The last week of 2025 will be marked by critical U.S. economic events, including labor data, an important Federal Reserve meeting, Rate Cut and market-moving reports, which will influence investor sentiment and the market.

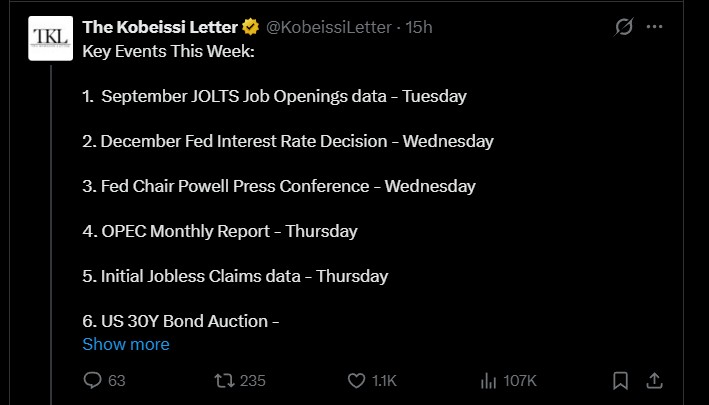

Some of the key economic indicators and events in the U.S. that the investors and analysts should watch this week are likely to affect market movements:

The JOLTS Job Openings data on the number of unfilled jobs and labor demand will be released on Tuesday, September. The unemployment rate of September, at 4.4% will possibly assist in measuring the labor market strength and the possible wage pressure.

The much-anticipated Federal Reserve interest rate decision is on Wednesday, where the Fed is likely to declare its third 25-basis-point rate reduction of 2025, reducing the federal funds rate to 3.50%-3.75%.

Fed Chair Jerome Powell will conduct a press conference, where he will offer more information about the monetary policy, economic growth, and inflation. Markets will be keen on his remarks to give suggestions on future rate movements.

Thursday will see investors get the first jobless claims data, which will provide information on the weekly unemployment trends. OPEC Monthly Report will also be released, which may affect the oil prices and energy stocks.

Source: The Kobeissi Letter X

Also, the 30 Year Treasury Bond auction may have an effect on long-term yields and the dynamics of the bond market.

Together, these developments could increase volatility in the market, especially in the case of labor statistics that are unexpected or oil supply changes that threaten to disrupt the Fed's soft-landing expectations.

In sum, this week offers a focused group of reports that can influence the market direction in both equities and bonds, and commodities.

The Federal Reserve is expected to announce the third interest rate cut of the year 2025, after it had already been reduced in September and October.

The anticipated reduction of 25 basis points would reduce the target to 3.50%-3.75%, which will be an indication of an aggressive strategy to curb sluggish job growth and aid the economy.

The history of rate cuts demonstrates that they tend to drive equity markets, and equity gains could be 5%-15% in six months, but long-run bond prices may be strained.

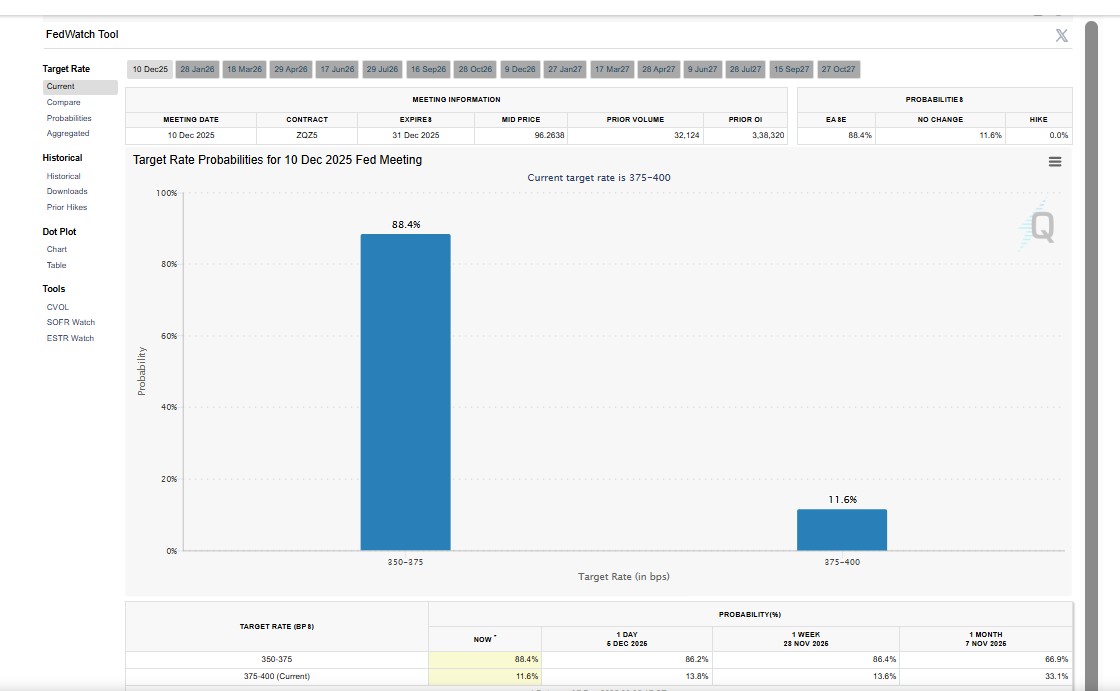

Source: Website

The stakeholders in the market are paying close attention to the actions of the Fed, with the help of tools such as FedWatch, which is used to monitor implied rate-change probabilities based on 30-Day Fed Funds futures.

The press conference of Powell is also observed by investors in order to obtain subtle commentaries on the state of the economy, inflation rates, and the future prognosis of the central bank in 2026. On the whole, this meeting might predetermine the financial markets in the new year.

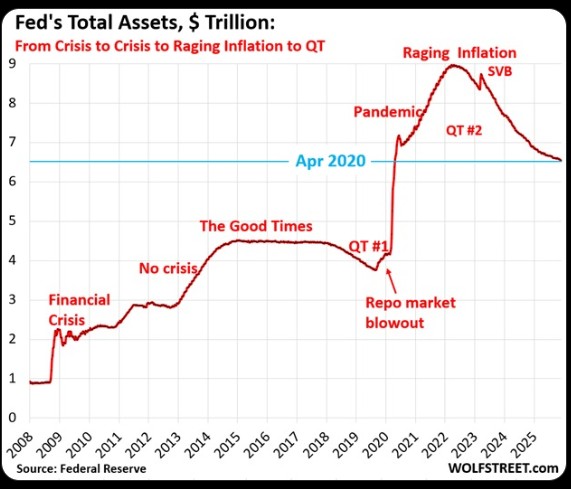

The balance sheet of the Federal Reserve fell to $6.53 trillion in November 2025, the lowest level since April 2020.

This is after a 3.5-year quantitative tightening (QT) program, which shrunk assets by $2.43 trillion, unraveled 51% of pandemic-era quantitative easing programs.

The treasury holdings dropped to $4.19 trillion, and mortgage-backed securities dropped to $2.05 trillion, not since 2020.

Source: X

Although the balance sheet is still 63% higher than the pre-pandemic levels, the liquidity strains on markets could be relieved at the end of QT.

The investors will still gauge the impact of this normalization, coupled with the cuts, on the bond and equity performance in the coming months.

The current labor statistics, Fed interest announcement, and balance sheets are significant, as they provide information about the economic well-being and market outlook at the end of 2025.

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.