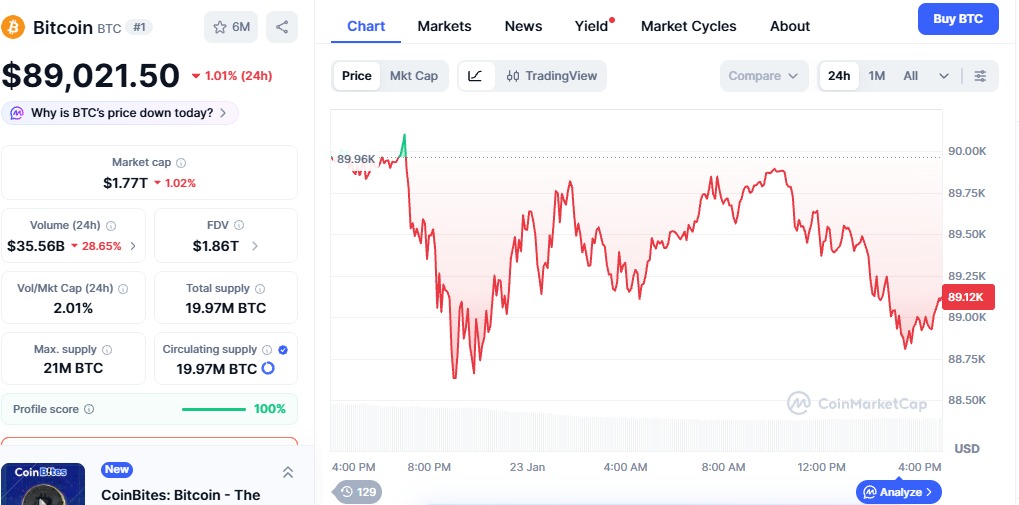

Bitcoin (BTC): Bitcoin Trading at approximately $89,131, down nearly 0.90% today and roughly 7% over the past week. Daily trading volume has plummeted by 28.88% to $35.8 billion, signaling a significant drop in short-term activity.

Source: CoinMarketCap Data

Source: CoinMarketCap Data

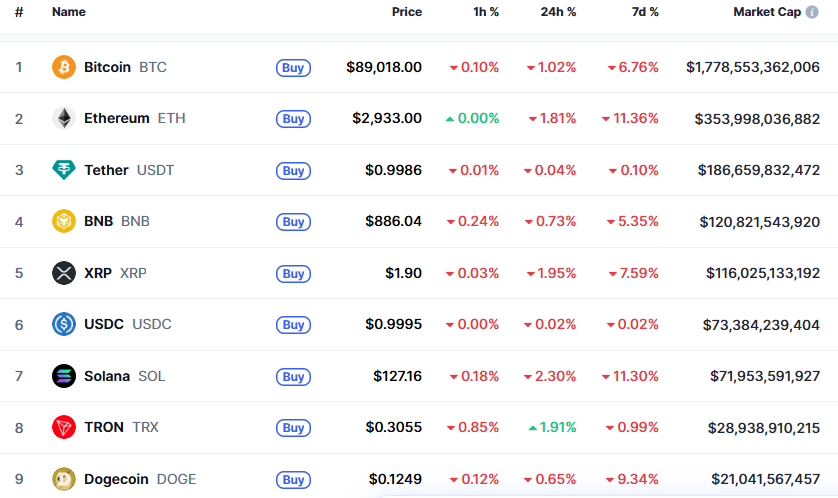

Ethereum (ETH): Down 1.37% to $2,975, failing to maintain the psychological $3,000 level after a steep 13% weekly decline.

Top Altcoins: Solana (SOL) dropped 1.04% to $128, while XRP fell 1.60% to $1.91.

Other Coins Data

Other Coins Data

1. Trump’s Davos Speech and the "Greenland Crisis"

Volatility returned to global risk markets following President Trump’s address at the World Economic Forum (WEF) in Davos. Markets were initially spooked by Trump's aggressive rhetoric regarding the acquisition of Greenland, including threats of heavy tariffs on European allies. Although he later softened his tone, hailing a "framework of a future deal" on January 21, the uncertainty triggered a massive shift toward traditional safe havens like gold, which recently hit record highs near $5,000.

2. Historic ETF Outflows

Institutional "paper hands" are a major factor in today's drop. Spot Bitcoin and Ethereum ETFs recorded a staggering $1 billion+ in combined outflows on January 21.

BlackRock’s IBIT saw its highest one-day redemption of $356.6 million.

This marks three consecutive days of net outflows, indicating that major players are locking in profits after last year's run to $126,000.

3. The CLARITY Act Stalls

Regulatory hope has turned to hesitation. The CLARITY Act, a bipartisan bill meant to define crypto rules, hit a major snag when Coinbase withdrew its support on January 18. CEO Brian Armstrong cited "fatal flaws" in the Senate's rewrite, including amendments that could "kill rewards on stablecoins" and grant the government excessive access to financial records. This has crashed the probability of a 2026 legislative signing from 80% down to 40% on Polymarket.

4. Bank of Japan (BoJ) Macro Pressure

Investors are closely watching Japan. While the Bank of Japan held rates at 0.75% yesterday, its signal of continued policy normalization threatens the "yen carry trade". Historically, BoJ rate hikes have led to Bitcoin drawdowns of 20–30% as investors unwind leveraged positions in risk assets to repay yen-denominated debt.

The market is currently in a high-risk consolidation phase. Analysts at Glassnode and Swissblock warn that the path forward depends on several technical and macro triggers:

Key Support: Bitcoin must hold the $88,600–$88,800 demand zone. A sustained break below $87,000 could signal further downside toward $74,000.

Resistance for Bulls: A clean breakout requires BTC to reclaim and hold above the $98,400 short-term holder cost basis.

Timeline: Many insiders now project March 2026 as the next likely window for legislative movement, which could act as a catalyst for the next leg up.

This correction mirrors the Q1 2022 market structure, where repeated failures to reclaim support led to prolonged consolidation. Until Bitcoin reclaims $98,000, investors should remain cautious and prioritize risk management over chasing rallies.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.