Dogecoin did not enter 2026 quietly, it gave a rally of around 26%.

Price moved early, momentum appeared fast, and for a short moment it felt like DOGE might be waking up again, but that move failed, rejection came quickly, and the price slipped back into familiar territory.

This kind of start is common when longer cycles try to form early pushes to test sentiment before any real structure develops.

What matters now is not that DOGE pulled back, but how it reacts after that first attempt. For Dogecoin price prediction between 2026 and 2030, this phase feels like a checkpoint.

Momentum has shown up, hesitation has followed, and conviction is still missing. That mix usually appears when a market is deciding direction, not finishing one.

This discussion is no longer about the last rejection.

It is whether Dogecoin can turn this pause into a base for a new cycle or if time simply stretches again before anything meaningful happens.

The early move is already done; what follows matters more. Price is no longer driven by momentum or excitement, but by how it holds and reacts.

This phase often decides whether a cycle builds strength or slowly fades.

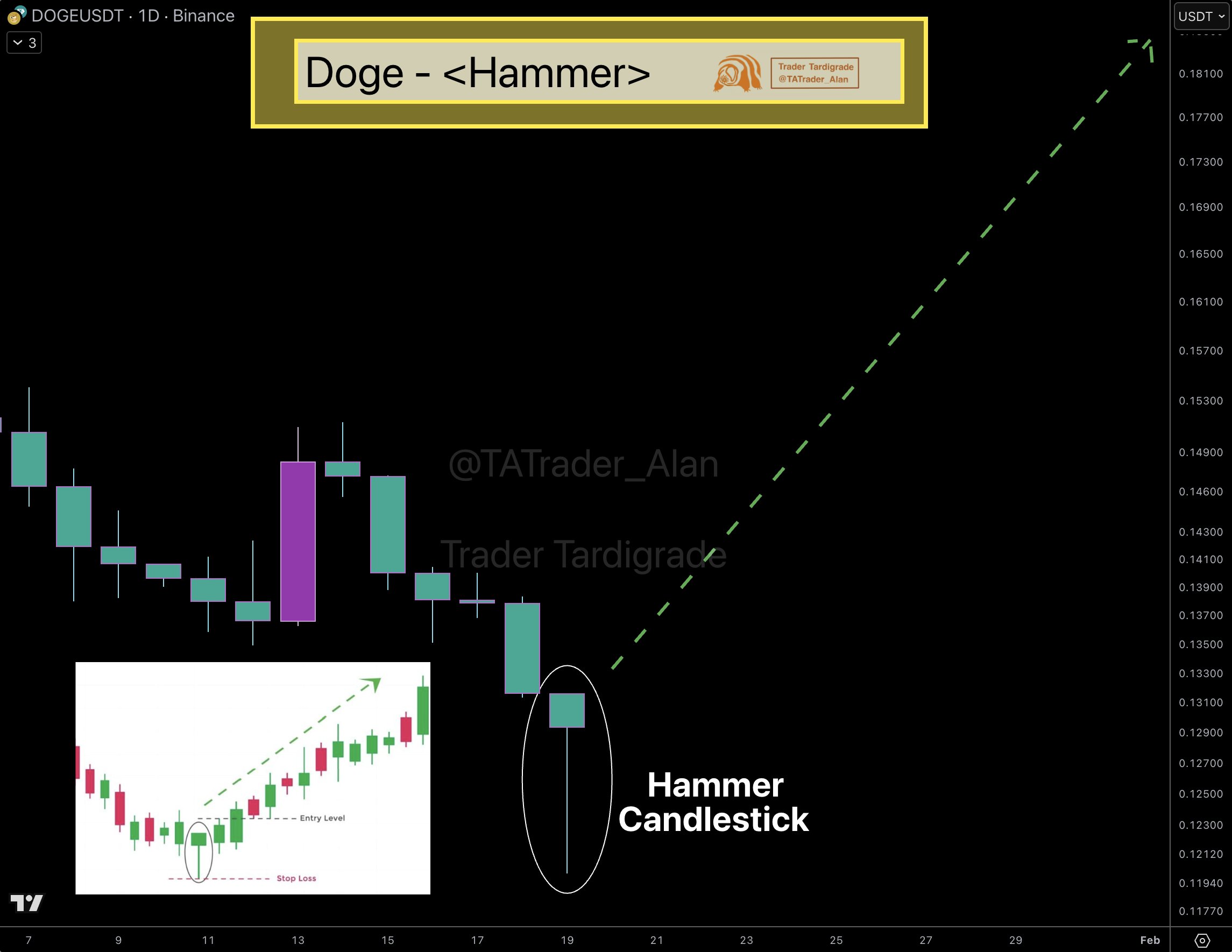

Dogecoin daily chart is closing with a hammer candlestick, and that alone explains why traders are paying attention here.

Price moved lower, selling picked up, but that pressure did not hold. Buyers stepped in near the lows and pushed price back up before the daily close. It was not aggressive buying, just enough to stop further downside.

Source: X@TATrader_Alan

In weak or uncertain phases, this kind of candle usually shows defense, not reversal. It tells the market that downside is being tested, not that a new trend has started.

If DOGE can hold above this hammer and build follow-through, the first upside reaction zone sits near $0.145–$0.15. Above that, $0.165–$0.17 becomes the next area where price may struggle again.

This setup remains valid only as long as price respects the hammer structure.

If any daily candle closes below the hammer low, this setup gets invalidated and downside risk opens up again.

On the weekly chart, DOGE is moving in a familiar pattern. Price has weakened, but selling pressure is slowing rather than accelerating.

In past cycles, DOGE has often made a slightly lower low on the weekly timeframe before stronger upside phases begin. That possibility still exists here and does not break the structure by itself.

Source: X@TATrader_Alan

If price starts holding this weekly range, upside reactions can stretch higher than daily levels; the first zone sits near $0.20–$0.22. Beyond that, $0.32–$0.38 opens up, with the $0.45 area acting as a broader reaction zone if momentum expands.

If weekly structure fails to hold, the cycle simply takes more time. For now, the setup stays open, not confirmed, not invalidated.

On the monthly chart, Dogecoin’s structure looks less random and more deliberate. Price has been moving inside a broad curved range, where sharp rallies were followed by long cooling phases rather than full breakdowns.

This kind of structure usually reflects cyclical behavior, not short-term trading. Momentum expands, fades, and then compresses again near long-term support before the next phase starts. DOGE appears to be sitting in that compression zone right now.

Source: X@TATrader_Alan

According to analysts tracking long-term DOGE structure, this rounded or “sphere-like” formation often shows up before larger directional moves, but only after patience is tested. Time matters more here than speed.

If the monthly base continues to hold, the upside space remains wide. The previous expansion zone near $0.45–$0.50 stands as the first major reaction area. Beyond that, historical structure opens room toward $0.75–$1.00, but only if the cycle fully reactivates.

If the base fails, the structure does not break instantly. It simply stretches longer.

From 2026 to 2030, Dogecoin feels tied more to market mood than to clean chart patterns. When liquidity improves and new narratives pick up, DOGE usually moves with the flow. When that fades, it slows down just as easily.

2026 looks more like a holding year; the price may drift, test patience, and spend time defending its base. In supportive conditions, DOGE could move around $0.12–$0.22. If that base struggles, the phase just stretches. No breakdown, no breakout.

If conditions improve, 2027–2028 can bring sharper moves. Momentum often shows up in bursts here. Price could reach the $0.30–$0.45 area, but swings stay messy. Some rallies stick, others fade fast.

By 2029–2030, things usually get louder. If DOGE stays relevant and participation remains strong, higher reaction zones between $0.60 and $1.00 come into view. Risk rises too. Late-cycle moves are rarely smooth.

From an analyst perspective, Dogecoin is moving through a time-driven phase rather than a price-driven one. Structure matters more than speed here. The 2026–2030 Dogecoin price prediction stays conditional. If the broader market supports it, price expansion becomes possible. If not, time does most of the work while the cycle develops slowly.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.