Bitcoin is closing 2025 on a low note while gold and silver are setting new records.

This contrast raises one important question for the investors: Is 2026 finally the next bullish phase for Bitcoin and the whole crypto market?

The market has been taken by surprise because December has turned red for the asset, breaking the usual year-end rally trend. However, history tells us that BTC often moves against the expectations before starting its strongest rally. The strong liquidity across the global markets has led many to think that crypto's turnaround may still be coming.

As per Crypto Rover, Cryptocurrency has made a triple negative in the last three months of the year, marking a fully bearish fourth quarter. This is an unusual case, as the last quarter of the year is generally characterized by BTC's positivity.

This unusual behavior reflects a lack of confidence in the market, a decrease in trading activities because of the holidays, and careful investor actions. However, long consolidation phases like this have often come before major bull runs in past cycles.

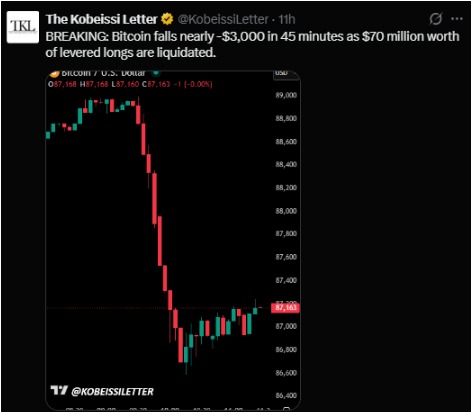

The world's largest cryptocurrency has just experienced very strong resistance at the level of $90,000. The price was then quickly cut down by a sell-off, which was so powerful that it decreased the price by almost $3,000 in a mere 45 minutes.

Liquidation of approximately $70 million worth of long positions in leverage was the main reason for the panic selling. The price fell from the upper $88,000 area to almost $87,000, recovering slightly afterward. This price movement vividly depicts how leverage can amplify volatility in a bad way, especially when trading volumes are low.

The upward movement of gold and silver continues while The world's largest cryptocurrency has difficulty making any significant gains. The patterns of these two metals reflect strong support from buyers who are in no hurry and are taking advantage of the price declines.

This situation has been upsetting to many traders of cryptocurrencies, as they expected the leader to be Bitcoin for the price hike.

Notwithstanding, experts are of the view that money often changes hands through different asset classes, instead of going out of the market altogether.

The crypto analyst named Ash Crypto opines that the BTC bull market is still in full flow. He brings to our attention the fact that the global liquidity is strong because of the good performance that is common to stocks, gold, silver, and even platinum.

Judging by the previous market cycles, BTC usually gets the spikes after the traditional assets have gone down in value. Following this pattern, the flow of capital into crypto could start in 2026, with the possibility of the price hitting $150,000.

In the last 12 months, Silver has increased by approximately 162% whereas Bitcoin has been on a downward trend of about 7.6%.

This analysis indicates that even if the price of BTC is weak in the short term, it still holds a strong long-term growth potential when compared with the traditional assets.

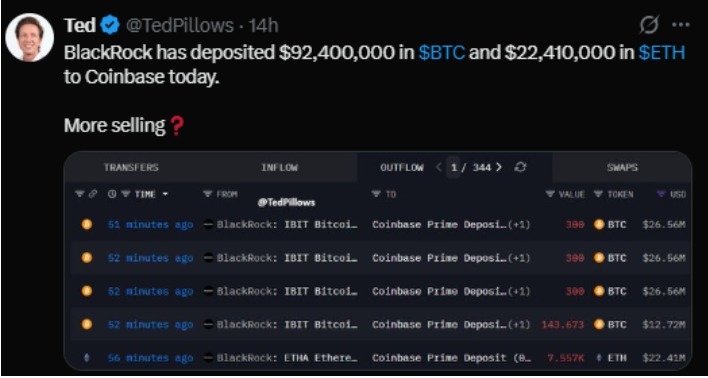

According to the latest on-chain data, BlackRock transferred $92 million in Bitcoin and $22 million in Ethereum to Coinbase.

Since Coinbase is a well-known exchange, such large transactions typically lead to concerns about the potential for selling pressure. However, such transactions do not always indicate selling. Large investors frequently transfer assets for reasons related to internal accounting or exchange-traded funds (ETFs).

Still, the news added to the anxiety surrounding the short-term market.

Nearly $908.96 million has been drained from the ETFs over six days.

Of that amount, $83.27 million was taken out yesterday alone, which implies that the market will remain cautious until the end of 2025.

This development is in line with the argument the asset will have pressure exerted on it for a short time only.

The prices of gold and silver have just set new records, thus reflecting the strong bullish market. It is very clear from the graphs that the prices are getting higher with the utmost certainty and are making slow but steady upward moves.

This strong uptrend of gold and silver is something that many investors looked forward to from Bitcoin, but the latter is still having a hard time in building up the same power.

Committed to getting new records and with gold and silver not letting go of the safe-haven demand, The world's largest cryptocurrency is still in a weak position, and this has led to the questions of when the next major crypto rally will start.

The most prominent cryptocurrencies have not been neglected by the largest financial institutions. VanEck, an investment firm, recently reported that the asset might become one of the best investment assets in 2026.

No matter how high or low prices go in the near term, the investors see the current price drop as just a phase in the market, not an indication of the end.

The wide range of market predictions reflects both uncertainty and opportunity:

By mid-2026: BTC might be trading around $70K or $130K

By end-2026: Price range widens from $50K to $250K

By 2027: Analyst Alex Thorn estimates BTC will hit $250,000

The less than perfect markets are not collapsing but rather resetting themselves as implied by the wide ranges.

Crypto price predictions are for informational purposes only and not financial advice. The crypto market is highly volatile, and prices can change at any time. Do your own research before investing. We are not responsible for any financial losses.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.