Bitcoin has entered February 2026 with a real bloodbath that has shaken both new and long-term investors.

Just days ago, the market was trying to hold above $80,000.

Now, Bitcoin is currently struggling to stabilize after hitting a 15-month low near $73,000 earlier this week, putting fresh pressure on every Bitcoin price prediction.

The mood across the market has shifted to extreme fear. The question is no longer only why price is falling, but who is actually selling.

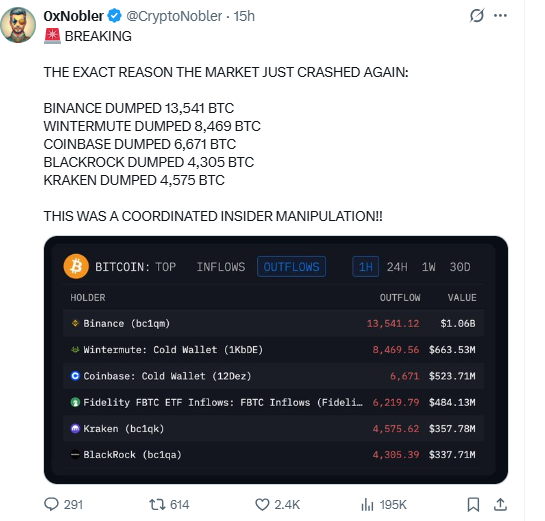

According to data shared by CryptoNobler on X, the latest Bitcoin crash was not random.

Large entities moved huge amounts of BTC in a short time:

Binance sold 13,541 BTC

Wintermute dumped 8,469 BTC

Coinbase offloaded 6,671 BTC

BlackRock moved 4,305 BTC, and Kraken added another 4,575 BTC to selling pressure.

This was not retail panic. It was big money reducing exposure together.

When multiple institutions sell at the same time, liquidity dries up and price falls fast.

That is why this drop felt sudden and heavy.

For Bitcoin price forecasts, this matters more than headlines.

As long as large players continue to unload coins, every bounce risks turning into another sell-off.

According to data shared by JacobKinge, Michael Saylor’s BTC strategy has slipped $630 million into loss, wiping out nearly $47 billion in unrealized gains from just four months ago.

This happened after price fell below his average buy price near $76,037.

Michael Saylor is still massively up since he began buying in 2020, but the problem is timing.

Most of his recent purchases were made near the top, and that has pushed the overall return close to flat.

For the market, this matters because Saylor represents long-term conviction.

When even the strongest bull is underwater, it sends a message of stress, not strength.

It shows that this drop is no longer just hurting late buyers. It is now testing the patience of the biggest holders too.

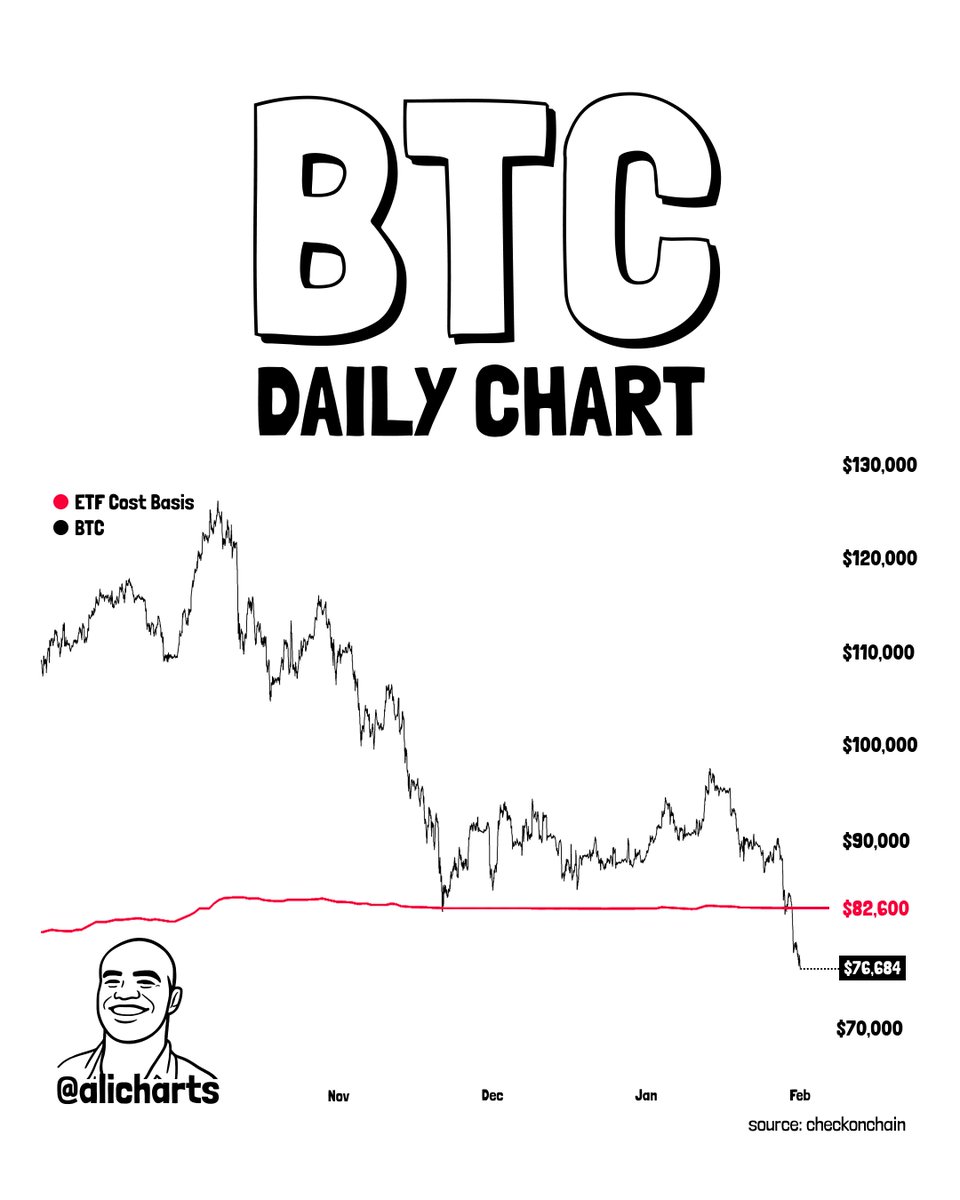

According to data shared by renowned analyst Ali Martinez (@alicharts), BTC has slipped below the ETF cost basis near $82,600 for the first time in over 18 months.

This level marks the average price at which spot Bitcoin ETFs accumulated BTC.

When price trades below the ETF cost basis, ETF holders move into a loss, which often weakens confidence and adds selling pressure.

Ali Martinez also highlighted that if price fails to reclaim this level, the next major downside zone sits near $70,000.

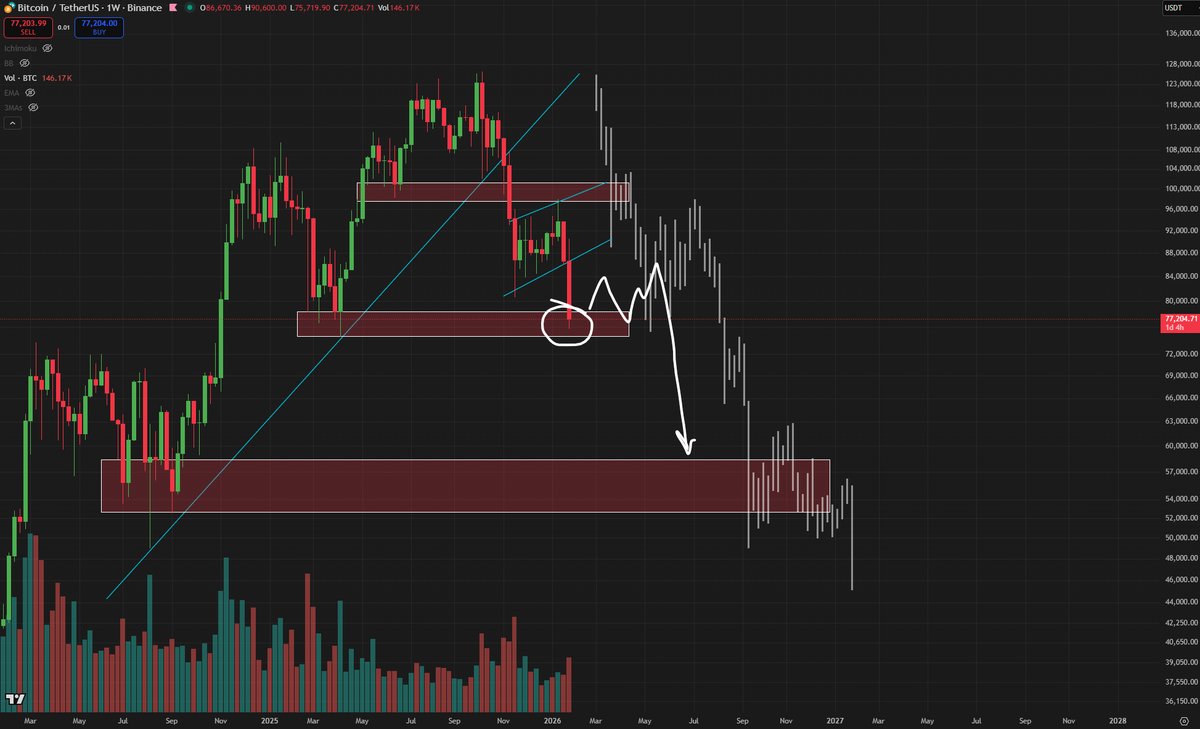

According to market data shared by Roman (@Roman_Trading), BTC has already hit the $76,000 target that many traders were watching.

Now, the focus is shifting to what comes next.

Roman notes that price may first move into a slow sideways phase, but the bigger risk is a sharp capitulation drop toward $60,000.

If panic selling increases, his longer-term accumulation zone sits even lower, near $50,000.

This view reflects the current fear-driven structure. Instead of quick rebounds, the chart is showing exhaustion.

The market is no longer chasing upside.

It is preparing for survival levels where real buyers may finally step in, similar to past market bottom phases.

Bearish side: If price fails to hold current levels and selling from ETFs and large wallets continues, price may drift toward the $70,000–$60,000 zone, where panic usually peaks.

Bullish side: If price manages to reclaim and stay above the ETF cost basis near $82,600, fear could cool down, and price may attempt a slow recovery toward higher resistance levels towards $90,000.

From an expert standpoint, this sell-off is being driven more by institutional behavior than retail panic.

ETF outflows, large wallet movements, and pressure near key cost levels show that risk is being reduced at higher levels.

For Bitcoin price prediction, this phase is important because it reflects a shift from optimism to defense.

Falling below major support and ETF cost zones has weakened short-term structure and increased downside risk.

If BTC fails to reclaim these levels, deeper liquidity zones may come into play before confidence returns.

However, if selling pressure slows and buyers absorb supply, the market could stabilize and attempt a gradual recovery. Right now, survival matters more than upside speed.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.