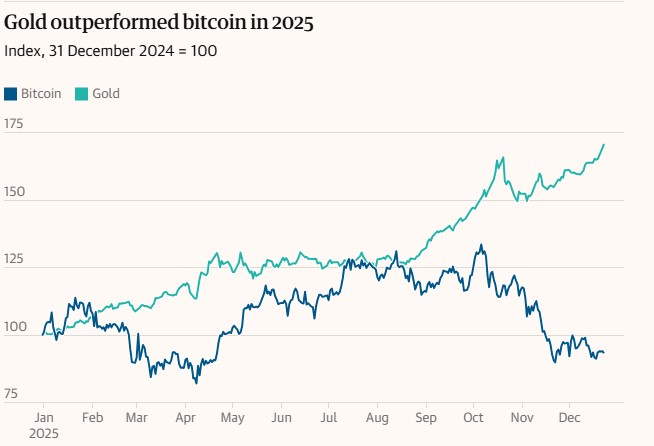

As gold hits new highs and silver records enormous ups, one big question is raising the crypto market: Will Bitcoin still be the "digital gold" that year? With BTC behind metals, flashing mixed signals and uncertain investors are split about the future of the world's largest crypto currency.

This year's price movements of BTC have questioned the classic assumptions for a long time. Gold leveraged and risk assets recovered, but the world's largest crypto currency lost its position as a leader. This divergence has sparked debate across markets—and raised hype and concern about Bitcoin’s next major move.

In the year 2025, traditional safe-haven assets clearly outperformed crypto. Gold is up almost 66% and silver has gained over 155%, while Bitcoin, so far, has lost approximately 6%. The sharp reshuffle of the situation weakens the “digital gold” thesis that many coin supporters rely on.

The real trick was after the first snap in October when the price went down sharply and did not come back as stocks and precious metals. From its October top of about $126k, the price dropped to about $88k, thereby erasing more than one trillion dollars off the overall crypto market within six weeks.

Many factors are mentioned by analysts as the cause of the weakness in the asset. Deutsche Bank said that the risk-off market sentiment, hawkish Fed signals, thin liquidity, institutional outflows, and profit-taking by long-term holders all contributed to the decline.

Moreover, leveraged selling during a thin market, partly caused by geopolitical tensions, led to a quick price drop. BTC, unlike previous corrections, did not bounce back this time; therefore, short-term strength was questioned.

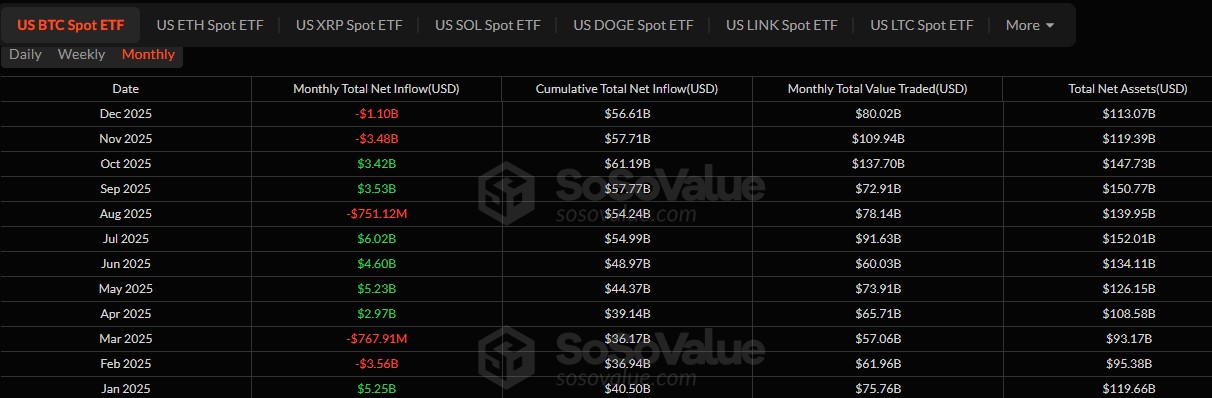

As per SoSoValue, The net inflow data for the month of 2025 indicates an increasing volatility. After a very good beginning in January, the coin suffered large outflows in February and March. In the middle of the year, the trust of investors returned and the market experienced the highest inflow by July.

However, the months of November and December registered substantial outflows, and this could be a sign of taking profits and also indicating uncertainty for the year 2026. The softening of institutional demand is one reason that is putting weight on the price prediction for Bitcoin.

As per CoinGlass data, Traditionally, the months of October and November have been the best for assets, and they are often the months of double-digit gains. However, in 2025, the two months were on the downside and the pattern of seasonal behavior that has been in place for a long time was broken.

Such a situation might mean that the cryptocurrency market is undergoing a change in the usual rhythm, probably because of the macroeconomic factors and the changing nature of the investors through their behaviors.

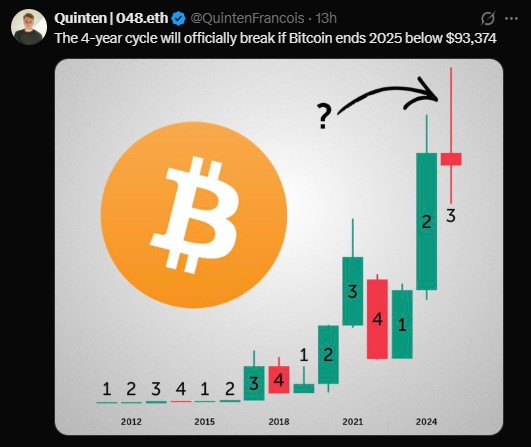

The alarm bell of a significant warning for Bitcoin’s 4-year halving cycle is ringing now. If the BTC price does not close the year 2025 at least above the $93,374 mark, the analysts consider that it will be a warning sign of a structural break in this cycle.

The end of the predictable bull runs driven by halving and the introduction of a new, more complex price dynamic would come along with such a shift.

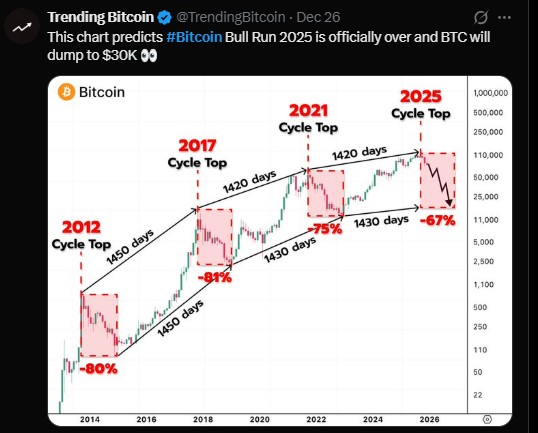

There are some indicators in the charts pointing to the creation of a bear flag, which is a typical way leading to the continuation of the negative trend. If this is a case, it may drop further before it gets to a level of strong support.

Analyzing the cycles with those of 2017 and 2021 also suggests being on the alert. In previous cycles, such setups led to corrections of 60-80%, which brings a worst-case scenario of around $30,000-$40,000 near the target. However, this is still a risk scenario and not an absolute certainty.

In the midst of Bitcoin's downward struggle, Ethereum's performance has crossed its long-term downtrend against BTC. The ETH/BTC breakout and the successful retest indicate a change of trend, thus, the already existing expectations of an impending altcoin season have gone up.

In case of Ethereum going on with its outperformance, the short term might witness a rotation of capital from Bitcoin.

Bullish scenario: Recovery of the range between $93,000 to $100,000 could bring back the faith

Neutral range: $80,000 to $90,000 area of accumulation

Bearish risk: Break below $75,000 might lead to a longer correction

Important level: $93,374 the end of the year close to maintain the four-year cycle

Bitcoin's fate in the future is connected to macro trends, liquidity, and institutional participation as well as just halving narratives.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Crypto investments involve risk; always do your own research.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.