BTC Price continues to hover just above a critical support level, with its price at $114,673.97 as of writing. The token has weakly recovered to 0.22% on the day but is down 3.48% in the past week.

Although the 24-hour window has been relatively stable, there are now several signs pointing towards a meaningful downside in Bitcoin price should $111,000 break.

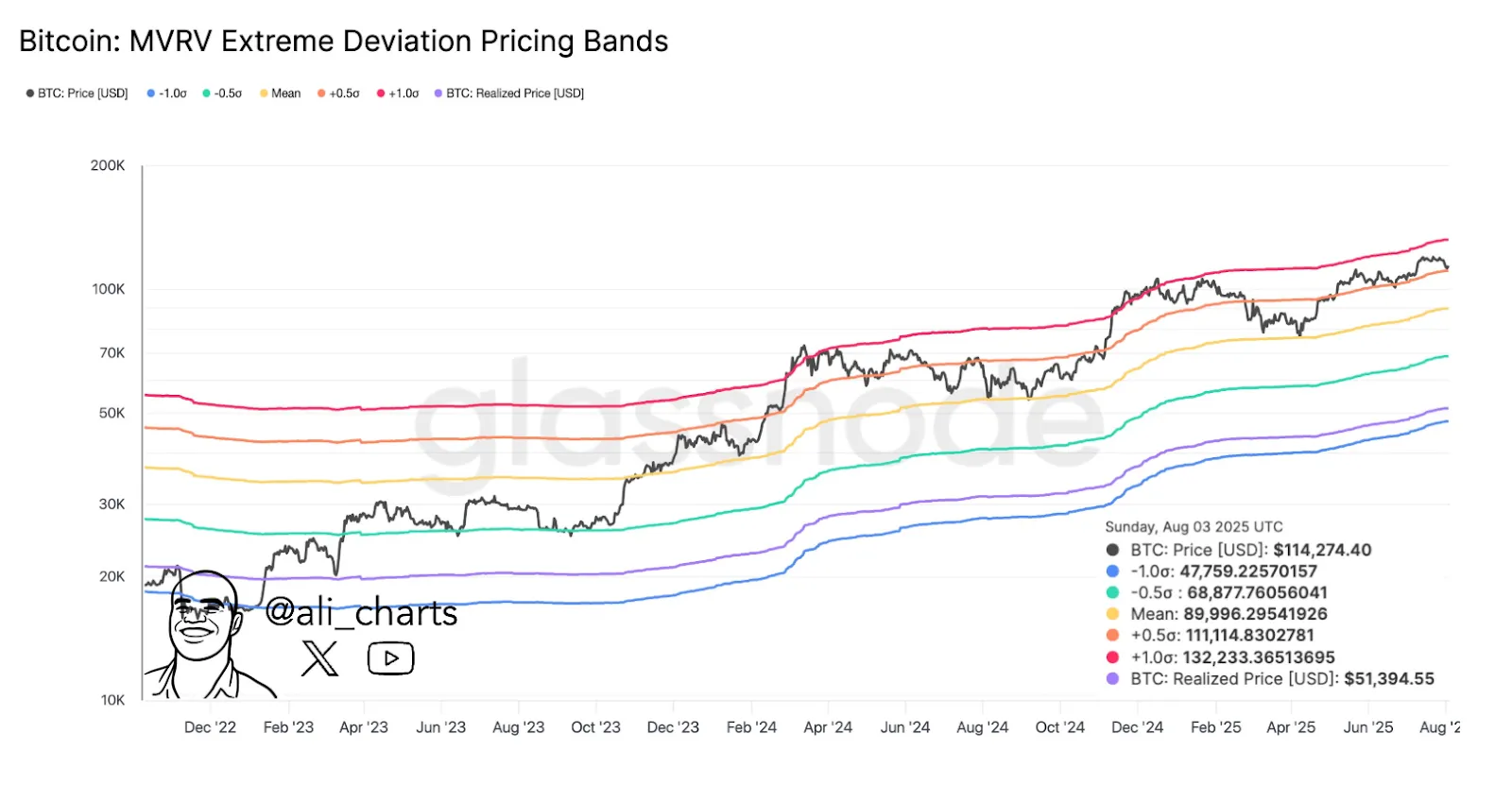

According to Glassnode data, this price point aligns with the +0.5σ band of the MVRV Extreme Deviation Pricing Bands, this is a crucial support in the present structure.

According to the MVRV model, Ali pinpoints $111,000 as a significant support level. Should the BTC price break beneath this threshold, the model projects the next major demand zone around $90,000 which is the same level as the model’s mean band.

Bitcoin MVRV Extreme Deviation Pricing Bands : Source : glassnode

As of August 3, the BTC price sat just above the +0.5σ band. Although the price continues to trade within the upper half of the deviation bands. In prior macro downtrends, breaches of the +0.5σ band have often been followed by retests of the mean level, which presently rests at $89,996.

MVRV Bollinger bands also show that the realized price is significantly lower at $51,394, and it reflects the high disparity between the average cost basis and the spot price.

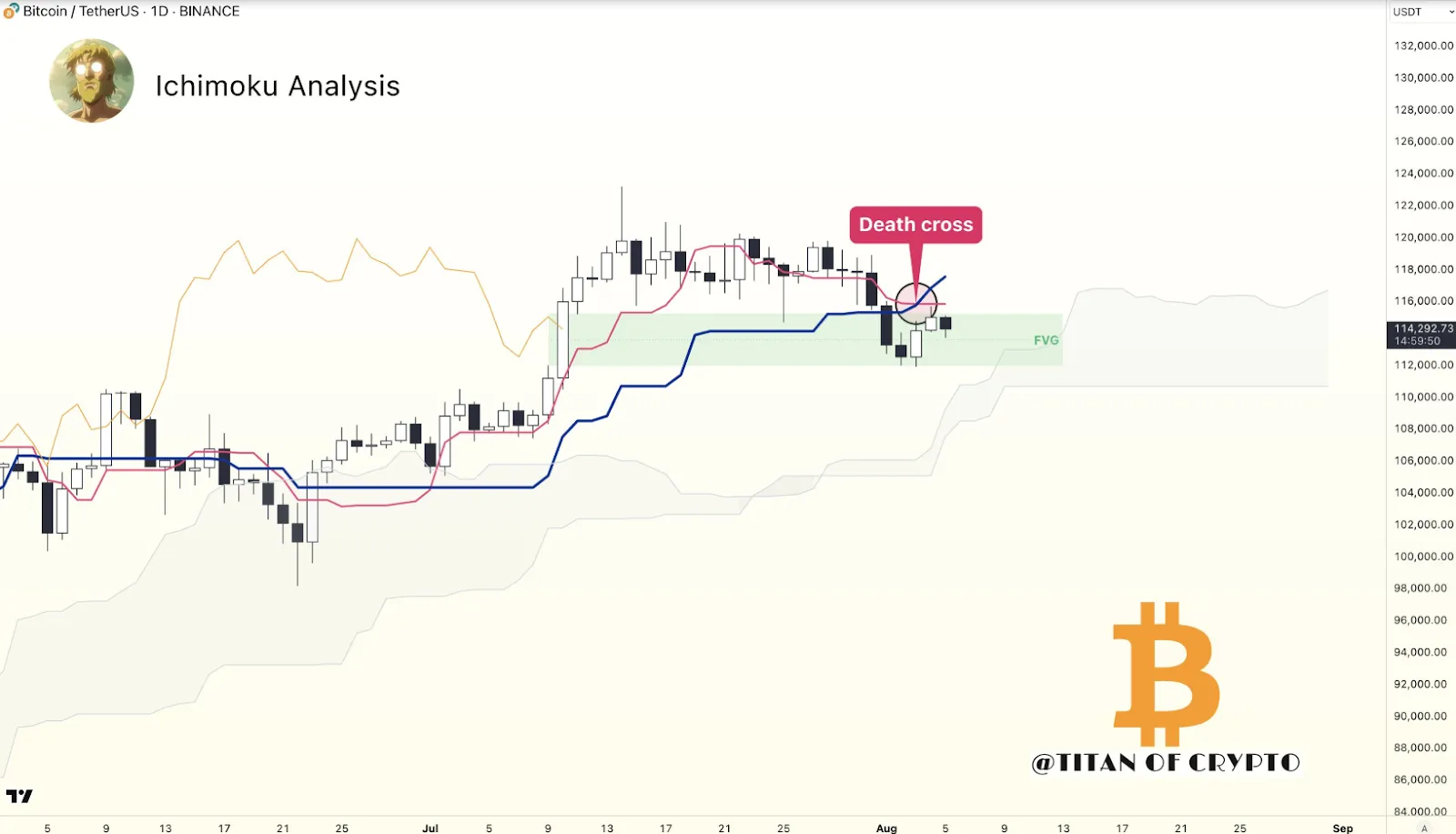

According to Crypto analyst Titan, the 1-day chart shows a bearish cross between the Tenkan and Kijun lines, creating a classic Ichimoku “Death Cross.”

This technical signal usually suggests near-term bearish momentum, and it has happened when BTC price was trading in the Fair Value Gap area at $114,200.

Bitcoin Daily Chart Price Analysis : Source : X

The level is presently undergoing a retest. Should this zone be held, the bearish signal could be negated; however, if price slips beneath it, downward momentum may once again resume.

At the same time, ETF flows may be contributing to short-term uncertainty. On August 4, Bitcoin Spot ETFs recorded $323.5 million in net outflows, while Ethereum ETFs saw $465.1 million leave.

Recent CryptoQuant data show that the liquidity inventory ratio has fallen to unprecedented levels, presently hovering at three months.

Such a collapse signals a marked reduction in the Bitcoin available for sale on exchanges. In efficient markets, this trend tends to generate upward price pressure; nevertheless, the prevailing conditions lack consistent demand.

Bitcoin Liquidty Inventory and US Spot ETF Demand : Source : CryptoQuant

Volatility in ETF demand exacerbates the issue further. Flows reveal sudden and sharp inflows that are swiftly followed by pronounced outflows, offering minimal support.

At the same time, there is ongoing smart address accumulation, but it is subdued. Purple-colored accumulator demand on the CryptoQuant chart has increased slightly, but it has been slow and inconsistent.

Without strong buyer activity to offset the limited sell-side liquidity, even small sell orders may have an outsized impact on BTC price.

Although its short-term condition is weak, other analysts remain bullish in the longer term. Gert van Lagen posted on X that a reversal head and shoulders pattern was confirmed on the 2-day BTC price chart.

This pattern has fulfilled a breakout plus a successful retest of the neckline, which makes the continuation to the target of $170,000 possible.

BTC 2-day chart Head & Shoulders Pattern : Source : X

The structure shows higher lows forming since March, and the breakout zone near $112,000 has held so far. This pattern suggests a longer-term upward trend remains valid unless the $111,000 level is breached decisively.

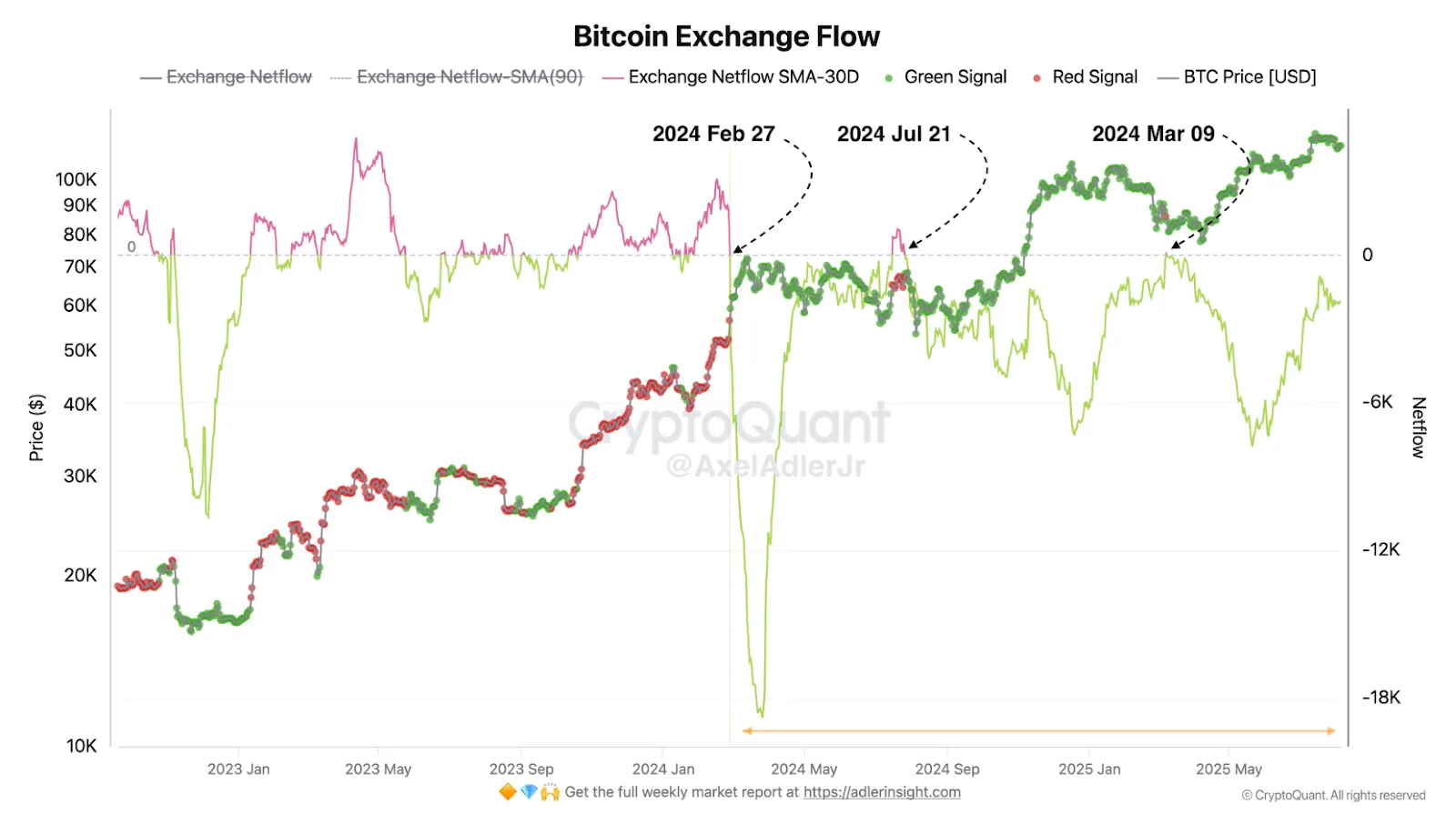

In the meantime, exchange netflow data is favorable in terms of long-term perspectives. According to analyst Axel Adler Jr., the demand on centralized exchanges has been higher than supply since late February 2024.

Bitcoin Exchange Flow : Source : CryptoQuant

The red signals have been reported only 2 times in the last 17 months, which means accumulation. Short-term conditions seem to be weak, but these indicators imply structural stability.

However, in case BTC price cannot sustain above 111,000, the correction towards 90,000 is still probable, according to the pricing models and historical trends.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.