The biggest question investors are asking right now is: is BlockDAG (BDAG) actually heading toward a Coinbase listing?

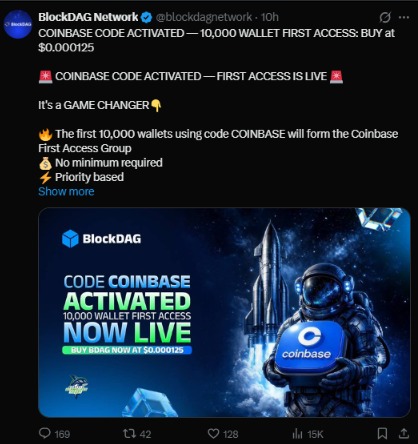

The project has activated a special Coinbase First Access code, allowing the first 10,000 wallets to purchase BDAG at $0.000125 and receive priority trading access once exchange trading begins.

The team has also announced U.S. and Europe trading starting March 4, which has triggered intense speculation across the crypto community.

And here’s why the market is excited — a potential Coinbase listing instantly changes visibility, liquidity, and investor confidence. Many tokens experience their highest attention phase when they first appear on a major exchange.

BlockDAG introduced a limited early-buyer group called the Coinbase First Access Group. Users who entered using the code “COINBASE” gained priority participation before public trading.

There is no minimum purchase requirement, but once 10,000 wallets are filled, the opportunity closes permanently. This structure creates urgency because early exchange access often brings higher volatility and strong initial trading volume.

The presale price remains $0.000125, and the gap between presale and expected listing price is extremely large. This gap is one of the main reasons the project is attracting attention.

Based on announced figures, the projected official listing price is around $0.05.

Early buyers entered at $0.000125.

This creates a nearly 400× difference between presale entry and potential opening value.

However, the exchange — not the project team — determines the real price once trading begins. When a token lists, the market enters a phase called price discovery, where supply and demand decide its true valuation.

The first trading hours are usually the most unpredictable.

Expected launch range:

$0.04 – $0.06

A brief spike above this level can happen due to FOMO buying, especially if large exchanges provide strong liquidity. But historically, early investors often take profits quickly, which causes a pullback.

So an early surge followed by a correction would be normal market behavior.

After the launch, two powerful forces will control the market:

• Presale investors booking profits

• New traders entering the market

If trading volume remains high and social media hype continues, BDAG could rally significantly.

But crypto markets never move straight upward. A correction typically follows.

Expected March 2026 range:

$0.18 – $0.22

This level may become the first stable support zone above the launch price.

Once the launch excitement settles, investors will shift their attention from hype to fundamentals.

The market will watch:

network usage

transaction activity

ecosystem development

real user adoption

If adoption grows and exchange volume stays consistent, confidence improves.

Mid-term target: about $0.45

Estimated range: $0.40 – $0.48

At this stage, the market values the project based on actual performance instead of launch speculation.

Coinbase is considered one of the most trusted crypto exchanges globally. A launch typically brings:

higher credibility

new retail investors

stronger liquidity

wider global exposure

This is why many investors are closely watching whether the trading launch connects to a listing announcement.

Despite strong hype, several risks remain:

heavy selling pressure after listing

short-term price crashes

delayed exchange listings

low adoption after launch

A large presale-to-listing gap often increases volatility during the first weeks of trading.

The BlockDAG Coinbase access program has created strong market attention because it signals possible major exchange exposure. However, the true success of BDAG will depend on real adoption after trading begins.

The listing may start the hype — but long-term value will come from usage, liquidity, and ecosystem growth.

This article is for informational purposes only and not financial advice. Cryptocurrency investments are highly risky and volatile. Always conduct your own research and consult a qualified financial advisor before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.