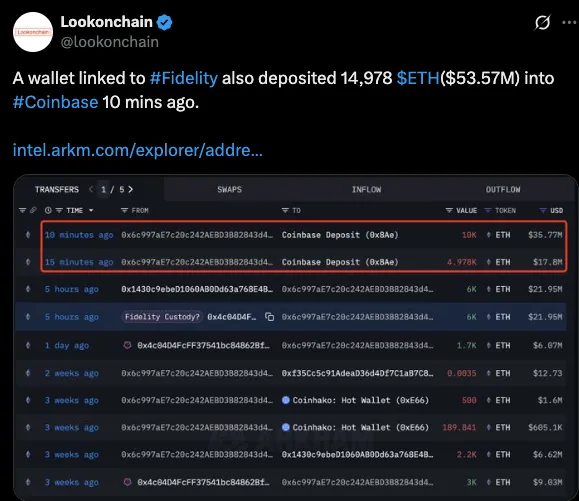

A wallet tied to Fidelity has recently made a significant deposit of 14,978 ETH into Coinbase, valued at approximately $53.57 million. This transaction was recorded just 10 minutes ago, as reported by Lookonchain on X-post.

The first part of the deposit involved 10,000 ETH, worth about $35.77 million. A few minutes later, an additional 4,978 ETH, valued at $17.89 million, was transferred. These large amounts of Ethereum being moved into Coinbase highlight ongoing activity from major institutional players in the cryptocurrency market.

Mainstream adoption of digital assets contributes, in a larger sense, to the series of such large-scale movements with Fidelity vested actions. This tendency of institutional investments has become so massive that it is bound to increase further as more legacy financial institutions enter the crypto market with their resources.

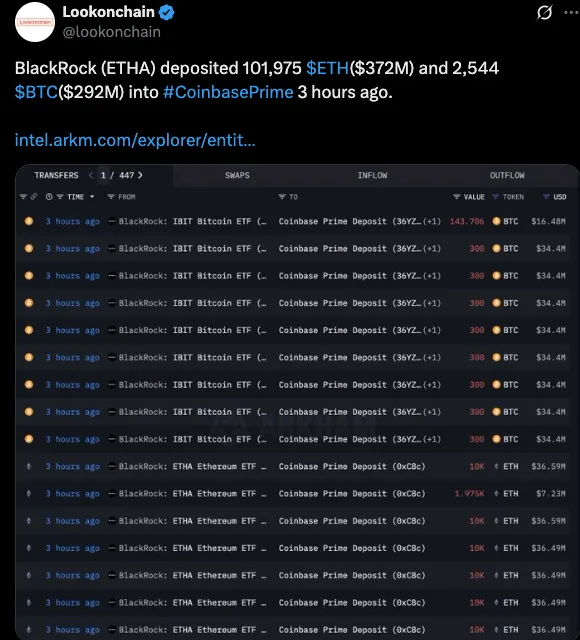

BlackRock has transferred substantial amounts of cryptocurrency into Coinbase Prime. The asset management giant deposited 101,975 ETH, valued at approximately $372 million, alongside 2,544 BTC, worth around $292 million.

These transactions were completed just hours ago, marking a notable increase in institutional interest in digital assets.

The deposits comprised both Ethereum and Bitcoin which were both deposited by BlackRock IBIT Bitcoin ETF & ETHA Ethereum ETF. When such transfers are coupled with the magnitude of the cryptocurrency transactions that the firm continues to engage in, eyebrows are raised in financial circles.

The Ethereum deposit in itself exceeds the mark of three-quarter a billion dollars, which demonstrates the increasing role of BlackRock in the market.

The action of BlackRock in transferring that immense portion in crypto assets demonstrates an apparent interest in digital currencies and the future. This deal that went through only within three hours is also a part of a larger-term trend of institutional buy-in of a massive size into crypto.

The deposits were done during the period when both Bitcoin and Ethereum are continuing to dominate the standings in the digital asset universe.

The ETH price hovered at $3,601 on August 5th, showing a slight increase of 2% in the past 24 hours. The Ethereum price movements indicated mild bullish momentum, with the asset approaching key resistance levels near $3,700. Over the past few hours, ETH tested the support at $3,500, creating a tight trading range.

Source: Tradingview

The MACD (Moving Average Convergence Divergence) showed that there was the possibility of a positive performance as it touched 14.46 which indicated that it had the potential to move further upwards. The MACD histogram has quite a spread of 3.81 which indicates that there is an increase in momentum, and the momentum is not so high.

Relative strength index (RSI) stood at 50.62 making index to be slightly above the neutral range, and this means that the index is at a neutral position as regards to buying and selling pressures.

In summary, Fidelity and BlackRock big crypto deposits show that there is increasing institutional demand on digital assets as a measure of market trust. This increasing interest of the institutions has a good chance of even more sealing its legitimation and increasing adoption of cryptocurrency worldwide.

Annah Mugoiri is an emerging voice in the crypto content space With More than 5 years of experience, with a growing passion for blockchain technology and digital finance. She possesses a sharp grasp of market dynamics and the broader cryptocurrency landscape, skillfully simplifying complex topics like Bitcoin, altcoins, DeFi, and NFTs into reader-friendly, engaging articles. Annah combines in-depth research with a clear and concise writing style that appeals to both beginners and seasoned crypto investors. Dedicated to monitoring price trends, project launches, and regulatory changes, she keeps her audience updated on the rapidly evolving crypto scene. Annah is a firm believer in blockchain’s transformative power to foster innovation and expand financial access worldwide.