The launch of LIT has added a new angle to Hyperliquid Price Prediction, as traders begin comparing how both projects attract the same trading crowd. That overlap is starting to matter. While Hyperliquid already has its place, fresh launches tend to pull attention, at least for a while.

The timing stands out. As liquidity shifts and traders reassess where activity is moving, price behavior around Hyperliquid is getting watched more closely than before. The real question now is simple: does new interest around LIT stay isolated, or does it start influencing how Hyperliquid trades from here?

Even though HYPE and LIT are often mentioned together, the market is not treating them the same way. HYPE is currently being traded with a focus on structure, levels, and follow-through. Most positioning around HYPE appears reactive to price behavior rather than driven by launch-related excitement.

LIT, on the other hand, is still in the early phase after its official announcement. Price movement there has been more expectation-based, with attention shifting quickly as traders wait for broader participation and clearer liquidity. So far, LIT activity appears to be lighter and more sentiment-driven than HYPE, which has seen consistent engagement.

What stands out is that capital does not seem to be rotating directly between the two. Instead, traders appear to be treating Hyperliquid as an active trading asset, while LIT remains in a price-discovery phase. For now, both are being watched, but the way risk is approached in each market is clearly different.

On the daily chart, HYPE has been trading in a falling wedge from many previous sessions; now finally the pattern has been broken. On 18th December the price reversed from the $22 level, which has acted as support more than once. Since that bounce, downside pressure has eased, but upside progress remains slow.

Chart Source: TradingView

RSI has moved up from oversold levels and is now hovering around 43. While that’s still not a bullish signal, it does indicate that selling pressure has eased compared to previous sessions. Also the 21 EMA continues to act as a static resistance, and as the price moves into it, it struggles and then backs off. Until there is a clean daily close above that level, upside attempts are likely to stay uneven, but if the price gives a daily close above the 21 EMA with volume, it might open the room for the next resistance zone of $30 and then $40.

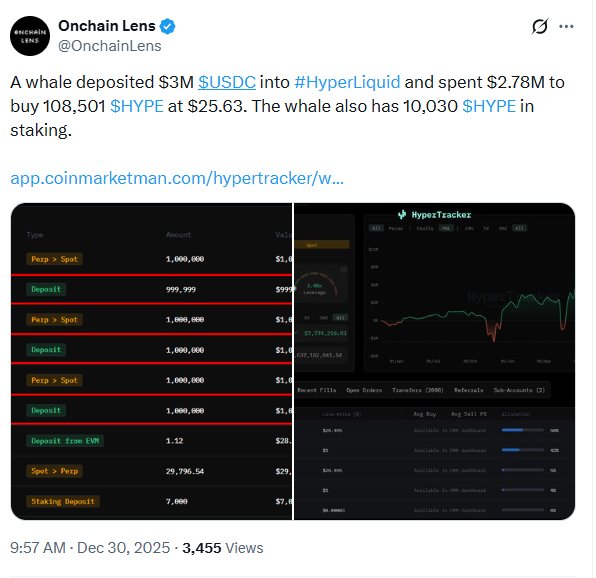

Recent on-chain data has brought Hyperliquid back into focus. A whale deposited around $3 million in USDC and used close to $2.78 million to buy 108,501 HYPE at $25.63. Alongside that, the same wallet is also holding 10,030 HYPE in staking.

Source: X @OnchainLens

As the whales bet on looking at the LIT price, which is up by 45%. If hype also follows the same path, then there should be huge profits in a short time. Investors and traders kept tracking this type of event so that a short-term gain could be absorbed.

In the short term, coin is trading inside a rising wedge, and for now that structure is still holding. Price continues to sit above the 21 EMA, which has been acting like a static support rather than resistance. Every pullback toward that level has been getting bought, which keeps the structure intact.

Chart Source: TradingView

Volume has picked up compared to earlier sessions, and RSI is hovering around 55. It shows steady momentum without the price feeling stretched. As long as this wedge holds, the bias stays to the upside.

If price manages to push higher from here and hold above the current range, the next area to watch sits around $28–$30, where price reacted previously. That zone becomes the natural short-term target if momentum continues.

This view only weakens if the rising wedge breaks to the downside. A clean break below the structure would invalidate the setup and likely bring lower support levels back into play. Until then, the chart favors continuation rather than reversal.

According to experts, the Hyperliquid price prediction is currently based on confirmation rather than momentum. Price is respecting structure across timeframes, while on-chain activity shows interest without urgency. Larger wallets are active, but risk remains. As long as key support holds, engagement is likely to stay intact. A clear break, not speculation, will decide the next meaningful move.

Disclaimer This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile; do your own research before making any investment decisions

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.