Why Is Crypto Crashing Today when traders expected a strong December? That is the biggest question circulating across the world as Bitcoin, Ethereum and major altcoins took another sharp hit. The global crypto market cap has fallen to $3.13 trillion, down 2.4% in the last 24 hours. Daily trading volume jumped to $128 billion, showing the intensity of panic selling.

Bitcoin price slipped below $90,000 again, dropping 2.5% to $89,579, while Ethereum fell 3.66% to $3,040. Meanwhile, ZCash, MYX Finance and Aptos faced the deepest fall, sliding nearly 9% in a single day.

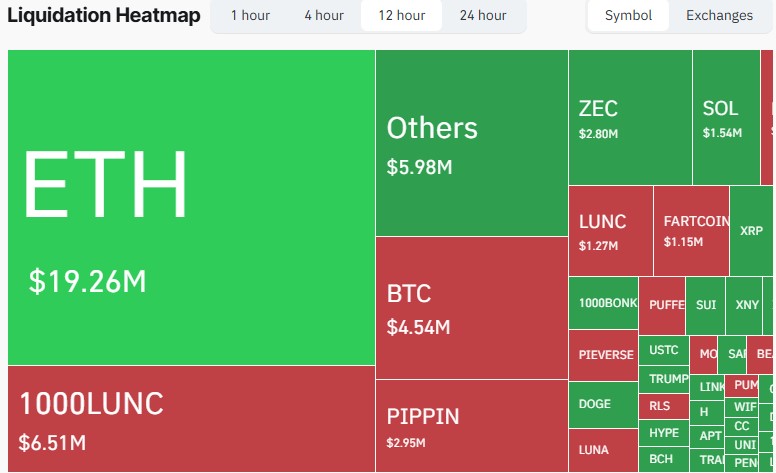

Liquidations Hit the Market Hard Again: The crash began with aggressive liquidations that pulled Bitcoin back under the $90,000 mark. Over $200 million worth of leveraged positions vanished within four hours, triggering a chain reaction across exchanges. According to CoinGlass, in the last 24 hours alone, 131,764 traders were wiped out, taking total liquidations to an enormous $413.35 million. The largest single liquidation order came from Hyperliquid, where a BTC-USD position worth $8.50 million disappeared instantly. This cascade forced both Bitcoin and altcoins to slide deeper.

Source: CoinGlass

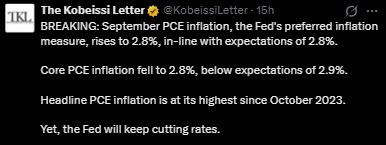

Hot PCE Data Sparks Macro Fear: Fresh PCE news today added more pressure. September PCE inflation stood at 2.8%, perfectly matching expectations. According to The Kobeissi Letter, Core PCE also came in at 2.8%, slightly below the forecast of 2.9%. However, headline PCE reached its highest point since October 2023.

Source: The Kobeissi Letter

Even though the Federal Reserve is expected to continue cutting rates, the stubborn inflation trend triggered fear across all risk assets. This is one of the major reasons analysts cite when answering Why Is Crypto Crashing Today.

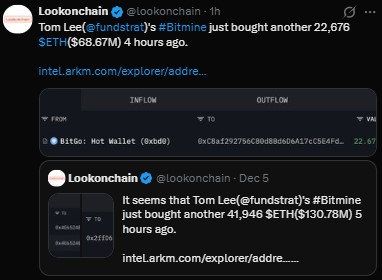

Whale Movements Create Market Shockwaves: Large whale movements added to the nervousness. Tom Lee’s Bitmine bought 22,676 ETH, worth $68.67 million, only a few hours ago, as per Lookonchain data.

Source: Lookonchain

At the same time, a whale wallet that had been silent for 14 years suddenly transferred 1,000 BTC—worth $89 million—to a new address. This whale originally received those coins when Bitcoin was only $3.88. Sudden whale wakeups often trigger panic, as traders assume these funds may hit the market.

SEC News Crypto Impact and Regulatory Pressure: The SEC also played a role in today’s correction. Its major privacy meeting, which was previously delayed, has now been rescheduled to December 15. The discussion will run from 1:00 p.m. to 5:00 p.m. and will involve regulators, privacy experts and major industry participants. Since the topics include data collection, surveillance standards and user protections, uncertainty has risen again. Whenever regulatory pressure builds, traders start revisiting the same question: Why Is Crypto Crashing Today?

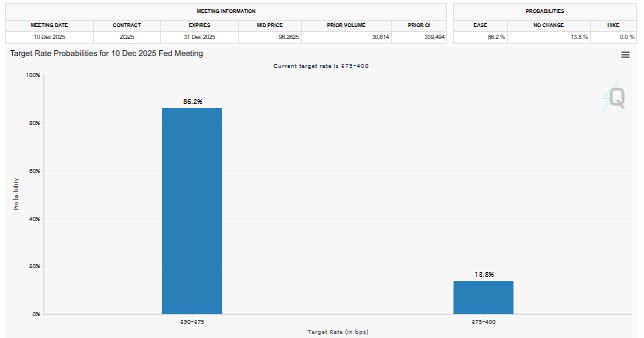

Fed Meeting Uncertainty Ahead: Only four days remain before the December Federal Reserve meeting, and the market is still unsure whether Jerome Powell will announce another rate cut. The probability of a 25-bps cut stands at 86.2%, while a 50-bps cut sits at 13.8%.

Source: FedWatch Tool

Current rates range between 372–400 bps. Whenever the market becomes uncertain about the Fed, volatility spikes—and crypto absorbs the first shock.

According to Tom Lee, the market may already have bottomed. He believes the best years of growth are still ahead, with nearly 200x adoption expected. The Fear & Greed Index also shows extreme fear at 23, indicating that many traders are panic-selling at the bottom. Historically, this stage has often preceded strong market recoveries.

So, Why Is Crypto Crashing Today? The fall is a direct result of heavy liquidations, hot PCE data, unpredictable whale movements, SEC discussions and uncertainty before the Fed meeting. Despite the crash, analysts like Tom Lee maintain a bullish long-term outlook. For traders, the smartest strategy now is to stay calm, avoid panic and treat this moment as a disciplined dip-buying opportunity.

Disclaimer: This is for educational purposes only. Always do your own research before any investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.