The crypto market is again under pressure today.

Bitcoin and Ethereum are both down in the 3 to 6% range, and most coins are feeling the impact. Red candles are spread across the board.

Canton Network , however, is not moving with the rest of the market. While many coins are losing ground, Coin is trading around 11% higher and sitting among the top gainers. That kind of move stands out on a day like this.

The price behavior does not look like a retail chase. Instead, it feels more aligned with institutional positioning, especially given the broader risk-off mood.

For those tracking Canton Network Price Prediction 2026, this shift matters. Canton is starting to trade less on hype and more on its connection to real financial infrastructure.

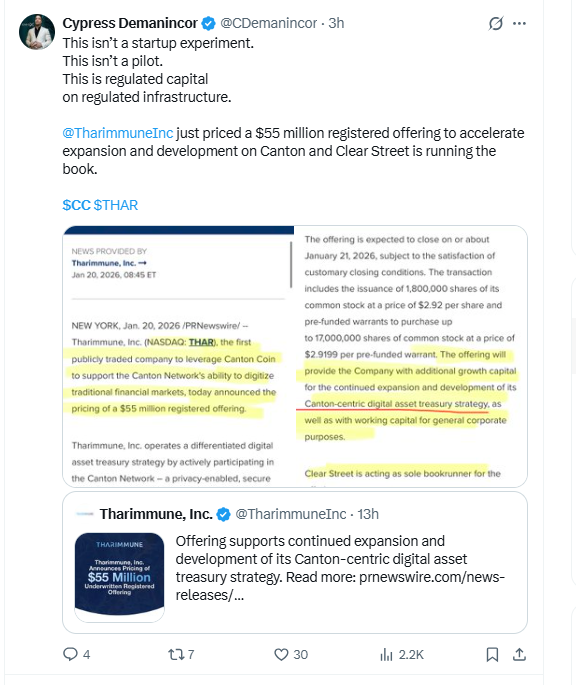

The primary driver for today's price behavior is a strategic move from the traditional finance sector. Tharimmune Inc. (NASDAQ: THAR) is set to close a $55 million capital raise today, January 21, 2026.

According to prominent analyst Cypress Demanincor, this isn't just a "startup experiment" or a pilot. As he noted on X (Twitter), this represents "regulated capital on regulated infrastructure."

Source: X (formerly Twitter)

Based on the company disclosures and offering details, this capital is not limited to routine corporate operations:

Treasury Allocation: Tharimmune has confirmed it will use a portion of these funds to acquire Canton Coin for its corporate treasury.

Validator Operations: Tharimmune is not limiting its involvement to holding tokens. The company has indicated plans to apply for a Super Validator role, placing it closer to the operational side of the network rather than staying a passive participant.

Market Impact: This kind of institutional entry changes how supply behaves. While parts of the market are reducing exposure during the broader sell-off, this participation is absorbing some of the available supply. That has helped Coin hold its ground when many other assets are slipping.

While macro conditions are currently weak for major assets like Bitcoin, Canton’s integration with a NASDAQ-listed firm is providing unique price support.

This shift in behavior is noticeable. CC is no longer reacting like a typical short-term momentum coin. Price action is starting to reflect usage and positioning rather than pure volatility to behave like a financial utility rather than just another volatile crypto asset.

Alongside the Wall Street interest around Canton Network, trading access for the token is widening. Canton Coin has recently been listed on Swyftx exchange, adding another regulated entry point for the market.

The listing does not change the structure overnight, but it does increase access. With more participants able to trade CC, liquidity has room to spread beyond its earlier base.

Source: X @Swyftxglobal

This development adds another layer to how the market is reading CC right now:

Global Reach: The integration allows many Australian and New Zealand investors to access $CC directly, diversifying the token's holder base.

The Clear Street Factor: With Clear Street acting as the bookrunner for the recent $55 million offering, the inclusion of $CC on major retail exchanges suggests a growing ecosystem for the asset.

Market Divergence: With broader crypto under pressure, CC is reacting to a different mix of inputs. Added accessibility and institutional visibility appear to be influencing how the token is behaving relative to the market.

The current price action on the 4-hour charts shows that Canton CC has stabilized after its recent pullback. The 11% move did not fade into weakness. Instead, price found support at a level that traders usually watch closely after an expansion phase.

Source: TradingView

Fibonacci Golden Pocket Reaction: On the 4-hour chart, CC came back into the 0.5–0.618 Fibonacci zone, roughly between 0.117 and 0.131. This is where the last move started to slow down. Price did dip into this area, but it did not slide through it.

Candles tightened, selling cooled off, and the market started to pause. That kind of reaction usually shows the move is catching its breath, not falling apart.

Ascending Support Holding: The rising support from early December is still there. Price has come back to this line more than once and bounced each time. Higher lows are still visible on the chart, which tells us the structure has not broken yet.

RSI Momentum: RSI has recovered from lower levels and is now sitting near 60. Momentum is picking up, but it does not look stretched at this point.

This fits with the current consolidation, where price is absorbing supply rather than pushing into exhaustion.

Short-Term Setup (4H Chart)

$CC is currently stabilizing between $0.117 and $0.131 (0.5–0.618 Fib). By holding above its rising support while the broader market dips, the immediate bullish structure remains intact.

Immediate Hurdle: A hold above $0.177 (1.0 Fib) is key.

Reaction Zone: The next area of interest is $0.25–$0.26 (1.618 Fib), where profit-taking could cause some hesitation.

Long-Term View (2026)

The 2026 altcoin outlook hinges on $CC maintaining its pattern of higher lows. As long as the rising support line holds, higher Fibonacci extensions remain the primary areas of observation.

Later-Cycle Zones: If liquidity remains supportive, the $0.37 (2.618 Fib) and $0.48 (3.618 Fib) levels stand out as zones where the market might reassess its momentum. These are not targets but potential reaction areas.

Invalidation Level

A sustained 4-hour close below $0.117 would weaken this setup. Breaking this base (rising support) would signal that the trend is no longer holding, likely leading to a longer stabilization phase before any further upside attempt.

Canton CC is behaving differently from most assets right now. Holding firm during a weak market usually points to positioning rather than short-term hype. Institutional involvement and gradually improving access appear to be tightening supply, which is showing up in price behavior.

From a Canton Network Price Prediction 2026 perspective, the view stays straightforward. As long as the four-hour rising support remains intact, higher reaction zones stay relevant. This looks less like a speculative run and more like a market responding to steady participation. Direction from here will depend on how price reacts when it reaches the next resistance areas.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.