Can a single asset defy the broader market’s pace?

While the crypto market inches forward in mild green territory, Enso has accelerated far beyond the general trend.

Over the past 24 hours, ENSO surged more than 80%, printing a high near $2.19 and currently trading around the $1.90 level.

An 80% spike naturally shifts attention fast.

Now traders are asking, why ENSO’s price up today? and whether this move suggests the beginning of larger ENSO price prediction 2026 targets.

The spike to $2.19 marked a clear structural breakout.

Now the focus shifts to whether token can hold above $1.90 and build strength for a potential push toward the $2.37 resistance.

A decisive move beyond that level could open space for new highs.

But the bigger question remains.

Is this rally backed by real ecosystem developments, or is it simply a short-term liquidity squeeze amplified by FOMO?

The surge appears to have been powered by intense trading activity.

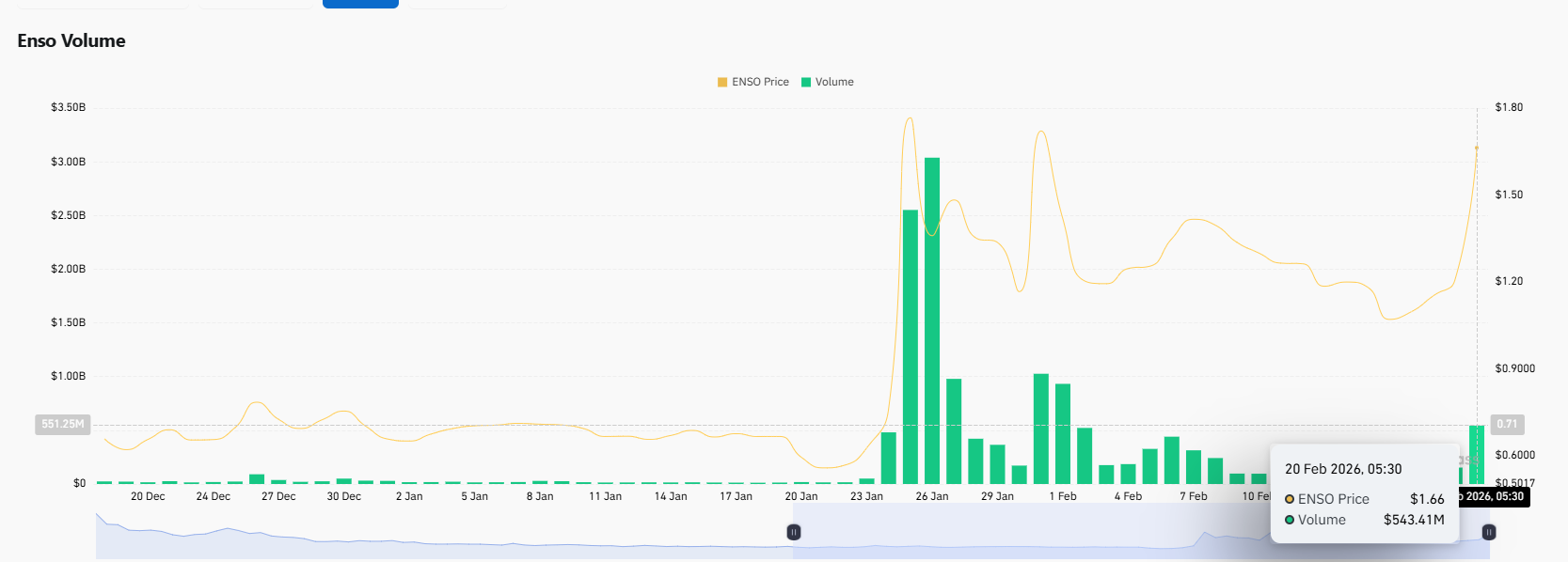

As per the recent Coinglass data, spot volume jumped sharply, crossing the $540 million mark, reflecting aggressive participation.

At the same time, token repeatedly ranked among top gainers on Binance and Bybit futures, with derivative volume expanding more than 200% in short intervals.

As price accelerated, trading accounts amplified buy calls across social platforms, reinforcing the upward momentum.

What it means: The rally was likely driven by leveraged speculation and crowd momentum. Such moves can extend rapidly—but they can unwind just as quickly if futures activity starts to cool.

On February 17, ENSO officially announced the expansion of its execution layer using Chainlink’s CCIP, introducing an institutional-grade cross-chain infrastructure upgrade.

That announcement appears to have shifted attention toward the project.

While price did not react immediately in a dramatic way, market interest gradually started building after the update.

Integrating Chainlink’s cross-chain interoperability protocol strengthens ENSO’s positioning within the broader DeFi infrastructure narrative.

Unlike purely speculative pumps, ecosystem-level upgrades tend to attract a different type of capital: traders looking beyond short-term volatility.

The timing of the recent rally suggests that the February 17 announcement may have acted as an underlying catalyst, with derivative activity amplifying the move later.

In short, fundamentals may have set the stage, and leverage accelerated the breakout.

On the 4-hour chart, price had been respecting a descending blue trendline for an extended period, repeatedly reacting from that upper boundary.

That trendline acted as dynamic resistance for weeks.

The recent breakout above this descending structure reflects a potential shift in short-term momentum.

Before the breakout, price briefly dipped below the 200 EMA near the $1.00 zone but quickly reclaimed it, forming a strong base.

Since then, buyers have pushed the price above the 21 and 50 EMA, with a bullish crossover now visible between those shorter-term averages.

Price is currently trading above the 21, 50, and 200 EMA, which keeps the structure constructive for now.

RSI previously stretched toward the 80–90 zone during the surge and has cooled back near 70, suggesting momentum is stabilizing after an overheated move.

In the near term, ENSO may face its first major resistance around the $2.00 zone.

A clean push above that level could open the path toward the $2.40 resistance area.

However, structure remains conditional.

If price slips back below the 21 and 50 EMA or a bearish crossover forms between them, the current bullish structure would weaken.

A sustained move below the $1.47 support zone would further increase downside risk.

Key Support Levels:

$1.47

$1.31

$1.07

Key Resistance Levels:

$2.00

$2.40

As of now, momentum favors buyers, but follow-through above resistance will decide whether this breakout evolves into a larger trend.

On the daily chart, ENSO has broken out from a long accumulation range near the $1.00 zone, signaling a structural shift toward expansion.

A recent chart shared by @hami8040 on X also highlighted this clean breakout pattern, suggesting that continued higher lows could support further upside.

If price sustains above the $1.80–$2.00 region, the next major area to watch sits near $3.00.

Beyond that, the $5.00 zone becomes a broader projection level — but only if momentum and market conditions remain supportive.

For now, the daily structure favors buyers, though consolidation phases remain likely after such a sharp rally.

From a structural standpoint, ENSO’s breakout reflects improving momentum supported by strong derivatives participation and ecosystem developments.

However, sustainability will depend on holding key support above the $1.90–$2.00 region.

If higher lows continue to form, the broader ENSO Price Prediction 2026 outlook remains constructive, though volatility should be expected.

Disclaimer: Cryptocurrency markets are highly volatile. This price prediction is based on technical structure and current developments, not financial advice. Investors should conduct independent research and assess risk tolerance before making decisions.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.