The tokenized gold trading market is gaining fresh momentum after Wintermute, a global crypto trading firm and liquidity provider, launched institutional-grade OTC, which means outside public exchanges trading for digital gold-pegged assets.

The crypto market revealed that it now supports large, confidential block trades for digitized bullion, marking a major step deeper institutional participation in real-world assets (RWAs).

Source: X Official

Wintermute’s new OTC desk is designed for hedge funds, corporates, and professional investors who want efficient, 24/7 exposure to the precious metal without relying on fragmented exchanges. The platform currently supports leading assets such as PAX (PAXG) and Tether (XAUT) Gold.

These trades settle directly on-chain and support USDT, USDC, fiat currencies, and major cryptocurrencies. For institutions placing large orders, this setup reduces slippage and improves execution compared to public exchanges, where liquidity is often spread thin.

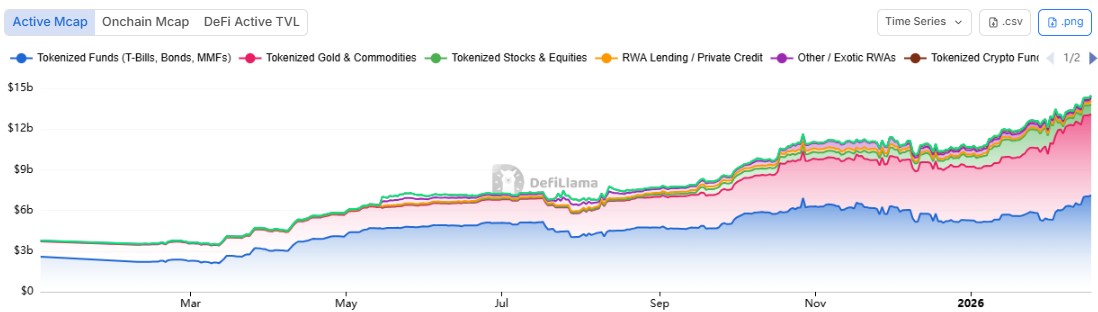

The total RWA market is sitting on the marketcap of more than $20 billions, where gold alone contributes nearly $6 billion ($5.98B), only after tokenized funds like T-Bills, Bonds, MMFs which have $7.033B Mcap.

More than 1.2 million ounces of physical metal are now locked in vaults backing these tokens, highlighting the scale of adoption. Trading activity has also surged. Digitized gold-products recorded roughly $178 billion in annual volume, with some quarters even outperforming traditional gold-ETFs.

Source: DefiLlama Official

Many analysts, with the continuously growing interest in the digitized bullion, predict that it could surpass the tokenized-funds very soon to claim #1 position as there is only ~$1 billion gap between them.

Wintermute believes that the recent move could help push the market to grow 2.5–3× from current levels to $15 billion by the end of 2026.

Analysts see institutional demand, improved liquidity, and macro uncertainty as key drivers, however, the continuous volatility in the broader crypto market also played an important role in the demand of alternate options.

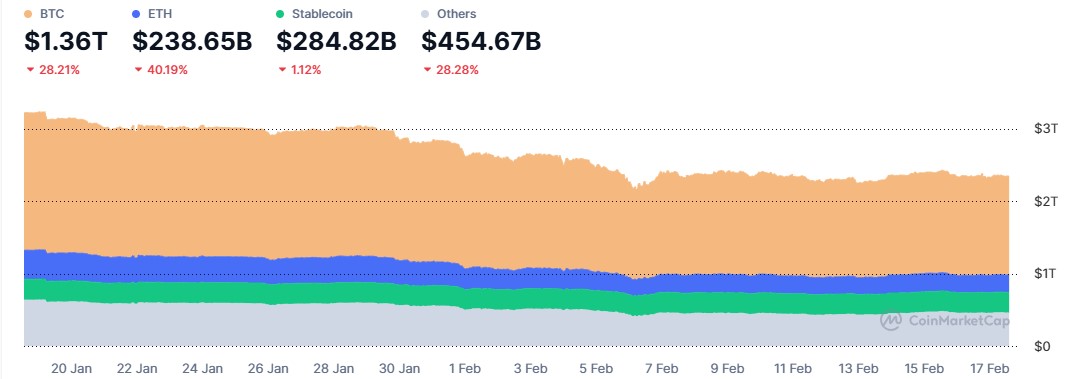

Since the market crash in October 2025, the overall market has struggled to come back, losing millions in forced liquidations. Bitcoin went deep, observing 28.16% monthly and 28.93% yearly downs, and trading in the $60-70K range for almost 2 weeks.

Source: CoinMarketCap

On the other hand, Spot gold prices have rallied strongly into 2026, driven by safe haven assets demand due to inflation concerns and geopolitical tensions, which pulled crypto down as well. After hitting its $5,419 ATH in January, 2026, the physical asset is currently trading at $4,917, observing 1.44% day-down while recording 67.71% yearly gain.

This trend stands in contrast to Bitcoin’s recent underperformance and highlights a broader shift toward RWAs.

If adoption continues at this pace, Tokenized Gold Trading could become a core bridge between traditional finance and on-chain markets, offering digital bullion with real-world backing and crypto-native flexibility.

Note: This article is for informational purposes only and does not constitute financial advice.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.