The United States announced new tariffs on European countries, 10% starting February 1.

That headline quietly changed the mood.

Early in the session, the market started feeling uncomfortable while gold and silver kept moving higher, almost ignoring everything else. Gold jumped around 1.7% and pushed toward the $4600 area. On the other side, crypto did not look confident; BTC slipped, and the rest of the market followed without much fight.

The broader crypto market was down close to 2.95%. Bitcoin, which had been moving well on the upside for the past few days, was suddenly down around 2.50%. Major altcoins fell between 3% and 5%. It did not look like panic selling, but the ease with which prices gave up ground was hard to miss.

This is where things start to feel slightly off.

Is this just a reaction to global headlines, or did the market already feel stretched before today showed up…

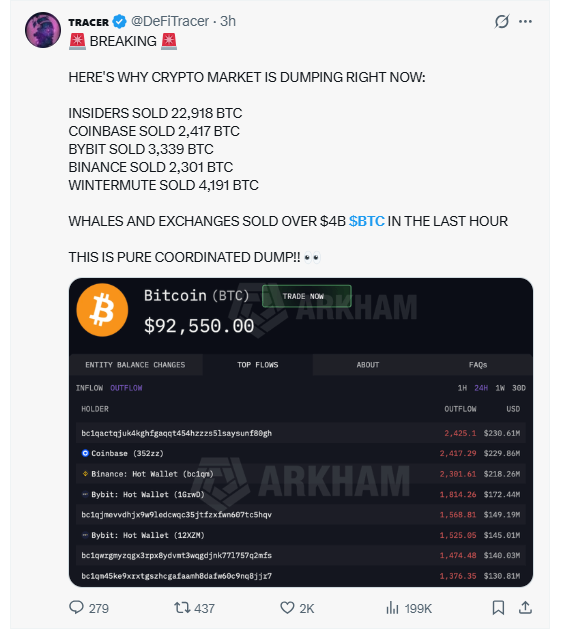

Selling pressure picked up after a sharp wave of selling data hit the market, and the numbers were hard to ignore.

Insiders were flagged selling around 22,918 BTC. At the same time, Coinbase-linked wallets moved about 2,417 BTC, Bybit close to 3,339 BTC, Binance around 2,301 BTC, and Wintermute nearly 4,191 BTC.

Together, whales and exchanges were linked to over 4 billion dollars' worth of BTC sold within a short window.

Source: X@DeFiTracer

That kind of activity does not stay neutral; screens turned tense, and buyers hesitated. Price stayed heavy and nervous; Bitcoin did not crash, but it clearly struggled to find support. When big names move together, the market rarely stays calm for long.

Bitcoin started losing its balance after the recent upside slowed near the higher supply zone. Price did not reverse immediately; it first tightened. On the 4-hour chart, a falling wedge began to form. Highs kept stepping lower, and the downside held for a while; it felt controlled, almost too calm.

Source: TradingView

That calm faded once the price slipped below the structure and the $94,800–$93,500 zone. This area had acted as support earlier, but when it broke, buyers did not defend it with conviction. Selling was not aggressive, yet price dropped with little resistance.

The move slowed near the 200 EMA around $91,500. Price is reacting here, trying to hold; buyers are present, but cautiously. The bounce feels hesitant, more like the market catching its breath.

If this 200 EMA zone weakens, the next area to watch sits around $90,000, and if selling increases, it might be $87,200, which is the important demand area in the short-term price outlook.

On the upside, pressure eases only if Bitcoin moves back above $95,000, and a stronger shift would need acceptance above $97,000.

Long-term resistance remains around $97,000–$100,000, where price has repeatedly faced selling pressure.

On the downside, $90,000 acts as key support, with a deeper demand zone near $87,000–$85,000 if weakness extends.

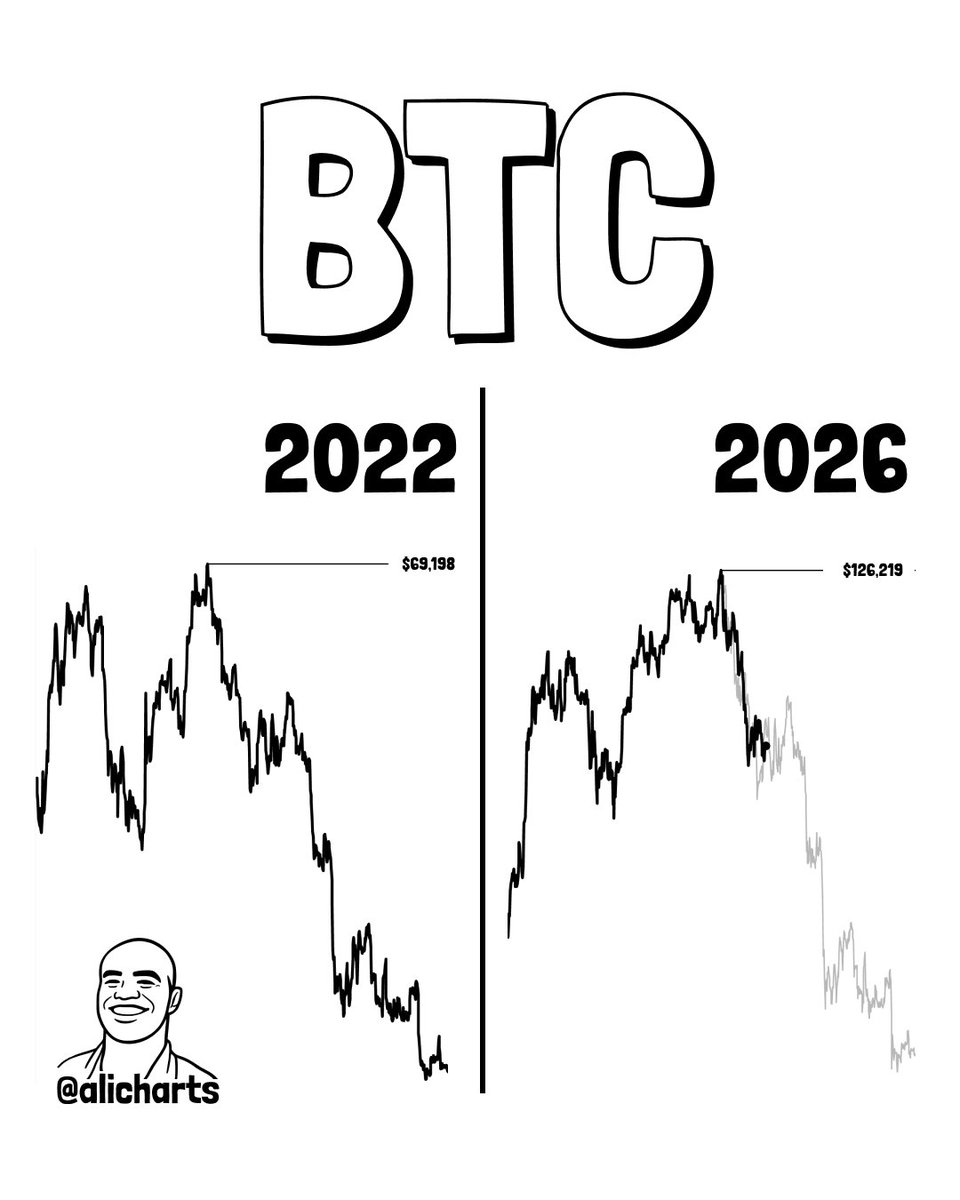

Some analysts are stepping back from the daily noise and looking at the timeline instead. A comparison doing the rounds puts 2022 near $69,198 on one side and a projected 2026 zone around $126,219 on the other. The idea is not about straight lines or easy upside. It is about how Bitcoin has moved through these phases before.

Source: X@alicharts

These stretches usually feel slow and uncomfortable while they are happening; price swings and sentiment keep flipping, and nothing feels clear. According to analysts watching the bigger cycle, this kind of confusion often shows up before the market finds its longer-term direction.

From an analyst's view, this Bitcoin price prediction still feels unsettled; the recent drop has shaken short-term confidence. After a strong upside phase, holding above the 200 EMA near $91,500 matters now, not for upside, but to slow things down.

If pressure continues, a drift toward $90,000 or even $87,200 stays on the table. Buyers may show up there, but not aggressively. On the upside, $95,000 is where price needs to breathe again.

The bigger test sits higher, around $97,000–$100,000. Until those levels are overcome, the market may stay jumpy, with no clear direction yet.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.