Bitcoin has been moving a bit differently lately. After months of fast reactions and nonstop headlines, price action has slowed down. Ethereum and Solana are doing something similar. Moves are happening, but they are smaller, and follow-through is harder to find. It feels like the market is pausing more than pushing.

When things get this quiet, the focus usually shifts. Instead of watching every short-term swing, people start wondering what comes next. That is where Bitcoin Price Prediction 2026 starts coming into the picture. Not because the market is excited, but because calm phases like this often matter more than the loud ones.

The Bank of America comment matters more for when it came than for the number itself. Talking about a small allocation to Bitcoin and crypto is not excitement; it is positioning. It treats crypto like something to sit in a portfolio, not something to trade aggressively.

Source: X@cryptorover

This comment does not mean that the money is flowing like a flood into the portfolios. It just makes it easier for long-term capital to stay involved in BTC and crypto coins. When institutions start using allocation language instead of speculation, it quietly changes how Bitcoin is discussed behind the scenes. Those shifts usually come into play slowly, not in a single candle move.

One of the analysts updated that long-term holders have stopped selling BTC for the first time since July 2025; things are getting better from here. The next year is going to be interesting; lots of variables are in play. That is just one scenario; the broader market has a lot more to decide.

Source: X@TedPillows

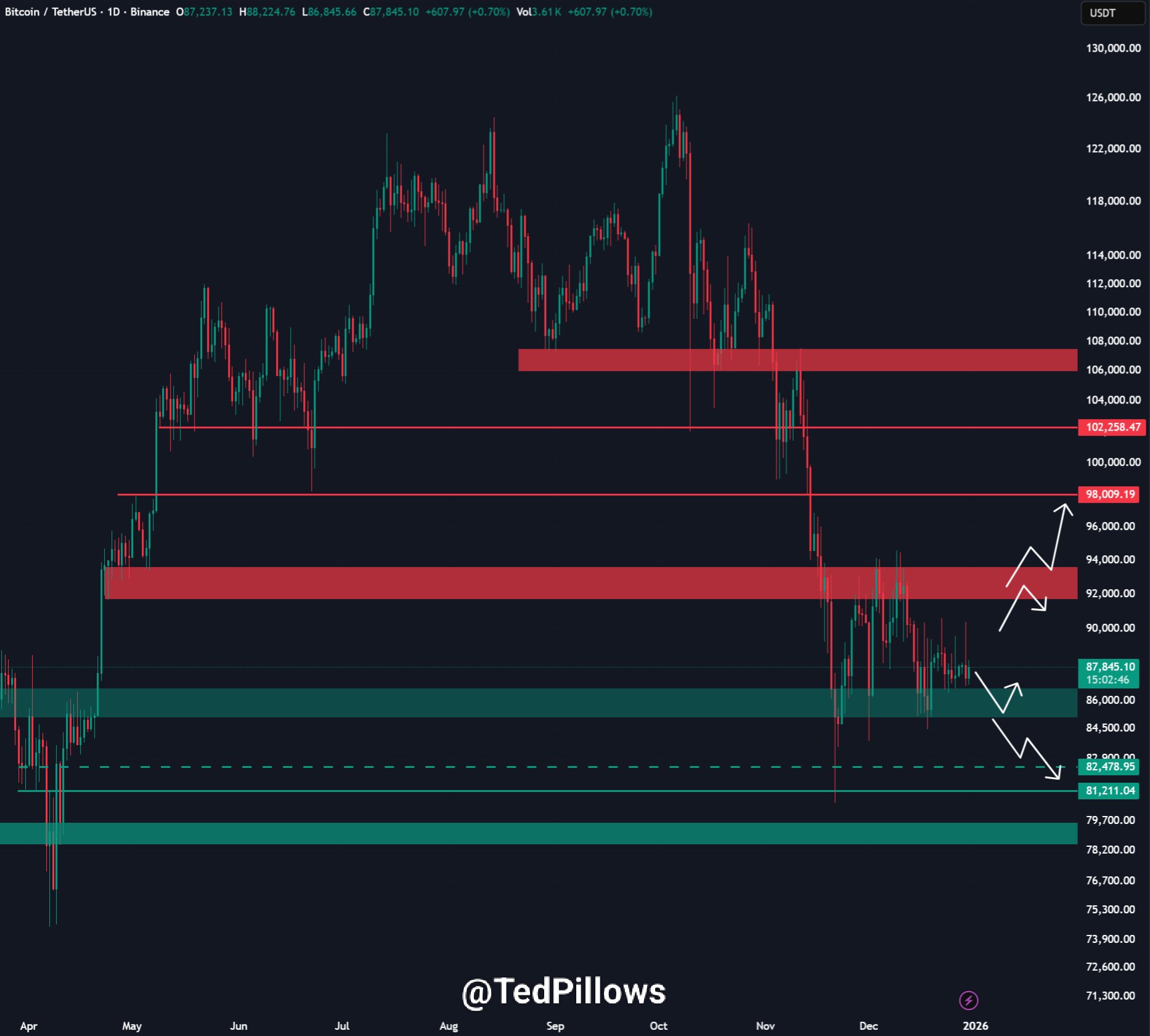

From a longer-term perspective, Bitcoin continues to trade within the $87,000 to $90,000 range, and this area is shaping up as a key decision zone. Until the price manages to hold above $90,000, upside momentum is likely to stay limited. Any recovery move can still attract selling interest as the price moves higher, especially closer to the $105,000–$108,000 supply area, where strong resistance has already been seen.

Chart Source: X@TedPillows

On the downside, the $85,000 area is acting as an important support. If BTC fails to hold this zone, a deeper pullback toward the $80,000–$78,000 range becomes very likely. Until a clear breakout happens, the price may continue to move sideways with volatile swings, keeping the market uncertain rather than trending. Until volume starts picking up and key support levels show real strength, Bitcoin is likely to keep moving sideways. The market is still unsure, and price action feels mixed rather than confident. At this point, there is no clear signal pointing to a strong long-term trend in either direction.

Bitcoin Price Prediction is currently in a phase where patience matters more than prediction. Price action suggests the market is still digesting earlier volatility. There is no real push for a fast breakout right now. Institutional interest looks steady but cautious, more focused on long-term positioning than short-term gains. That helps with stability, but it also slows upside momentum. Long-term holders are selling less, which usually points to cooling conditions rather than a market top. Volume remains light, and risk sentiment has not shifted in a meaningful way yet. Until that changes, Bitcoin is likely to keep moving sideways

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Crypto investments involve risk; always do your own research

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.