The global crypto market is seeing a tough day, with its total value dropping slightly. Right now, the total market cap is $2.95 trillion, marking a 0.48% decrease over the last 24 hours, as per CoinMarketCap data. But interestingly, the total trading volume has gone up by 11.44%, reaching $56.4 billion.

The DeFi space holds $3.96 billion, making up 7.03% of the daily volume. Stablecoins, which are usually seen as safer options, account for $51.74 billion or 91.75% of the daily volume. Bitcoin’s dominance has slipped a bit too, now at 63.64%, down by 0.30% today.

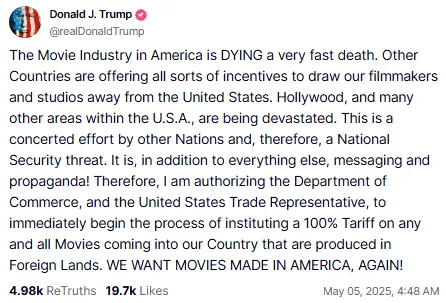

Source: Truth Social

Why is this important to crypto? This brazen trade policy has unnerved the world economy and created additional uncertainty. Investors are spooked, and when that happens, risk assets such as Bitcoin and other tokens tend to suffer.

Why is Bitcoin Dropping Today: The world's largest cryptocurrency, Bitcoin, has fallen below the crucial $95,000 level. Currently, it's valued at $94,394.17, having declined 1.10% in a day. Its market capitalization is $1.87 trillion with $21.53 billion worth of daily trades.

According to Lookonchain, a big whale withdrew 500 BTC (worth $47.82 million) from Binance just 12 hours ago.

Source: X

Such large moves can shake the market and create selling pressure. Analyst Ali Martinez has also warned that if Bitcoin doesn’t hold the $95,000 support level, it could slide further to $92,000.

Fear and Greed Index Moves to Neutral: The Fear and Greed Index, which tracks investor sentiment, shifted from Greed (64) yesterday to Neutral (52) today. Just a month ago, it was in Fear (30). Extreme fear can signal a buying opportunity. Also, extreme greed often warns that a industry correction is near.

While the current mood is cautious, there are some signs that the sector could bounce back:

FOMC Meeting May 2025 and Powell’s Speech in Focus: Investors are closely watching this week’s FOMC meeting, where the Federal Reserve is expected to keep rates at 4.25%-4.5%. However, Jerome Powell’s tone on inflation and economic growth could drive volatility. Hawkish remarks may strengthen the dollar and pressure Bitcoin, while dovish signals could spark renewed risk appetite and support a industry rebound.

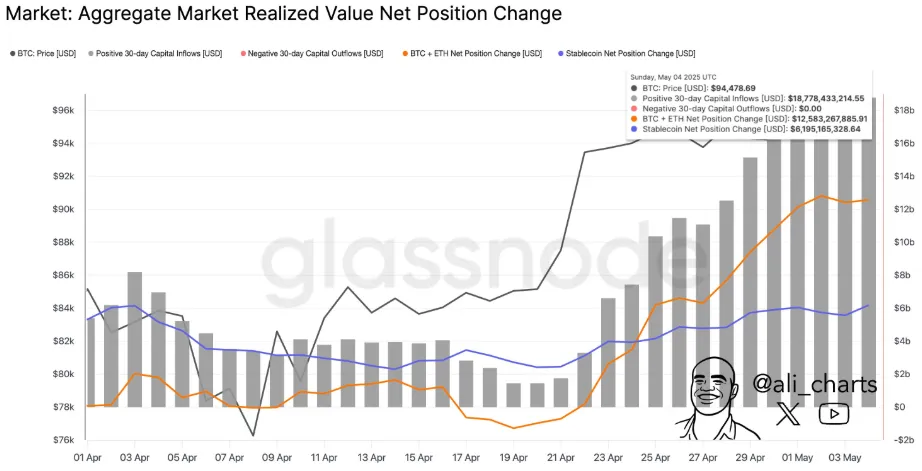

Crypto Inflows Signal Market Strength: Ali Martinez reports that nearly $19 billion entered the sector over the past 30 days, with no major outflows. Of this, $12.58 billion flowed into BTC and Ethereum, and $6.19 billion into stablecoins.

Source: X

As of May 4, Bitcoin traded at $94,394.17, suggesting strong investor confidence despite recent price pullbacks and macroeconomic uncertainties.

The sector is going through a tricky phase, with global politics, whale moves, and investor sentiment all playing a role. While today’s crypto price dip is worrying some traders, upcoming Fed events and strong capital inflows might bring back bullish momentum.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.