Bitcoin has consolidated tightly in sideways mode over the past week, with barely any volatility. Although the surface looks calm, something is brewing beneath. Crypto analyst Ali (@ali_charts) recently showered an array of important technical indicators that highlight critical price levels that may decide BTC's next major movement. Now that the world's largest cryptocurrency is sitting around important thresholds, the traders and investors are eyeing a factor that could confirm the next trend.

Let’s unpack these levels further and find out what is bound to happen with BTC in the weeks to come.

As per CryptoQuant's data, MVRV_STH (Market Value to Realized Value for Short-Term Holders) shows that $94,000 is hugely important for maintaining a bullish sentiment. As long as the price stays in the air beyond this level, it represents a bullish market; should it fall below, the bears take over.

It shows the short-term holders’ perception of BTC value; hence, when the market price goes above their average realized value, it is an indication of growing confidence. This is the level that acts both psychologically and technically as a pivot.

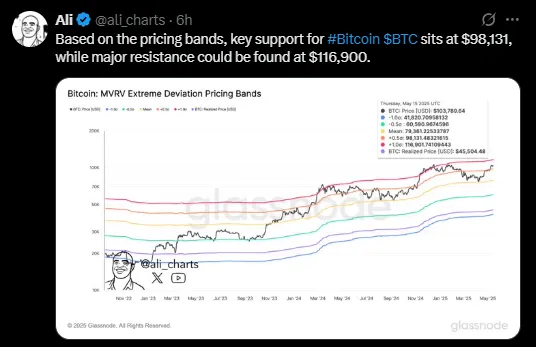

Further supporting the bullish thesis, another chart from Glassnode places Bitcoin within the MVRV Extreme Deviation Pricing Bands. These bands identify statistically significant price extremes, and they now show a strong support zone at $98,131. Historically, pullbacks into this region have triggered strong accumulation phases.

The next critical resistance stands at $116,900 presently. The upper band might act as the ceiling for any momentum in the price at the moment, and a breakout above this area might launch an explosive growth spurt. These pricing bands go some way to framing the high-probability zones for Bitcoin’s support and resistance.

Following the importance that Ali has given to the resistance zone set at $107,000, one would say that Bitcoin has been consolidating just beneath this level, and a daily close above it should be the start of another upward wave. However, in the meantime, traders are advised to tread with caution and avoid taking over-leveraged positions.

The breakout above $107K will only confirm the bullish continuation and thereafter, induce fresh demand from sidelined investors as well as those from institutions. Momentum indicators, volume profile, and historical data strongly point to this threshold being a hotly scrutinized price level in the sessions ahead.

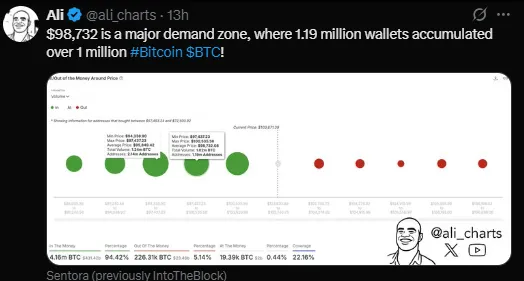

With Bitcoin being supported by the current price level, on-chain data from Sentora (previously IntoTheBlock) shows an intense cluster of accumulation at $98,732. More than 1 million BTC is held by 1.18 million wallets, accumulated at this price, forming a strong demand zone.

The behavior of investors implied confidence in long-term price appreciation. Such zones have generally tended to offer strong support to a downward price movement during corrections as holders are reluctant to sell below their entry price. This accumulation range could become important in the short term should Bitcoin sustain a pullback.

Ali further sees a potential catalyst for a quick surge toward higher pricing, citing data from CoinGlass that signposts a liquidation of some $23.65M worth of shorts if $105,000 is taken out on Binance's BTC/USDT perpetual contract. A bunch of liquidations means a lot of traders positioned against Bitcoin around this level.

If BTC manages to break the $105K, then these short positions could be wiped clean in minutes, since that would be a pretty straightforward case for a short squeeze. It is this squeeze that usually gives rise to an aggressive upward price movement: the forced buybacks from the liquidated traders and momentum buyers rush into the market to push prices higher.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.