The global markets anticipate the U.S. Federal Reserve rate decision on May 7, while Bitcoin executes its strategic movement. The focus on macroeconomic indicators has distracted investors from the institutional accumulation and whale transactions, which suggest an emerging bull market that retail investors might overlook.

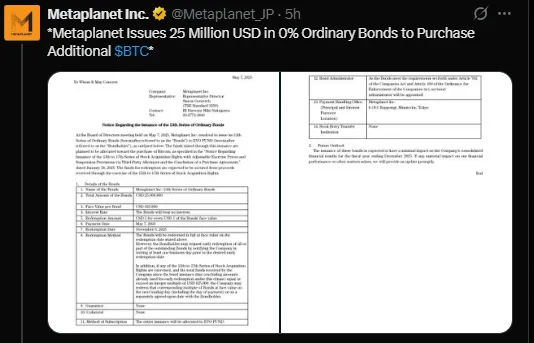

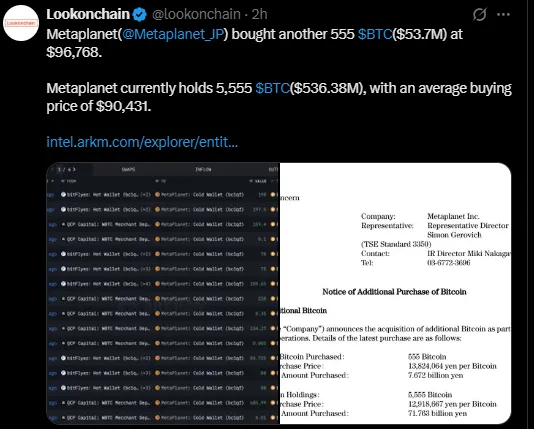

The Japanese-based Metaplanet Inc., which is being called the “Asian MicroStrategy”, is making news because of its purchase of 555 BTC worth $53.7 million. The company issued $25 million of 0% ordinary bonds and has used the entire proceeds to grow its Bitcoin holdings.

With this latest purchase, Metaplanet acquired 5,555 BTC through this purchase, which now totals $536.38 million in value, with an average purchase price of $90,431. The company's aggressive Bitcoin accumulation through 0% interest debt demonstrates increasing corporate trust as a long-term treasury asset.

The on-chain data shows an interesting split between what retail investors are feeling and what institutions are doing. Large-scale investors who hold between 10 and 10,000 BTC have purchased more than 81,000 BTC during the last six weeks.

During the same time, smaller wallets containing less than 0.1 BTC have sold a total of 290 tokens. The current market behaviour indicates that retail investors are losing patience while institutional investors continue to buy during periods of consolidation.

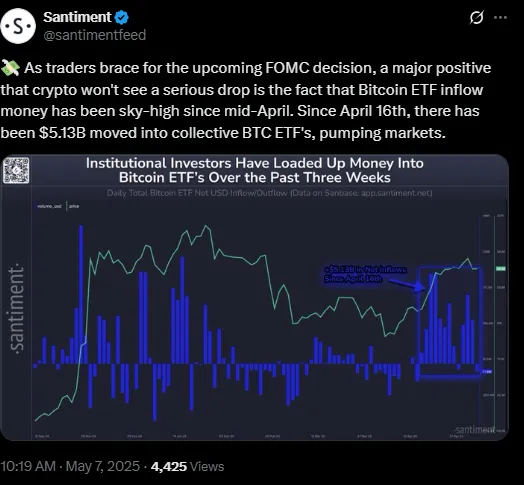

Demand for Bitcoin ETFs remains strong despite the recent volatility in the market. The ETFs have acquired over $5.13 billion in net inflows since 16 April. The IBIT by BlackRock alone has bagged investments worth $4.7 billion, indicating continued institutional investor interest.

That aside, May 6 saw a one-day outflow of $85.64 million, possibly for short-term profit-taking ahead of the FOMC meeting.

According to Polymarket, the Federal Reserve has a 98% chance of maintaining an interest rate of 4.50%. This would allow rates to remain unchanged for the third consecutive time. The less-aggressive policy may also be a bullish factor, as it relieves tightness in the macro.

In addition, positive macroeconomic trends—like the resumption of US-China trade talks—are underpinning risk sentiment, which has remained at or above $96,000.

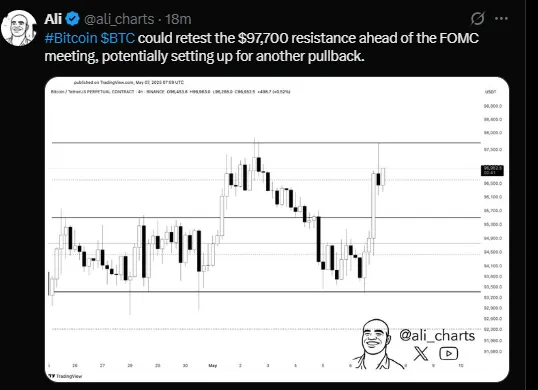

As per Ali, technical charts indicate that the world's top cryptocurrency is eyeing the $97,700 resistance level—a historically significant zone that has previously triggered pullbacks. If the asset manages to close above $97,700 and stays there, the price will go toward the next psychological level of $1,00,000. This level was last seen on February 7, 2025.

However, traders must stay cautious, though. A rejection at $97,700 sets the stage for short-term corrections. With solid foundations, whale build-up, and institutional interest, any fall can be viewed as a buy-the-dip opportunity.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.