The broader crypto market is still pretty quiet because of the year-end holidays. Trading volumes are light, and the total market cap is still sitting below the $3 trillion level. Most traders are clearly playing it safe right now.

In that kind of slow market, BIFI’s move stands out. The token jumped 194% in the last 24 hours, while the rest of the market barely moved. It also comes after a strong week for BIFI price prediction, which suggests this isn’t about a general market push. The move looks more tied to BIFI-specific factors and how thin trading has been, rather than any wider rally.

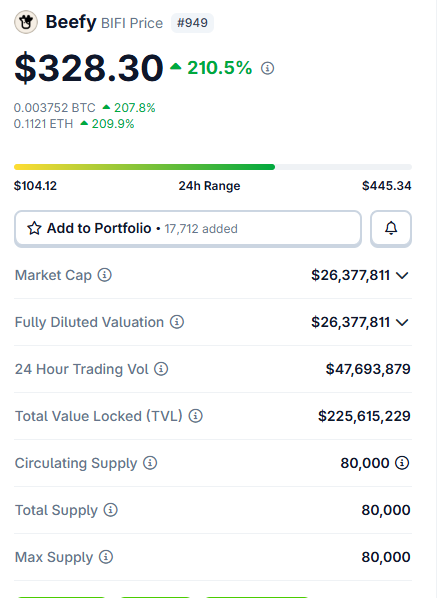

There are only about 80,000 BIFI tokens in circulation, which is one factor contributing to the company's recent price change. Compared to most crypto assets, this is a very small amount of tokens actively available in the market. Because of this, price doesn’t need heavy buying to start moving.

Source: CoinGecko

When buyers step in, available supply can dry up quickly, and that’s where thin liquidity comes into play; there aren’t many tokens sitting on order books, and it does not take much buying to push the price up. Even fairly normal demand can move things faster than expected.

For BIFI, the low supply and thin liquidity mean the price reacts quickly when interest picks up. That’s why moves can look sudden instead of gradual.

This helps to explain why its price reaction has been much stronger than the overall market, even during a relatively quiet trading period.

BIFI has been consolidating in a narrow range for a long time, with the price primarily moving sideways. Due to dry volume, a sharp spike is seen, and the price jumps more than 5500%; however, the price retraces sharply and goes back again to its previous level near $200. After that the speculation went, and the movement was seen so fast.

Volume jumped as soon as the breakout came in. Trading activity went up to around $45.53 million, around 1369% higher than before, telling us the move wasn’t just a couple of trades pushing the price around.

Price and momentum picked up together, which is why the move looked fast and aggressive, not slow or controlled.

The RSI moved higher quickly, suggesting strong buying interest in a short span. However, after the dip the RSI is currently hovering above 50 level. While this shows momentum is still present, it also hints that price swings could stay sharp in the near term.

There has also been a bit of a shift in how traders are looking at DeFi tokens. Instead of chasing only high-risk speculative coins, some capital appears to be moving back toward older and more established DeFi platforms.

Because of this, governance tokens linked to well-known projects like Beefy Finance can start seeing renewed interest, even when there isn’t any specific update or announcement driving the move.

Being an analyst, if you are a small trader, you have to stay away from this type of token. This type of trading is known as pump and dump.

In the last two days, the inflow hit all-time records, indicating that the bulls are holding the position and waiting for another move. If the price again crosses the $500 level, a sharp rise can be seen, and the price can test $3000 as well as a new high again.

However, If this is a case of pump and dump, then the price retrace and if fails to hold $275 then the price may again come in consolidation phase that is near between $150-$200 levels.

Disclaimer

Crypto price predictions are for informational purposes only and not financial advice. The crypto market is highly volatile, and prices can change at any time. Do your own research before investing. We are not responsible for any financial losses

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.