BlockDAG has reached a crucial moment. The mainnet is live, the Token Generation Event (TGE) is complete, and global trading is approaching. Investors now ask one key question: after listing, will BDAG explode in price or drop due to early selling?

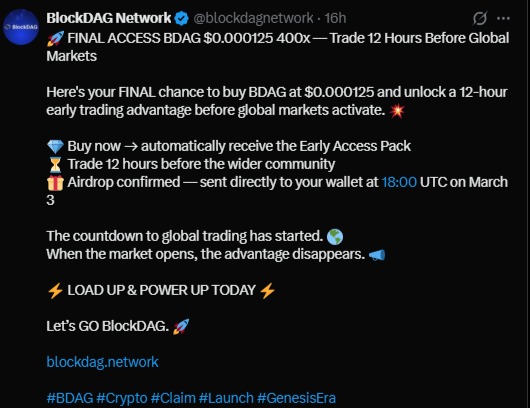

The project is still offering a final chance to buy BDAG at $0.000125, and early buyers even receive a 3–12 hour trading advantage before public markets open. Airdrops will reach wallets on March 3 at 18:00 UTC, and presale allocations are nearly finished. Because of this setup, hype around the launch is rising fast — but hype alone never decides a token’s future.

To understand what could really happen, we need to examine the listing reaction, short-term volatility, and long-term adoption.

BlockDAG allows investors to use Ethereum wallets like MetaMask, Trust Wallet, or Cold Wallet. Tap Miner rewards have already converted into BDAG allocations, and the X1 Miner system continues distributing tokens through mining rewards. The project also plans a future super-app combining mining, staking, and dApps.

However, one concern remains: the presale deadline.

If the remaining coins are not sold, the team could extend the timeline again. Previous extensions can reduce urgency, which may weaken listing momentum.

This matters because market psychology strongly influences early price action.

After listing near $0.05, BDAG will face two powerful forces:

1. Selling pressure (profit-taking)

Early presale investors bought extremely cheap tokens. Many may sell immediately to lock gains.

2. Buying pressure (new demand)

New traders entering exchanges may push the price higher.

Because the presale lasted long, excitement may be slightly softer than a sudden launch. Therefore, analysts expect an early trading range of $0.25–$0.40 as the market balances buyers and sellers.

In simple terms:

The first day will not depend on technology — it will depend on trader psychology.

During the first few weeks, volatility is almost guaranteed. Airdrop receivers and short-term traders typically sell quickly.

If demand stays strong, BDAG could stabilize around $0.20–$0.30.

In a bullish scenario — especially if large exchanges like Binance or Bybit list the token — the price could temporarily reach $0.45–$0.50.

But investors should understand something important:

Early spikes are usually speculation-driven, not adoption-driven. Without real usage, prices often retrace.

Once launch hype fades, real blockchain metrics begin to matter. Investors will track:

Active wallets

dApp usage

Transaction volume

Developer activity

Exchange liquidity

If these grow steadily, BDAG could maintain $0.35–$0.45.

This phase determines whether BlockDAG becomes a functioning ecosystem or just a presale-driven token.

At this stage, fundamentals replace marketing.

Long-term value depends entirely on real adoption.

BDAG could reach $0.50–$0.60+ if:

developers build applications

users transact regularly

staking and mining attract participants

exchange liquidity increases

However, if development slows or adoption weakens, the token may enter a long consolidation phase and trade sideways.

In crypto markets, utility sustains price — hype only starts it.

Before investing, pay attention to:

Circulating supply after listing

Lockup and vesting schedules

Exchange listings

Network activity and wallets

Real ecosystem usage

Presale delays may soften initial gains, but they do not automatically destroy long-term potential. Real demand decides survival.

BlockDAG has strong launch hype, but price performance will depend on adoption rather than marketing. The listing may create volatility, and early profits may trigger selling pressure. Still, a growing ecosystem could support long-term value.

Always research before investing and manage risk carefully.

Disclaimer: This article is educational only and not financial advice. Cryptocurrency investments are risky. Always do your own research (DYOR).

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.