As we move closer to 2026, the crypto market is already beginning to show signs of a recovery, which comes right after a week of losses. The 2.34% increase in the total value of all cryptocurrencies has allowed the market to stay above the $3.00 trillion mark for the time being.

With Bitcoin still above $87,000, Ethereum has no trouble remaining over $3,000 and XRP is still able to hold its ground at the support level of around $1.80.

However, the main question is: Is this just a short-lived rebound, or the start of something much bigger that could set the tone for 2026?

Let's clarify the main crypto market events and the corresponding price predictions that investors should keep an eye on during the last week of the year.

The current price movements of Bitcoin are rather confusing yet very strong at the same time. On one hand, there is the possibility of a long and tedious consolidation, which is of course the most patient way of dealing with the situation.

Conversely, historical patterns are pointing towards explosive moves—either way, up or down.

One of the charts compares Bitcoin and silver which in turn reveals some significant similarity between them. Silver went through a slow and steady consolidation phase before breaking out and getting into a strong vertical rally. Now it seems that BTC is going through a delayed version of that same pattern of consolidation under key resistance.

If Bitcoin follows the historical path of silver, a huge bullish breakout will be the result that is projected to lead up to $400,000 sometime in 2026. This situation will only strengthen the bullish story for patient long-term investors.

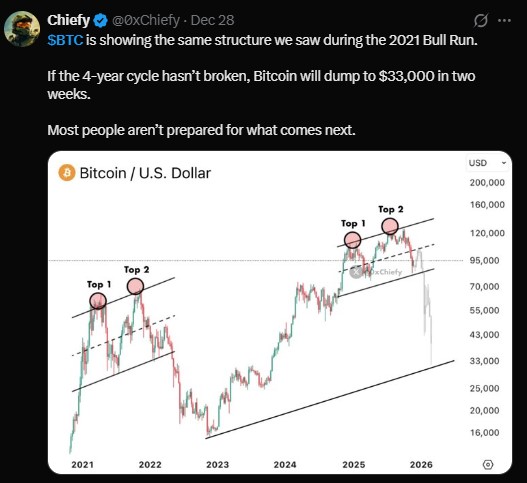

Nevertheless, not every indicator points to a reversal of trend. One more illustration puts forth the idea that Bitcoin is reenacting the 2021 bull run structure, creating a double-top inside a rising channel. This kind of setup in the past has been followed by drastic price falls.

In case the four-year cycle is not disrupted, then there will be a temporary drop in the price of Bitcoin with targets of $33,000 on the downside. This has sparked the worry that the present range movement could be distribution rather than accumulation.

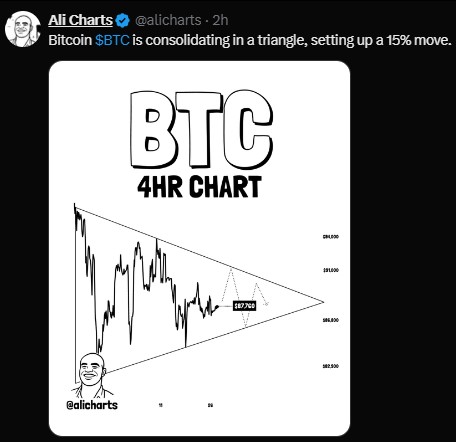

The 4-hour chart shows Bitcoin making a symmetrical triangle pattern, which means that there is a reduction in volatility. Often, the occurrence of such patterns might be followed by big moves. The analysts predict a 15% price movement after Bitcoin is out of this pattern.

At the moment, Bitcoin is trading around $90,000, thus a gathering of bullish momentum could send the price up to $103,500. Hence, the coming few sessions will be vital for the short-term direction of Bitcoin.

Ethereum has been a strong performer, and it has very solid fundamentals, which the technical and on-chain data corroborate.

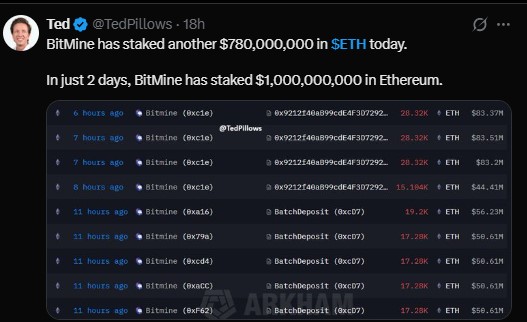

$1 Billion ETH Staked in Two Days

One of the most significant bullish signals is from BitMine, which staked Ethereum worth $1 billion in just 2 days, including $780 million in 1 day. This huge staking activity is a reflection of the strong institutional confidence in the long run of Ethereum's value.

The large-scale staking of ETH diminishes the supply that is available to the public, and this scarcity usually leads the prices to go up in the long run.

From a technical perspective, Ethereum is retreating to a monumental demand zone marked in orange, an area where the price has in the past met with very strong support. Therefore, this zone can be considered as a high-probability buying area.

In case the buyers hold this level, Ethereum will be able to continue its upward trend and target higher resistance areas.

On the contrary, a fall through this zone would result in a negative impact on the bullish scenario and would also make it possible for more drastic corrections.

In the existing market, XRP is exhibiting some of the strongest bullish setups.

Adam and Eve Bottom Indicates a Trend Reversal

XRP is building an ideal Adam and Eve bottom pattern on the hourly chart. The steep decline of “Adam” followed by the gradual rise of “Eve” is a sign of selling pressure becoming weaker.

XRP has reached the neckline resistance, and the confirmation of the breakout could lead to the strong bullish reversal, particularly if there is an increase in volume.

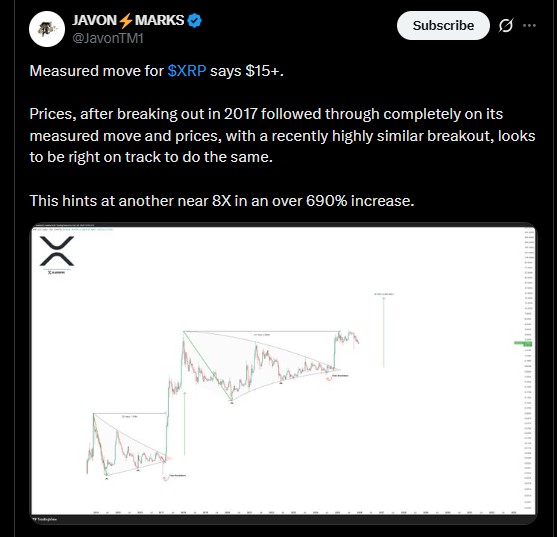

As per Javon Marks, The longer-term chart shows a comparison between XRP’s current breakout and its 2017 rally, where price completely followed through after the consolidation period. The current structure is a close resemblance to that historical setup.

If XRP history is to repeat itself, the measured move implies a price of above $15, which translates to an 8x rally or over 690% gain from the current levels.

It does not matter whether the market will make a final shakeout or will enter a new cycle; one thing is certain: the last days of the year could affect the year 2026.

Crypto price predictions are for informational purposes only and not financial advice. The crypto market is highly volatile, and prices can change at any time. Do your own research before investing. We are not responsible for any financial losses.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.